🦉 WoW #84 - The many paths to success 🦉

Sep 02, 2021 12:47 am

Happy Wednesday, Wise Owl Nation!

Last week I wrote from Florida and this week I write from Atlanta, Georgia.

The funny thing to me is that it might seem like I travel a lot when in reality these are the first two trips I've made since 2019.

So, my last vacation occurred before this newsletter was born!

Anyway, I digress. My time in Florida last week was great.

My time returning to Texas from Florida was not great, as we drove through Louisiana when it was in the full swing of evacuations ahead of Ida.

Many, many people attempted evacuation, which led to the following fun travel conditions:

- Completely packed freeways

- No gasoline to be found anywhere

- Law enforcement restricting movement through small towns

- A lot of frustrated and scared drivers

It was a classic situation where all six people in the vehicle I was in had to practice the stoic principle of "focus on what you can control."

My trip to Florida had me discussing success and investing with various members of my family and it got me thinking about two topics:

- How many ways to succeed in life there are

- Diversification of investments doesn't accumulate wealth at all, it just protects wealth

So that is what I am writing about this week.

Let's get into it.

You can find all past issues (including this one) here.

_____________________________________

Was this email forwarded to you?

_____________________________________

🧠 Wisdom Tip(s) of The Week: The Many Ways To Win

"There are hundreds of paths up the mountain, all leading in the same direction, so it doesn't matter which path you take. The only one wasting time is the one who runs around and around the mountain, telling everyone that his or her path is wrong." - Hindu Proverb

This quite has been stated in a million different ways by a million different people, but this Hindu Proverb version is quite elegant in my opinion.

In life, you will always see others working towards their goals in their own way. Let them. You need to focus on your own path up the mountain. Especially if you aren't able to follow the footsteps of someone who came before you.

There may be hundreds of paths up the mountain, but all of them have one thing in common. You can only climb them with consistent effort.

If you start your climb and meet a dead end, don't just lay down and quit. Find another path up.

Sometimes I feel like my own path of success has been hypocritical. I have always wanted to "escape the rat race" and "be my own boss" only to find that I do really well when I have a stable income, create a gap of opportunity between my income and expenses, and then start to build wealth that way.

Now, at age 31 I am on the cusp of true financial freedom and I look back at how much of my twenties I considered to be a failure at the time. I wasn't a failure at all, I was just walking my own path up the mountain, too busy comparing my journey to others.

Don't be like me. Have more confidence in your own path forwards.

🤑 Wealth Thought of The Week: Thoughts on Diversification

One of the questions I used to get asked all the time when I started talking about cryptocurrency is the concept of diversification.

In the world of personal finance and investing, diversification means spreading your investments out across various levels of risk so that you don't lose all of your hard-earned money on a single risky investment.

It's the classic "don't put all of your eggs in one basket" parable.

The problem with this though is that while it is a great way to preserve your wealth, it is a terrible way to accumulate and grow wealth.

It's true you need to be diversified enough for your investments to survive, but not so diversified that nothing ever grows. Areas of your investments need to be concentrated enough to matter.

This is where Crypto came in for me.

I've invested in index funds and real estate for almost all of my 20's.

The real estate did well, the index funds maintained the value of money I put in them, but what really took off was the riskiest investment of all - cryptocurrency.

The rabbit hole can get even deeper when you talk about diversifying your crypto assets, and again the same wisdom holds true. Diversify enough to survive, but not so much you miss the big growth opportunities.

This is why I always pushed so heavily at Ethereum while still holding onto Bitcoin.

The more that time passes, the safer and less risky Ethereum is looking, so I am constantly asking myself if I should look for more opportunities?

I don't have an answer to that yet, but I do know that my focus and concentration on Ethereum has been a resounding success, and I feel there is still so much growth potential for ETH and the Ethereum Network.

So for now, it is business as usual.

I am going to continue focusing on accumulating ETH, and then staking that ETH so it earns more of itself over time.

Ethereum Stats:

Total ETH burned - 161,000 ETH (or $595 million)

ETH burned in the last week - 67,055 ETH !!!! 😱

Avg ETH burn per minute - 4.11 ETH/min

My favorite website for watching the ETH 🔥 is ultrasound.money.

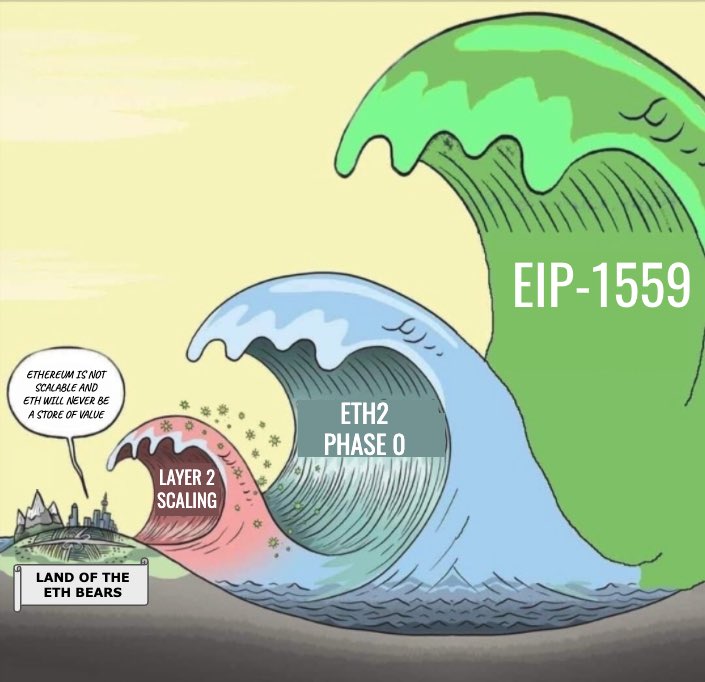

Quote/Meme of the week:

Have a great week!

This concludes our issue this week, I hope it gave you some perspective or injected a little motivation into your life!

If it helped, let me know! I read every newsletter response I receive, and I absolutely love hearing from all of you. This newsletter is for you, so I need your help to make it as great as possible.

If you'd like to show me some love for writing all this free stuff, you can always buy me a coffee.

More Resources

I will be adding to this section over time as we find resources that will help you all.

- Check out the Wise Owl Store

- All Wise Healthy Wealthy Articles on Medium

- Start your own Sendfox Newsletter

- Free products to help you level up

Crypto Resources

The Bankless Podcast: This is a link to the bankless podcast on Spotify. Start from the very beginning and learn why I am so positive about the power of Crypto and Ethereum in particular. You can find the podcast easily on the internet, but I am linking to episode 1 on Spotify for your convenience.

Buy your first ETH or BTC:

- On Coinbase - this is the easiest starting place for the newest beginners

- On Gemini - Another great option founded by the Winklevoss brothers. They are based out of New York.

- On Kraken - Kraken has a bit of a harder user interface, but they already have ETH staking enabled with the push of a single button.

Earn interest on your crypto

- BlockFi - Currently, you can earn 4% interest on BTC, 4% interest on ETH, and a whopping 7.5% on stable coins like USDC. Use the referral code b09f24fd to support the newsletter.

Other tools:

- Argent Wallet - This is the best mobile wallet for Ethereum, Defi, and all things on the Ethereum network, including staking. They even have plans to implement Layer 2 to remove network fees.

- Ethhub - this is a weekly newsletter that lists out all the interesting news, articles, and tweets that have happened in Crypto that week. It's free and awesome.

- Ethdashboard - A simple dashboard to look at various metrics in the ethereum space. I mainly use this as a quick tool to check ETH gas fees.

- Cointracker - this is one of the better tools for tracking all of your various crypto across all of the various wallets, exchanges, etc. You can also use them to do your crypto taxes each year.

- Metamask - this is a crypto wallet that you can access from your browser and allows you to easily interact with blockchain apps online.