🦉 WoW #91 - Unhelpful Stress and Advanced Personal Finance🦉

Oct 20, 2021 6:33 pm

Happy Wednesday, Wise Owl Nation!

We are getting deeper into October and it really feels like this year is blurring by.

Crypto is up, Covid is down, and everyone still seems to be as stressed out as ever.

Is any of our stress helpful? Maybe a tiny portion of it is helpful, but the rest is just a huge mental and physical drain.

This week I write about

- Unhelpful stress

- An intro to advanced personal finance (what to do when you are on the path to wealth, but not quite wealthy yet)

Also, thank you to the few of you that have recently bought me a coffee! Y'all always make me freak out and go tell my fiance that people like my writing!

Let's get into it.

You can find all past issues (including this one) here.

_____________________________________

Was this email forwarded to you?

_____________________________________

🧠 Wisdom Tip(s) of The Week: Unhelpful Stress

In life, there are things we stress about that make sense, and there are a lot of things in life we stress about that don't make sense.

I saw a post from my favorite Stoicism author Ryan Holiday. It lists 8 questions you can ask yourself that can help you find areas of your life you need to change.

My personal favorite question is the first one. Focusing your energy on what you can control, and letting everything else go is one of the simplest and most powerful mental tools I have ever come across.

Another question I loved was "does this actually matter?" In many cases the answer is "no" which always helps me stress less about things.

Which of these questions hits hardest for you?

Remember, the key to success is consistency, not the amount of work you do in a single day. Here are two quotes from James Clear that read well together.

"The secret to being productive is to work on the right thing—even if it's at a slow pace."

"Do less. Keep returning to one thing and continue to refine it." - James Clear

🤑 Wealth Thought of The Week: What changes once you're on the path to wealth?

This week I decided to spice things up in this section.

I spend a lot of time writing about wealth fundamentals: keeping your expenses below your income, increasing income, investing, etc. But I rarely talk about what my thoughts are when you get to a point where you're doing everything, and don't know what else to do.

To become wealthy takes time and years of consistency, so there will come a time (I hope) where you have mastered the basics, but still want to find more you can do.

I'll write a little bit about that phase of the journey today. This is a pretty long topic, so this section will be long but know that I am keeping it way shorter than I would for a blog post. If you like reading about this and want to read more on this topic please send me an email or message me on Instagram.

Seriously, you can email me if you like a topic. It makes me feel good.

Personal Finance Basics

The basics of wealth-building are the following. You know this stuff if you read my content, but it will never not be relevant, and it is a brief primer before we get to the more advanced stuff.

- Reduce expenses

- Increase income

- Pay-off/avoid debt

- Invest

The greater the gap between your income and your expenses, the more you can pay off your debts and invest. This is the basic process for building wealth.

A common breakdown of expenses are the following:

- 60% of your income goes towards fixed expenses

- 20% of your income goes towards savings & investments

- 15% of your income goes towards "guilt-free spending"

- The last 5% is a buffer in case you mess up. Put that into an emergency fund if you crush it each month.

You want to save up/invest in the following, in this order, if you are an American:

- If you have a 401k that matches, put the minimum in to get the maximum matching from your job. It's free money. If you don't get 401k matching proceed to the next step.

- Save up to a small emergency fund of $2,000 - $4,000

- Max out a Roth IRA for the year (around $6,500 or so)

- Invest a small amount of money each week into Bitcoin, Ethereum, or both

- Build up that emergency fund to cover 6-months of expenses

- Max out your 401k contributions for the year (like $16,500 in 2021 I think)

Most people are still working their way through these steps. For the rare few of you that are experts at this process and complete all the steps that apply to you, the next section might help you figure out what to do with the rest of your income.

Advanced Personal Finance

This is where life starts to get extra fun.

You've reached a point where money is no longer a burden or a worry and has instead become a tool for liberation.

At this point, you still need to keep working to keep the gravy train flowing, but you are well on your way to building generational wealth.

Even so, you still have extra income you want to put towards something, but you don't know what. Do you throw it all into crypto and pray it speeds up your retirement date? Do you throw it at a taxable investment account and hope the markets don't crash?

What do you do when you've been great with money and yet still have money to spare.

First, you need to know what your money triggers are.

By this I mean, what area of life would spending money on help improve your overall happiness or overall quality of life.

Which of these excites you the most? (these are just a few examples)

- Luxury

- Convenience

- Travel

- Family

- Health

- Education

- Hobbies

With this extra money, you could hire a personal trainer to come to your house and work with you to get in the best shape of your life. That is a combination of health and convenience.

You could hire a part-time virtual assistant to manage your calendar, send birthday gifts to friends, and plan your next vacation. Convenience, Travel, a sprinkle of luxury.

You could even hire a nutritionist to coordinate with your virtual assistant and personal trainer to create a holistic health and fitness plan.

You could use the money to treat your family to a formerly expensive mini-vacation multiple times a year. Or save up to go on a HUGE vacation.

You could spend the money on a sauna, like I am doing, which is a combination of convenience, health, and luxury.

You could start an expensive hobby, and pay for a course to get you started. Hobby and Education.

There really is no limit to the ideas you can come up with on how mastering the basics of personal finance can empower you to start enriching your life.

The point I am trying to make here is that at a certain point you can't just keep saving money or hoarding it. Money is a tool that can be used to enhance your life long before you reach a point of retirement.

Use it to enjoy life, get yourself healthy, and experience the world.

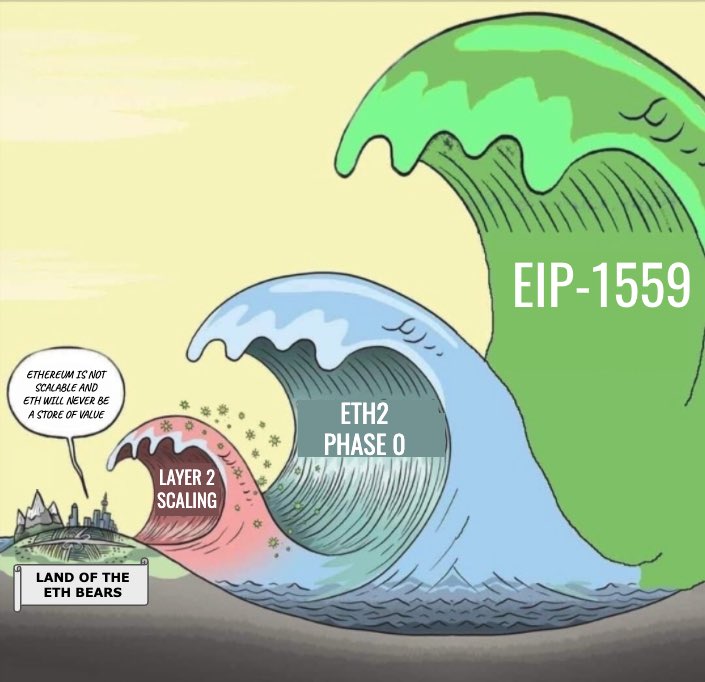

Ethereum Stats:

Total ETH burned - 581,000 ETH (or $2.2+ billion!!)

ETH burned in the last week - 61,500 ETH !!!! 😱

Avg ETH burn per minute (all-time) - 5.30 ETH/min

My favorite website for watching the ETH 🔥 is ultrasound.money.

Quote/Meme of the week:

Have a great week!

This concludes our issue this week, I hope it gave you some perspective or injected a little motivation into your life!

If it helped, let me know! I read every newsletter response I receive, and I absolutely love hearing from all of you. This newsletter is for you, so I need your help to make it as great as possible.

If you'd like to show me some love for writing all this free stuff, you can always buy me a coffee.

More Resources

I will be adding to this section over time as we find resources that will help you all.

- Check out the Wise Owl Store

- All Wise Healthy Wealthy Articles on Medium

- Start your own Sendfox Newsletter

- Free products to help you level up

Crypto Resources

The Bankless Podcast: This is a link to the bankless podcast on Spotify. Start from the very beginning and learn why I am so positive about the power of Crypto and Ethereum in particular. You can find the podcast easily on the internet, but I am linking to episode 1 on Spotify for your convenience.

Buy your first ETH or BTC:

- On Coinbase - this is the easiest starting place for the newest beginners

- On Gemini - Another great option founded by the Winklevoss brothers. They are based out of New York.

- On Kraken - Kraken has a bit of a harder user interface, but they already have ETH staking enabled with the push of a single button.

Earn interest on your crypto

- BlockFi - Currently, you can earn 4.5% interest on BTC, 5% interest on ETH, and a whopping 8.25% on stable coins like USDC. Use the referral code b09f24fd to support the newsletter.

Other tools:

- Argent Wallet - This is the best mobile wallet for Ethereum, Defi, and all things on the Ethereum network, including staking. They even have plans to implement Layer 2 to remove network fees.

- Ethhub - this is a weekly newsletter that lists out all the interesting news, articles, and tweets that have happened in Crypto that week. It's free and awesome.

- Ethdashboard - A simple dashboard to look at various metrics in the ethereum space. I mainly use this as a quick tool to check ETH gas fees.

- Cointracker - this is one of the better tools for tracking all of your various crypto across all of the various wallets, exchanges, etc. You can also use them to do your crypto taxes each year.

- Metamask - this is a crypto wallet that you can access from your browser and allows you to easily interact with blockchain apps online.