💯 Monday is for Winners - The Letter X

Jan 11, 2021 7:18 pm

THE LETTER X

ISSUE #34

Welcome to the new “Monday is for Winners” TLX!

As I mentioned on Saturday, my focus is to always be changing things up to keep TLX dynamic. I want to be able to deliver something inspired and interesting to start your week off right. I want to align TLX with my mission and focus in 2021 and I am excited to have you along for the journey.

Bring back the memes! You all have been heard loud and clear. But instead of focusing on our industry, I am going to the TLX Randomizer. So here is your Random Meme of the Week!

Say Yes Every Day

Laura Brandao - President of AFR Wholesale

This week Say YES to be open to the unexpected! Life truly happens when we stop planning out the details and we allow ourselves to experience each moment with a fresh and positive perspective.

For the last three years, I have picked my "word of the year" for me.

This year, I am not picking a word but instead will pick a phrase.

"Burn The Boats"

This year it will be all about going all-in and leaving it all on the field. There is NO Plan B, as the only option is winning with Plan A.

With that, this is the message I shared with my Strategy & Development team at EPM.

"Take tomorrow and the weekend to reflect, relax, and visualize the goals for yourself in 2021. Monday begins our journey to being one of the greatest Lenders of the next decade. Burn the boats because there is NO Plan B!"

The response of my team made me even more excited for 2021!

Time to take all the opportunity that was given to us in 2020 and capitalize on it for 2021 and beyond. It is time to get to work!

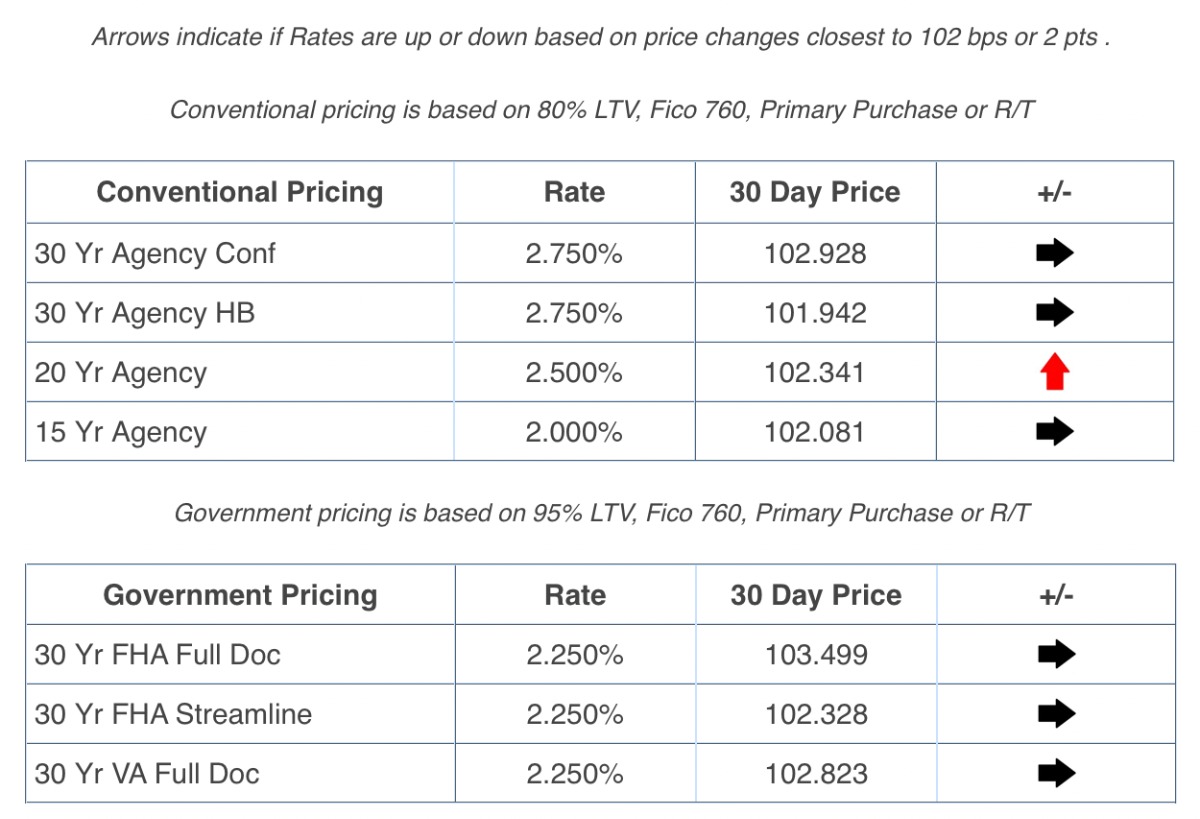

Mortgage Rate X

MBS X

Diana Bajramovic of MBS Highway

Happy New Year! While 2020 has been extremely difficult for all of us, we are blessed that our industry has been able to succeed through such hardships.

Slow Job Growth

This week we got the ADP Employment Report that shows job creations, and it was a bit disappointing. That being said, this number should be taken with a grain of salt because of the lockdowns we are seeing in many areas of the country. The market was expecting 165,000 job creations in the month of December, but instead we saw 123,000 job losses, which was much weaker than expectations. The more important BLS Jobs Report was released on Friday, and the expectation was revised lower from over 100,000 job creations down to 65,000. It came in at about 140,000 job losses for the month of December.

Mortgage Applications

We also got mortgage applications for the last two weeks. Again, take this with a grain of salt because we know that the MBA does a poor job of estimating and modeling for holiday weeks. Purchase applications were flat over the two weeks, and up only 3.2% year over year. Refinances are down 6%, and up 100% year over year. Rates are 1% lower than they were this time last year, and refinances still make up nearly 70% of all transactions!

A Crazy Ride

The markets have been on a crazy ride as you can see in the image below. Thanks to the technical signals in the candlestick chart for the UMBS 30YR 2% coupon, we issued a perfectly timed lock alert on January 5th that saved our subscribers and their clients 120 basis points in rate. After so many years of Barry and the MBS Highway team practicing technical analysis, it still amazes us all how accurate and telling technical signals are. For those of you that have completed the famous Module E in the Certified Mortgage Advisor course, you can see the value that the training has given you when the market begins to move this way.

Be sure to advise your clients by truly understanding the market and the reports that we broke down today. Make it a point to watch the Daily Morning Update on MBS Highway each day and complete the Certified Mortgage Advisor Course. As a thank you for reading my portion of the newsletter each week, and in hopes of helping you start the New Year off right, I’d like to offer you a $300 discount on the CMA course that you can take advantage of by using promo code DIANAX at checkout.

Just for the Xperts!

I mentioned the creation of TLX Masters, which is a new opt-in membership where you can receive more specialized content from me on a more frequent basis. If you would like to sign up for the new subscription you can do so here.

In case you haven’t looked at your Facebook feed in the last week, there is a new platform that is out there called Clubhouse. It is weird but kind of cool, and I will start to do some content on there starting TODAY at 3pm Mountain!

Apple’s recent iOS update gave everyone in the marketing world a bit of a wake-up call.

Do you want an advanced tactic for your business? Try mapping your customers' journey. I am not going to lie. Journey mapping can be complex and time-consuming. But those who map out the journey will have far better customer conversion than those that don’t.

In most parts of the country owning a home is more affordable than renting one according to ATTOM Data Solutions' 2021 Rental Affordability Report.

Refinance activity climbed to 45% of all loans closed by millennial borrowers in November, up to three percentage points from October to the highest percentage since May.

How about a little Top Gun Leadership from Lt. Col Waldo Waldman.

Original area codes had either a one or a zero for the second digit. States with one area code had a zero, states with more than one area code had a one. Codes were also designed for rotary phones. The bigger the city, the lower the non-middle numbers, resulting in faster dialing. NYC received 212, Chicago 312, LA 213, and Detroit 313. By contrast, Anchorage got 907.

While housing permits are running at 1.64 million/year, their best level since 9/06, the improvement is uneven. In the Northeast, permits are at 200,000/year and have been flat for decades. In the Midwest, permits are also at 200,000/year and have bounced between 200,000/year and 400,000/year since 1960. Out West, permits are 400,000/year, their midpoint since 1960. Only in the South, where permits are at 870,000/year, are they relatively high.

Despite better growth in the US than in almost all other developed nations, counterintuitively the US dollar continues declining in value. It is primarily because the Fed has promised to keep rates where they are for a long time, even if inflation worsens. Moreover, despite positive nominal rates here, real inflation-adjusted rates are already more negative here than in Europe and Japan, despite negative nominal rates in both those places.

Have you joined the Mortgage X Mastermind yet? It is our FREE Facebook Group.

On Tuesday’s call, we will be going over Lead Generation, Conversio, and Systems. Make sure to join our FREE Monthly Mastermind Calls, but you can only do that by being a member of Mortgage X!

The Vieaux

Brian Vieaux - President of FinLocker

Qualify More Borrowers With a Top of the Funnel Digital Transformation

Digital mortgage applications have almost become an industry table stakes. While some companies offer a digital solution to get prospects pre-qualified quickly, other companies have expanded beyond the initial loan application to provide an entirely digital mortgage process.

As mortgage lenders try to keep pace with this ever-evolving process and customer expectations, technology advancements in the mortgage industry have focused on the milestones after the loan application has been submitted.

Younger homebuyers are keenly aware of the convenience of online shopping, digital tools, and apps, so they expect the vendors involved in their home buying transaction to provide the same convenience.

If delivering a digital mortgage experience is now the expectation of borrowers, particularly younger homebuyers, why aren’t mortgage lenders offering a user-friendly digital solution at the top of the funnel to get their clients mortgage-ready?

According to a Fannie Mae National Housing Survey, about 38% of homebuyers did not shop around before selecting their mortgage lender. If an originator can capture these prospects in the early stage of their home buying process and stay top-of-mind, they will likely apply for a mortgage with that lender.

FinLocker provides mortgage originators with a digital solution that empowers borrowers to become mortgage ready at their own pace. The app will help first-time homebuyers overcome the most difficult steps of the home buying process, identified in the 2020 NAR Home Buyer and Seller Generational Trends report: "finding the right property," "paperwork," "understanding the process and steps," and "saving for the down payment." This digital solution also frees an originator's time to work with qualified borrowers ready to close.

To find out how a white-labeled FinLocker can be used to attract and qualify more first-time homebuyers, schedule a demo.

Lending, Leadership, and Life Quotes

Eddy Perez – President & CEO of EPM

Industry Professional to Watch!

Shane Kidwell, EVP of Sales at Victorian Finance

Make sure you tell Shane you saw him in The Letter X!

Beyond The Numbers

Fobby Naghmi, EVP, National Sales Mgr. of First Option Mortgage

If you asked a group of people what their definition of success is, I would imagine that the definitions would be equal to the number of people in that group. But if you asked that same group to define failure, it’s possible that one re-occurring theme would emerge: falling short of a desired goal. That means that there are multiple ways to succeed, but really only one way to fail.

So for 2021 let’s re-imagine goal setting so we don’t fail. WHAT?!?! Is that possible? Sure is.

For example, when I play golf, I warm up by placing my golf ball 1-2 feet away from the hole. After a few shots, I go back a few steps, then again and then again. Finally, I’m putting my golf ball from about 12-15 feet away from the hole. By now the muscles required to putt the ball are in sync. Even more important, I ‘ve heard the sound of the golf ball dropping into the hole multiple times. I have a memory of what success feels like and sounds like.

I’m not saying don’t set huge goals, nope…we all need those. What I am saying is set some goals that are quickly attainable so that the pattern of succeeding begins to become a habit.

Remember, no one else but you has the power to define what success means for you.

Mortgage X Marketing Manifesto

More Landing Pages = More Leads

Quick and dirty this week! Awesome stat to note of from our friends at HubSpot:

While most companies don't see an increase in leads when increasing their total

number of landing pages from 1-5 to 6-10, companies do see a 55% increase in

leads when increasing their number of landing pages from 10 to 15.

More landing pages give you more variety, potential traffic sources, and messaging

that you can cater to your specific audiences.

This gives you the ability to not only drive more traffic, but convert at a higher rate.

Ramp up the number of landing pages you're using in your marketing, and with

the right traffic sources, you'll see an increase in leads generated.

Thanks, and I'll catch you on next week's The Letter X!

I hope you enjoyed TLX #35! Now go crush this week!