🔥 Lenders are on notice. Start changing now! - The Letter X

Jul 25, 2020 7:06 pm

THE LETTER X

ISSUE #14

Are you ready for some Real Talk?

Good, because that is the theme of this week’s TLX. I was asked to give my thoughts and opinion on an article and video regarding Quicken and the industry. I will do that later in the newsletter in a summary fashion. What was the catalyst of this?

This all started with an article that Dave Savage, Founder & CEO of MortgageCoach, wrote on Linkedin titled “The Quicken Loans IPO Means “Game On” for Local Lenders.” This was a very well put together article which I highly recommend you give it a read.

Next up Dave did a video with Ryan Hills of TheResourceTV titled: “Is Rocket Mortgage Stealing Business From Both Realtors and Lenders?” This video expands on Dave’s article and I highly recommend you watch and listen to the conversation.

I have some strong opinions on this topic which I have been talking about for the past few years...BUT before we get into all of that let’s kick off this week’s TLX with some inspiration!

Say Yes Every Day

This week say yes to your intuition. So often we are told to “just trust your gut instinct, “ but what does it actually mean? Your intuition is your immediate understanding of something, there’s no need to think it over or get another opinion. It just feels “right”. Have a great week! - Laura Brandao

Sharing is Caring! Remember to share your personal referral link (bottom of email) for a chance to win a $50 Amazon Gift Card!

MBS X

I am excited to have Barry Habib and MBS Highway as content contributors to TLX!

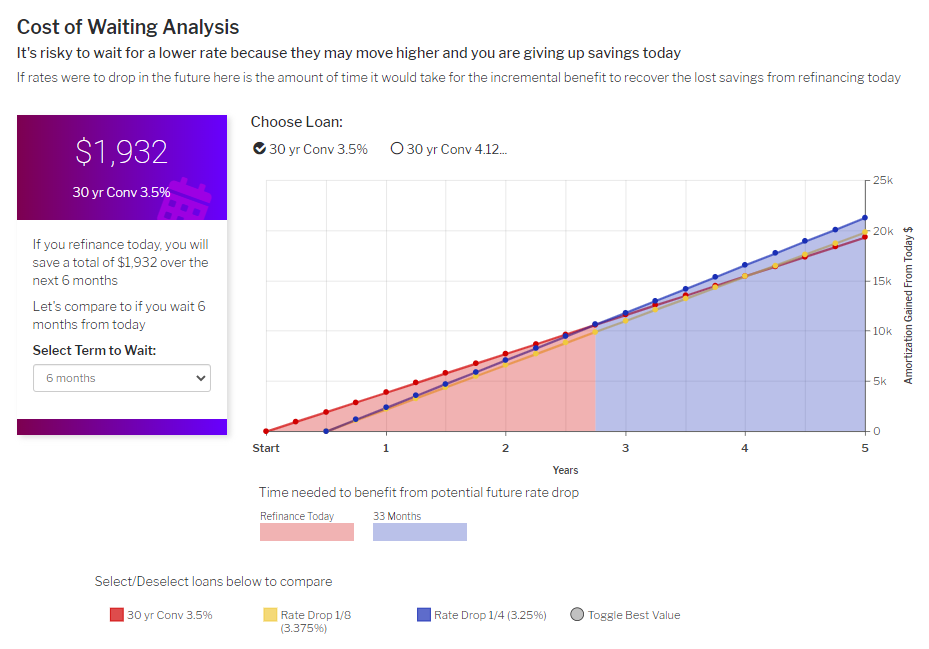

A lot your buyers are probably wondering if it’s a good idea for rates to move even lower to refinance. Even though that’s where it seems like the market is heading, it’s risky to wait for a lower rate because they may move higher and you are giving up savings today. Clearly show that even if rates move ¼% lower, for example, it would take nearly three years to recover the lost savings from refinancing today.

MBS Highway has a Facebook live coming on Wednesday, July 29th at 2 PM ET where you will learn how to show up on social media and stay relevant in today’s market. RSVP here.

The News X Recap!

One topic that hasn’t been covered enough in my opinion is what effect the Remote Work trend will have on migration habits. This week Siemens announced that it is going to let staff ‘Work From Anywhere’ permanently.

Did you say migration habits? Why yes, yes I did. Recently Redfin did a migration analysis and found that a Record 27% of Homebuyers Are Looking to Relocate, as Pandemic Accelerates Trend Toward Affordable, Less Dense Areas.

What about rates? After weeks of record-low after record-low mortgage rates, the downward trend is finally seeing a slight reverse. Freddie Mac's Primary Mortgage Market Survey reported the 30-year fixed-rate mortgage at 3.01%, up slightly from 2.98% last week.

What about the bubble? Lenders pull back as mortgages delinquencies rise. 9% of Inland Empire homeowners can't pay vs. 9% in LA-OC, 7% statewide and 8% nationally.

Are you doing video yet? Cmon! Don’t know what to say? Well..AIME has you covered. Learn from the AIME’s Creative Director, Nicole Peraino, as she explains the process of creating an effective script to make sure your self-produced video content comes out with a purpose and relevancy within the market.

The Vieaux

Sports are Back Baby!

Who would have thought that we would be so excited for late July baseball? This is typically when we are entering the “dog days” of summer and already looking ahead to football. It is also when most of us in real estate and mortgage are taking time for vacations at the beach. If there has been a silver lining resulting from Covid, which shut down sports, it is that many of us have been busier than ever with bulging pipelines and rates with a 2 handle.

I am not one of those who believes sports is going to make Covid disappear, but I must admit that I am so looking forward to a small bit of normalcy. Watching a baseball game (even with cutouts of fans in the stands) has never been more anticipated. Enjoy the games this weekend and stay safe & healthy. - Brain Vieaux

Good things come to those who Mastermind! Have you joined the Mortgage X Mastermind yet? I would like to invite you to join our community that is 100% focused on helping MODERN industry professionals crush it.

Mortgage X MLO & Agent of the Week!

Rachelle Heinzen-Ruchty with Keller Williams Realty Sonoran Living

Jamie Cavanaugh, COO of Amerifund Home Loans, Inc.

Doctor X

Let’s face it; most of us aren’t getting enough sleep. We stay up too late, get up too early, and our sleep quality ain’t what it used to be. Unfortunately, lack of sleep has some real consequences. Here are Five easy tips to sleep better tonight. - Gregory Charlop MD.

Positively Charged | Confident Closers | Blondes Have More Funds

Next Level Loan Officers | Laugh Lend and Eat | Treasure Coast Podcast | Charlotte Real Estate Buzz

Culture Matters Podcast | Mortgage X Podcast | Marketing Interrupt

#RealTalk

What does the industry not understand about Quicken?

First, let me get through the fine print and say this is not a dig or a blast on Quicken. They are doing everything I would be doing if I were in their position, blah blah blah….and I want everyone to understand that what I am about to say is because of my passion for helping the true mortgage xperts in the industry.

I am writing a full article on this for LinkedIn, but until then, here is the Letter X summary about Quicken as discussed with Dave Savage and Ryan Hills.

A majority of lenders in the industry will NOT be able to compete with Quicken...ever and not for the reasons that everyone talks about. So why is this?

First is retention. Looking at Dave’s LinkedIn article, you will see that the industry does not do a good job when it comes to retention of business. If you TRIPLED the industry’s retention rate, you would still be 10% worse than Quicken. I looked at this stat two years ago and guess what? It hasn’t improved much if at all.

Anyone knows that the golden key for legacy business in the mortgage industry is customer lifetime value. If your retention rate is weak, then you will have a hard time creating CLV. While Quicken has a gorilla retention efforts happening, most of the industry is thinking that their CRM drip with recipes, newsletters nobody cares about, and cleaning out your gutters will make that difference. Really?

Second, let’s look at training. I have had the good fortune to talk with some ex-Quicken LOs, and they will tell you that Quicken’s training programs are the best. Quicken wants to win, period. If they spend all that money on marketing, you can bet they are not leaving training to chance. For someone who has done hundreds if not thousands of trainings of MLOs over the last decade, I can tell you easily that over 75% of the MLOs brush off the way Jordan brushes off a double team.

Too many MLOs don’t put in the time and effort to be a master of their craft. According to Stratmor, a vast majority of MLO production for lenders is done by 10-20% of their LOs. Do we really think that number is scalable long-term?

Finally, we have fragmentation. Our industry is very fragmented in how it approaches systems, processes, and workflows. We have multiple LOS, POS, CRMs, etc… They are used differently, and most are not used efficiently. MOST lenders do not hold their MLOs feet to the fire on using these tools, defeating the purpose of a lender’s focus on implementing enterprise systems. Earlier this year, I spoke at SimpleNexus’s user conference and when I asked the room full of marketing, tech, and execs to hold up their hands if they had over 50% adoption rate on anything other than their LOS. Guess how many hands went up? Two.

Not every mortgage lender rolls this way, as some have a structure in place to where if an MLO wants to work there, they better adhere to the lender’s way of doing things. But that is far and few between with most lenders working in a fragmented way. When you are competing against a machine like Big Q that has only one way of doing business, you can’t afford to not all be rowing in the same direction.

At some point, leaders in the industry need to understand that the modern marketplace will not include a majority of the lenders that are around today if we continue to stay the course of business as usual. Don’t let the current boom we are going through erase the memories from a year and a half ago. Remember Q1 2019? Those times will 100% come around again, so take some of these record months to invest in building a company that can compete for the next decade.

Meme of the Week

This is courtesy of Fobby Naghmi.

If you have a meme you would like featured send it to frazier@marketinginterrupt.com

This Month’s Giveaway

A special thank you to Laura Brandao who is again sponsoring this week’s Book, Everything Is Negotiable: The 5 Tactics to Get What You Want in Life, Love, and Work by Dr. Meg Meyers Morgan.

In order to win a free copy please text the word “letterx” (no quotes) to 66866 and follow the instructions. Good Luck!

Remember to share your personal referral link below for a chance to win a $50 Amazon Gift Card! I hope you enjoyed TLX #14! Have a great weekend.