🦉 WoW #70 - The Trust Equation 🦉

May 26, 2021 6:56 pm

Happy Wednesday, Wise Owl Nation!

I started my new full-time job this week!

My first day was Monday, and whew I forgot what a mental overload starting at a new company can be like.

Usually, this mental overload comes from needing to learn the role you're in as it pertains to the company, but this time around the mental overload has come from meeting so many new people.

I think it might be pandemic related, in that, the past 12 months have been the least social for most of the world.

So the last two days I have been meeting dozens of new people, and trying to stay "on" and upbeat throughout the entire day.

It's a tough thing to do when you're out of practice!

Regardless, I am excited to be back at a full-time gig, and this new job has inspired sections of this week's newsletter.

This week I talk about:

- The Trust Equation (long and interesting)

- A reminder to myself, and to you, to drink more water

- Current thoughts on saving money

Let's get into it.

You can find all past issues (including this one) here.

_____________________________________

Was this email forwarded to you?

_____________________________________

🧠 Wisdom Tip(s) of The Week: The Trust Equation

I was perusing my favored newsletters this week and came across something very interesting.

An equation to determine trust. It was first discussed in a book called "The Trust Equation" (go figure) and I find this fascinating.

The equation goes like this:

This equation can be used to determine the trustworthiness of people, organizations, news sites, and corporations.

I'll break down the variables and share how I plan to use this equations (because I definitely am going to use this).

Credibility:

This is one that is pretty straightforward. Does the person or organization in question have the knowledge, experience, and familiarity to perform or back up what they claim?

If you're unsure about the credibility of a person or organization, do some digging. With individual people, like friends or coworkers, it's better to just have a conversation where you gently inquire about the subject.

A few strong questions that help sus out credibility:

- Where do you go to learn more in this area?

- How are you making decisions around this?

- What experience are you applying to this area?

These questions said in your own words can be powerful primers for a conversation that should help you gauge if the person truly knows what they're talking about.

Reliability:

To me, personally, this is a big one. Credibility is less important to me than reliability. It is the rarest of the three good traits in my estimation.

When friends, coworkers, or even companies show up for you time and time again it goes a LONG way.

You can be the most credible, authentic, and selfless person around, but if you aren't reliable... how can that be valuable?

This newsletter may not blow your mind every week, but I will make damn sure it gets sent out every single Wednesday. Vacation or no Vacation.

One pit you should try not to fall into is judging reliability in the short term versus the long term. I've been guilty in the past of being too critical of someone when they let me down for the first time.

You really need a larger body of work or experiences to draw from before making value judgments of people.

When someone is reliable about being unreliable, then you know what you're working with.

Authenticity:

How easy is it to truly get to know the person or organization in question? Is it clear what they care about?

This is what authenticity means in this equation. If they are not easy to get to know, or their motivations are hard to determine, those could be red flags.

Why do "used car salespeople" have such a bad reputation? It's because in the past these types of salespeople were Credible, Reliable (they never left you alone), but were so incredibly inauthentic they made people queasy.

They also were so obviously acting in their own self-interest (see next section) that they were impossible to trust.

It can be hard to judge your own level of authenticity out in the world, but what I've found always works, and you are definitely going to roll your eyes at me on this one....is just being yourself!

😂 Seriously, though! I love cryptocurrency, and so I write about it all the time! I love poker and reference it wherever makes sense.

Moreover, you can learn truths about life from all of your hobbies and interests, and apply that knowledge to other parts of your life.

For example, when I talk about mental training, I usually bring up poker as one of the best ways to train your mind. You can make all of the right decisions in poker and still lose. So you have to focus on the decisions you're making rather than on the results. Focus on what you can control, after all 😉.

This lets people know that:

- I like poker a lot

- I'm thoughtful enough to bridge concepts and knowledge between subjects

Be you. Be vulnerable every once in a while. Let others in.

This will go a long way to becoming more authentic.

Perception of Self-Interest:

When I first read this equation, it was the perception of self-interest part that was the least obvious to me.

Essentially, this part has to do with how selfish or self-interested the person, company, or organization in question appears.

This most often crops up in friendships when someone only engages with you when they need something. They expect you to do the majority of the actual friendship work, where they reap all the benefits.

They only act in their own self-interest, or at least that is the way you are perceiving it.

This is a big one to think about for yourself as well. How self-interested are you being perceived to be to others? You may not be acting in your own self-interest, but it may not appear that way to others. Do an audit of your friendships. Have you been too one-sided or selfish in any of them?

🧊 Health Thoughts of The Week: Drink More Water

To be honest, I forget to drink enough water.

I drink coffee every day, and there is water in that!

Of course, the caffeine reduces the actual hydrating ability of that water, but I digress.

Water is the fuel of all of your health-related practices.

When you're hydrated:

- you think more clearly

- you sleep more soundly

- you wake up more refreshed

- you stay alert longer

Your body is made mostly of water. Water fills your muscles, cells, and blood. It allows your brain to produce enough CSF (cerebral spinal fluid) to keep itself protected.

Water is critical to all of your internal organs.

So drink more of it! (Pointing at myself)

🤑 Wealth Thought of The Week: Current Thoughts on Saving Money

This week I want to chat about saving money more than anything else.

If you have questions about Crypto and are sad panda that I am not talking about it this week, you can always reach out to me on Instagram, or use your fancy referral URL to invite 1 person to the newsletter so you can get invited to the Wise Owl Discord server.

Alright, let's talk about savings.

First off, saving money is a core part of building wealth. It is never explicitly stated when I write out the four ways of building wealth, but it's heavily implied.

You need a gap of opportunity to save for the future, but I've never talked about saving for right now before, so I am going to cover that first.

To keep this section from turning into a full blog article, I am going to forcibly keep this brief.

The idea I want to discuss here is - I've found it far easier to save when you put away small chunks of money frequently.

For example, if I were to put $5 a day into a savings account, I would have $150 on average at the end of the month. You could also save $37.50 a week to reach the same goal.

The consistency of sending that money away in small increments will make it feel like you don't actually have that money to spend.

Most people, if they have achieved a Gap of Opportunity, are able to save a little bit of money every day or every week.

The problem usually comes when someone is asked to put away a larger chunk of money less frequently. I don't like the whole "Once a month" concept of saving. It's too infrequent and can make too big of a dent in someone's checking account.

Accounts you can build with this strategy:

- An emergency fund of 1-2 months of expenses

- A down payment on a House, Car, or Wedding

- A vacation fund

- Next months fun budget

Let your imagination run wild. Most online banks will allow you to easily open multiple savings accounts, name them, and start putting $ into them.

You can also use apps like Acorn, Thrive, or Betterment to do automate a lot of this. The upside and downside of these apps is having to transfer the money back when you need to spend it.

Okay, that wraps up this section.

Think a bit about how you save, why you save, and if you're saving habits are repeatable in the long term.

Quote/Meme of the week:

I'm not a huge fan of budgets, but this quote still rings true regarding the management of your money.

You should control where your money goes. Intentionally.

Have a great week!

This concludes our issue this week, I hope it gave you some perspective or injected a little motivation into your life!

If it helped, let me know! I read every newsletter response I receive, and I absolutely love hearing from all of you. This newsletter is for you, so I need your help to make it as great as possible.

If you'd like to show me some love for writing all this free stuff, you can always buy me a coffee.

More Resources

I will be adding to this section over time as we find resources that will help you all.

- Check out the Wise Owl Store

- All Wise Healthy Wealthy Articles on Medium

- Start your own Sendfox Newsletter

- Free products to help you level up

Crypto Resources

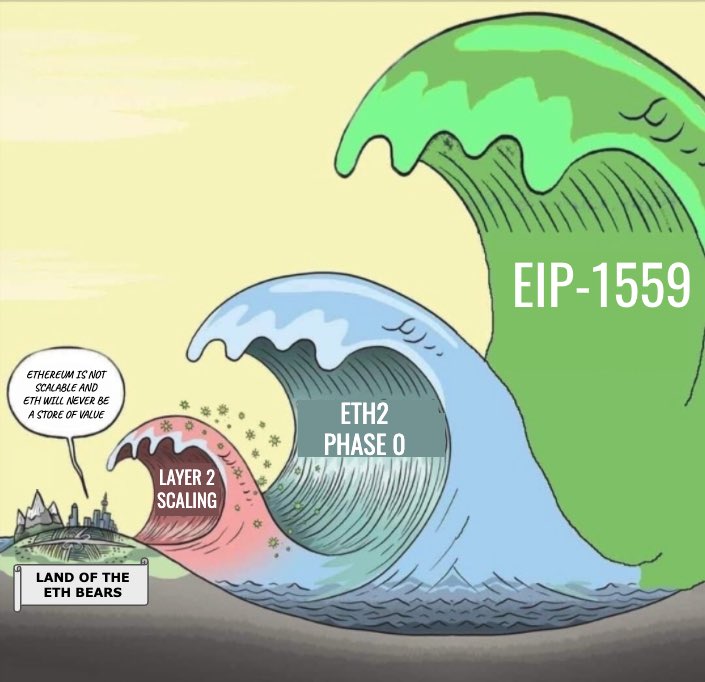

The Bankless Podcast: This is a link to the bankless podcast on Spotify. Start from the very beginning and learn why I am so positive about the power of Crypto and Ethereum in particular. You can find the podcast easily on the internet, but I am linking to episode 1 on Spotify for your convenience.

Buy your first ETH or BTC:

- On Coinbase - this is the easiest starting place for the newest beginners

- On Gemini - Another great option founded by the Winklevoss brothers. They are based out of New York.

- On Kraken - Kraken has a bit of a harder user interface, but they already have ETH staking enabled with the push of a single button.

Earn interest on your crypto

- BlockFi - Currently, you can earn 6% interest on BTC, 5.25% interest on ETH, and a whopping 8.6% on stable coins like USDC. Use the referral code b09f24fd to support the newsletter.

Other tools:

- Argent Wallet - This is the best mobile wallet for Ethereum, Defi, and all things on the Ethereum network, including staking. They even have plans to implement Layer 2 to remove network fees.

- Ethhub - this is a weekly newsletter that lists out all the interesting news, articles, and tweets that have happened in Crypto that week. It's free and awesome.

- Ethdashboard - A simple dashboard to look at various metrics in the ethereum space. I mainly use this as a quick tool to check ETH gas fees.

- Cointracker - this is one of the better tools for tracking all of your various crypto across all of the various wallets, exchanges, etc. You can also use them to do your crypto taxes each year.

- Metamask - this is a crypto wallet that you can access from your browser and allows you to easily interact with blockchain apps online.