🦉 WoW #97 - The Wealth Feedback Loop 🦉

Dec 01, 2021 8:16 pm

Happy Wednesday, Wise Owl Nation!

Last week I mentioned that I wanted to write a newsletter solely around wealth.

So that is what I am going to try to do in this week's issue.

I will do my best to make this newsletter short and sweet, while still providing a lot of value.

I am going to cover the wealth feedback loop I have used for the last 8 years. I've covered parts of it before, but most of the thought processes are all in this one article.

As always, thank you for reading my words 😀!

Let's get into it.

You can find all past issues (including this one) here.

_____________________________________

Was this email forwarded to you?

_____________________________________

🤑 The Wealth Feedback Loop 🤑

First things first, when I say "wealth" I am not specifically referring to money.

True wealth is having assets that earn while you sleep, and financial independence occurs when your assets earn enough to cover your monthly expenses.

"Making money is not a thing you do - it is a skill you learn." - Naval Ravikant

Building wealth is not really about hard work either. You can work in the service industry waiting tables for 80 hours a week and still never get rich. Not to say hard work isn't important too. Nothing gets done without hard work, but it is not the be-all, end-all thing to focus on.

Another personal finance reminder

I am always going to repeat this section when I talk about wealth because it is the foundation of everything. You HAVE to master this basic part before you can do much else.

You build with only 4 ways:

- Reducing expenses

- Increasing income

- Reducing debt

- Investing

Expenses

Back in the first paragraph, I mentioned financial independence occurs when your assets earn enough to cover your monthly expenses. The first step on the path of wealth is to get your expenses under control and reduce them if at all possible.

^ I show this graphic a lot because visuals are helpful. If your expenses are less than your income, you will have money to spare. This extra money is your gap of opportunity. Increase that gap of opportunity by increasing income and reducing expenses.

Of course, there will always be a limit to how much you can cut expenses, so once you've put time and effort into creating a proper gap of opportunity, then you can focus on increasing income. As Ramit Sethi is well known for saying "There is no limit to how much you can earn."

Multiple Streams of Income

I have a regular day job too, by the way, and I still have one because it is a powerful and additional stream of income for me.

There are a ton of ways to make money in this world.

"The internet has massively broadened the possibl space of careers. Most people haven't figured this out yet."

- Naval Ravikant

I wrote an article a few years ago that still gets a lot of traction today, about generating multiple streams of income. Feel free to read it as an extension of this week's newsletter.

^ Read this article and think about ways you can start to leverage your own skills and abilities to add value back to the world.

I wrote that article in 2018 and that single article has earned me $720+ by itself. I wrote it once and I keep getting paid for it. That is adding value at scale. You do something once and it can continually add value in perpetuity.

Good Debt vs. Bad Debt

There are two different kinds of debt.

Most debt in my experience is bad debt.

Bad debt is your consumer debt brought about by credit cards, car loans, etc. I love credit cards and use them for most purchases, but I make sure to pay off those credit cards multiple times a month. Carrying a credit card balance from month to month is bad. Don't do it if you can avoid it.

Then there is good debt.

Most wealthy people utilize loans to spend money. They use their assets as collateral to secure loans that allow them to go invest in more assets.

I call this good debt because it is being used to build more wealth by creating more assets.

Investing

"All the returns in life, whether in wealth, relationships, or knowledge, come from compount interest." - Naval Ravikant

When it comes to assets, most of your wealth growth will come from the cash flow of those assets.

When you buy stocks, bonds, or index funds of both most of the growth of those assets will be from reinvesting the dividends.

When you buy an investment property, most of the wealth generated comes from the monthly rent you collect. That rent buys you more equity in that property and creates cash flow for saving for another property.

Even in crypto, you can stake your ETH and earn more ETH. Since ETH is a triple-point asset, the ETH you earn can increase in value as well as the asset appreciates, as well as be immediately spendable since ETH is also usable as a medium of exchange.

The Wealth Feedback Loop

All four of these areas of wealth building compound together.

The longer you make more income than you spend, the more you are able to pay off bad debts.

↓

The sooner you can pay off debts, the sooner you can focus solely on investing.

↓

The more you are able to invest, the more your investments can earn more of themselves.

↓

The longer those investments earn more of themselves, the more they grow, and the sooner your investments can cover your monthly expenses.

↓

Once your investments can cover your monthly expenses you have a choice.

↓

You can maintain a day job as a primary source of income while allowing your investment portfolio to rapidly continue to grow.

↓

You can use your investments as collateral to take out loans to invest in more assets.

↓

You can do both of those things at the same time.

Or...you can retire from being an employee and do whatever you want with your time since your assets/investments now pay for your entire lifestyle.

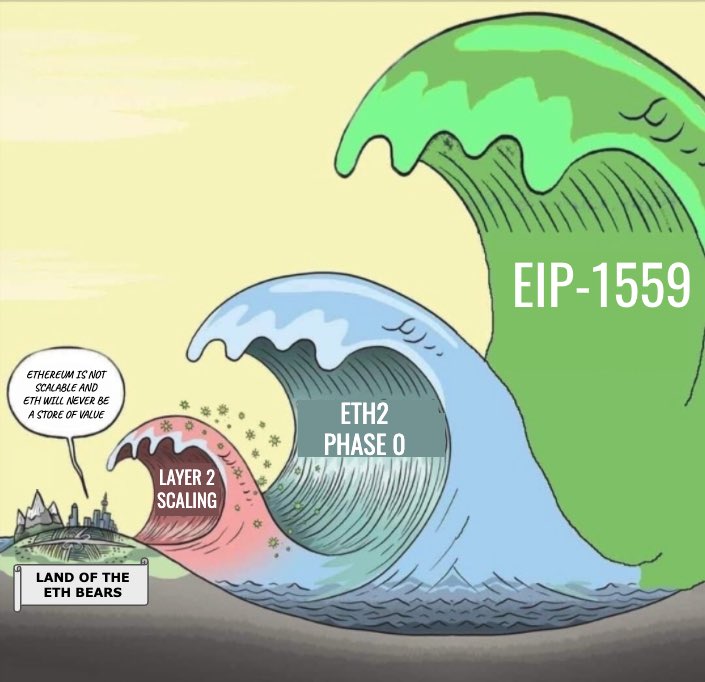

P.s. You can do all of these things with Crypto. Specifically Ethereum.

Ethereum Stats:

Total ETH burned - 1.1 million ETH!!! (or $4.7+ billion!!)

ETH burned in the last week - 77,000 ETH !!!! 😱

Avg ETH burn per minute (all-time) - 6.34 ETH/min

My favorite website for watching the ETH 🔥 is ultrasound.money.

Quote/Meme of the week:

Have a great week!

This concludes our issue this week, I hope it gave you some perspective or injected a little motivation into your life!

If it helped, let me know! I read every newsletter response I receive, and I absolutely love hearing from all of you. This newsletter is for you, so I need your help to make it as great as possible.

If you'd like to show me some love for writing all this free stuff, you can always buy me a coffee.

More Resources

I will be adding to this section over time as we find resources that will help you all.

- Check out the Wise Owl Store

- All Wise Healthy Wealthy Articles on Medium

- Start your own Sendfox Newsletter

- Free products to help you level up

Crypto Resources

The Bankless Podcast: This is a link to the bankless podcast on Spotify. Start from the very beginning and learn why I am so positive about the power of Crypto and Ethereum in particular. You can find the podcast easily on the internet, but I am linking to episode 1 on Spotify for your convenience.

Buy your first ETH or BTC:

- On Coinbase - this is the easiest starting place for the newest beginners

- On Gemini - Another great option founded by the Winklevoss brothers. They are based out of New York.

- On Kraken - Kraken has a bit of a harder user interface, but they already have ETH staking enabled with the push of a single button.

Earn interest on your crypto

- BlockFi - Currently, you can earn 4.5% interest on BTC, 5% interest on ETH, and a whopping 8.25% on stable coins like USDC. Use the referral code b09f24fd to support the newsletter.

Other tools:

- Argent Wallet - This is the best mobile wallet for Ethereum, Defi, and all things on the Ethereum network, including staking. They even have plans to implement Layer 2 to remove network fees.

- Ethhub - this is a weekly newsletter that lists out all the interesting news, articles, and tweets that have happened in Crypto that week. It's free and awesome.

- Ethdashboard - A simple dashboard to look at various metrics in the ethereum space. I mainly use this as a quick tool to check ETH gas fees.

- Cointracker - this is one of the better tools for tracking all of your various crypto across all of the various wallets, exchanges, etc. You can also use them to do your crypto taxes each year.

- Metamask - this is a crypto wallet that you can access from your browser and allows you to easily interact with blockchain apps online.