🔥 BREAKING: Live in-person events are back! - The Letter X

Sep 12, 2020 7:06 pm

THE LETTER X

ISSUE #21

You heard me. Live in-person events are happening, with real people, in the same room, together, in person! Yea, I was pretty excited about that too.

This past week we had the UAMP Expo in Salt Lake City with speakers, lunch, vendors, the whole shabang! I was honored to be one of the speakers at the event, along with my friend Sue Woodard (Pictured Above) of Total Expert, Allen Beydoun of UWM, and John Wise of Angel Oak Mortgage Solutions.

It was a nice return to normalcy to be able to hang out with fellow mortgage pros and it was great to speak to a live audience again that wasn’t via my webcam. There was also something cool about this event in regards to the greater mortgage family, which I will talk about later in this issue. But for now, please enjoy this week’s edition of TLX!

Say Yes Every Day

Laura Brandao - President of AFR Wholesale

This week say YES to practicing! What we practice will grow stronger so remember to practice, good health, great relationships, expanding your knowledge and striving to always get better while challenging yourself to make a difference in the world.

Sharing is Caring! Remember to share your personal referral link (bottom of email) for a chance to win a $50 Amazon Gift Card!

MBS X

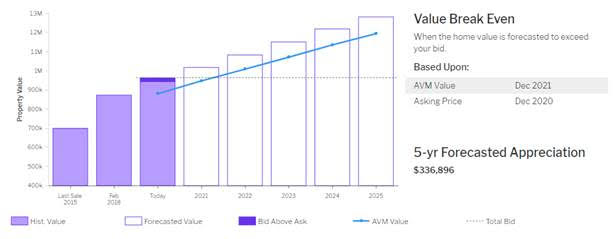

In August, 54.5% of Redfin offers in the U.S. faced bidding wars. With the influx of people moving away from city living due to the pandemic, competition will continue to increase. Not only that, we have chronically low levels of inventory alongside low interest rates driving demand. How are you helping your buyers win the bidding war?

Show your buyer the forecasted appreciation for the area they are looking to purchase in. In many cases, they will recover their bid over asking price within the next year!

In this example, we are looking at a home in San Jose that sold for $700,000 in 2015 with a current asking price of $945,000. If the buyer were to come in $19,000 above asking price, they should expect to recover their bid over ask by December 2020. Based on the AVM (Automated Valuation Model), they are expected to recoup by December 2021.

Use the Bid Over Asking Price tool to get your buyer into their home faster and ease their fears of increasing their offer.

The News X Recap!

Consumers need to be careful about overspending! Today’s housing market is red hot, with homes getting multiple offers and selling above list price in many cities. Sixty-eight percent of U.S. homes sold in July were on the market for less than a month, and the median existing-home price was up 8.5% from July 2019, according to the National Realtors Association.

Consumers More Upbeat on Buying and Selling Despite Lower Price Expectations. There was similar improvement in the percentage of respondents who say it is a good time to sell a home. That sentiment increased from 45 to 48 percent, while those who said it was a bad time fell from 48 percent to 44 percent. This resulted in a net increase in those who say it is a good time to sell of 7 percentage points to 4.0 percent. The net is down 36 points compared to a year earlier.

With that home prices are up! How much? Home Prices Up 13%, Biggest Increase Since 2013.

Lower mortgage rates during the pandemic have meant lower monthly payments, providing buyers across the country with a strong motivation to purchase a home. But in metro Denver, home prices have appreciated so rapidly this summer that the benefits of that cheaper money have evaporated.

Congratulations to Jane Fraser who made history by being chose as the first Woman CEO to lead a major US Bank. However, it is all business for Fraser as she faces pressure to improve Citi's profitability metrics and stock market valuation while steering the $2.2 trillion-asset company through lingering fallout from the coronavirus pandemic. The health crisis has led to a slump in card activity — Citi's lifeblood — higher credit costs and a myriad of employee- and customer-safety issues.

Bowtie Economist Quick Hits

Despite new auto sales being down but rebounding nicely, car prices are regularly setting price records. In August, the average new vehicle went for $35,420, up 6.1% Y-o-Y. The combination of limited inventory, cheap money, longer-term auto loans, inexpensive gas, and a desire to avoid public transit, is fueling demand. Regrettably, younger buyers are literally getting priced out of the now higher-margin, bigger, more luxurious vehicles coming off assembly lines.

August’s employment report was strong. 1.4 million new jobs, a higher labor force participation rate, and a decline in the unemployment rate to 8.4% from 10.2%! Ignoring the hiring of 238,000 temporary Census workers, job growth is still down from 4.8 million in June, 1.7 in July. Permanent job losses are rising, and even at this highly elevated rate, it’ll be late 2021 before the remaining 11.5 million jobs return.

The Family Connection

As I mentioned earlier, there was something cool about the UAMP Expo for me, which was to connect with John Wise from Angel Oak. As most of you know, the mortgage business is family business for me. I am a second generation mortgage professional, as is John.

What made this special is that in the 80’s my mom used to work for John’s dad. He has the same memories that I do growing up in mortgage with the same people. We never met before but were able to connect because of our family connection. It’s a small industry, a family driven industry, and the relationships you make can transcend generations. For those of us who are in this business for legacy, these connections are what makes what we do special.

Good things come to those who Mastermind! Have you joined the Mortgage X Mastermind yet? I would like to invite you to join our community that is 100% focused on helping MODERN industry professionals crush it.

The Vieaux

Brian Vieaux - President of FinLocker

Today’s The Vieaux is based on feedback and questions I received from last week’s edition. I am sharing how FinLocker enables the local originator and real estate professional to empower consumers with technology to support financial health and wellness, including the journey of home ownership. Whether you partner with FinLocker or other technology providers, meshing innovative consumer facing technology with local expertise and relationships is a differentiator and a smart business strategy.

FinLocker provides originators with a custom branded consumer facing financial super-app. The app arms a consumer with tools they would otherwise need 3-5 individual apps for (Credit Karma, Nerd Wallet, Mint, Zillow, etc). A key difference from those other apps is that your consumer is not exposed to other financial services companies in your instance of FinLocker.

Getting a tool like this in the hands of young people well before they are ready to own a home helps you to build your pipeline for next year and beyond. From their super-app, your consumers have access to their credit report, including score and real time monitoring and alerts. The app becomes an extension of you, offering digital financial assistance that includes spending analysis, budgeting, savings goal tools and a mortgage readiness assessment. A deep library of homeownership and mortgage education content gives your consumer a “self-serve” learning experience. All of this happens under your logo keeping you front and center with the consumer. Given the breadth and depth of data compiled in a consumer’s locker, when they are ready for a mortgage, the locker enables the secure sharing of data and documents to dramatically streamline the application process.

The local professional has the geography advantage over the national call-center platforms. This advantage is lost if you are not providing a digital experience and tools that at least match what these platforms do. Providing value beyond a mortgage with consumers builds deeper, long-term relationships producing repeat business and referrals. Invest in your future pipeline now.

Mamapreneur: Real Talk with a Side of Mom Jeans

Jess Vogelpohl Southwest Coaching

Master Procrastinator

🖐🏻 Raise YOUR hand if YOU never procrastinate... 🤘🏿

...some of you may raise your hand 🙋🏽♀️ later - see what I did there?

We call procrastination "CREATIVE AVOIDANCE" and it's filling your day with trivial work that makes you feel productive. It's justifying why you don't need to do the thing you need to do, when you need to do it.

Here's an example of creative avoidance:

📱It's 3PM and you are going to prospect:

❌It's 2:58 - "imma just make my dentist appt. quick."

❌Oh snap, my coffee is warm.

❌Mom called - better call her back.

❌Shoot - I need to respond to this email.

❌Wow, did you see that new cat video on YouTube?

❌ Now, it 4:59PM, and you say - I'll do it again, tomorrow, Monday, next month....til it never gets done.

Wash, rinse, repeat.

👆🏼How's that working for ya?

Grasping at the business that is jumping into your boat because of the current market - that’s awesome. BUT, if you are not planting the seeds NOW, even while the low hanging fruit is still being picked, then you will have nothing to harvest in a few months and be in famine mode. Which is probably the rollercoaster you’re always find yourself on. Feast —> famine.

Do yourself a solid and schedule prospecting time into your schedule, every week. AND COME HELL OR HIGH WATER, stick to it.

Podcasts of the Week!

Top Producer Mastermind Recap from Nashville

Next Level Loan Officer Podcast

Creating The Customer Experience and Beyond

Laugh, Lend, and Eat

Podcasts of the REAL Disrupt Network

Virtual Coffee with Estie Briggs

Mortgage Interrupt

Mortgage Industry Professional of the Week

Bill Stephens – Michigan Mortgage Broker at Paradise Mortgage Brokers

Congratulations!

To everyone featured in the Top 20 Mortgage Professionals of 2020

The Edumarketer

Ginger Bell - CEO & Founder Edumarketing

Everything You Need to Know About Promoting Your Facebook Live Event and Growing an Excited Audience

Last week, I shared how to start streaming on Facebook Live and this week I am sharing how to grow your audience. Facebook live is an easy way to educate your real estate agents and borrowers.

Unless you’re the spontaneous type and plan to go live right away, you’ll need to promote your livestream ahead of time. Advertising your upcoming livestream ensures that you’ll have an audience ready to interact with you the moment you go live.

My three tips can help you grow viewership long before you’re live on Facebook:

1. Tag Friends, Family, Partners, and Other Brands

Generate excitement about your upcoming livestream by tagging people you think would enjoy the content. Tag friends and family and ask them to share the post with their network. Or tag your business partners and brands you’ve done business with too. Just make sure you are providing value to that audience and you aren’t “that guy” on Facebook who “keeps tagging me in really irrelevant posts that I have no interest in.” Yes, don’t be that guy. As always, use tact!

The more people who know about your livestream, the larger the audience that’ll tune in!

2. Share the Livestream Link on Other Platforms

Let the world know you’re planning to go live by cross-posting about it on other social media platforms such as Twitter, Instagram, or LinkedIn.

3. Send the Link To Your Email Subscribers

Remember to inform your email subscribers about your livestream, too. Send them a message about the upcoming Facebook Live event along with the livestream link and a calendar invite. Recipients who accept the calendar invite will be notified right when it’s time to log onto Facebook for the event.

Next week I will be sharing What to Do Once You're Live.

Always pass on what you have learned!

ESPORTS X

Blaine Bell - Co-Owner & Founder Sanguine Esports

The History of Esports - Part 3

The Game Changer – Twitch

Twitch, born out of Justin.tv, and now a part of Amazon, came into popularity in 2011. Considered to be the ‘ESPN of esports’, the purpose was to promote viewership of esports tournaments. Twitch is an online streaming service and it allows anyone to become their own broadcast network. It provides a platform for engagement between the audience and the broadcaster. This is something that was not possible with TV. Almost immediately after its launch, popular video game players started streaming, via Twitch, to the internet.

Within a year of its launch, Twitch.tv had achieved an incredible number of over 20 million monthly visitors. Less than a year later, August 2013, the number more than doubled, reaching a mark of over 45 million. Interestingly, the most popular game streamed during this period was League of Legends.

Twitch’s success and the growing spectator market for esports led Amazon to acquire it in 2014. As Twitch went mainstream, so did video games, its ‘most popular broadcast category’.

The 2010s experienced incredible growth in Esports spectating and therefore garnered the attention and increase in third-party corporate sponsorships. Developers were already contributing to prize pools, but tournaments were now receiving sponsorships from ‘PC retailers, energy drinks companies, and computer software’. This made it possible for game titles to award large sums of money.

Today, League of Legends has become so popular as an esport that the United States Government recognizes its Pro Players as professional athletes “and award(s) visas to essentially work in the United States under that title”. They are able to procure a non-immigrant P-14 visa to visit the States and compete. In fact, our entire professional Sanguine Esports team that EPM sponsors is all here from Latin America on professional athlete visas. They said it was really cool going through customs because the officials recognized the “professional athlete” visa and it garnered respect.

The WESA (World Esports Association) was founded in 2016, providing more standardization to the sport. The objective was to “become the global benchmark for industry-wide standards”.

Today, the best esports athletes make millions and the industry is backed by big names in traditional sports. One of the teams that our Sanguine team competes against is owned by the Pittsburgh Steelers. There are efforts to get esports included in the Olympics, but whether they will be remains to be seen.

Meme of the Week

This is courtesy of John C. Riley!

If you have a meme you would like featured send it to frazier@mortgagexpodcast.com

Remember to share your personal referral link below for a chance to win a $50 Amazon Gift Card! I hope you enjoyed TLX #21! Have a great weekend.