A house in Canada is at 1988 price in GOLD compared to Canadian DOLLARS?! 🇨🇦

Sep 26, 2024 6:02 pm

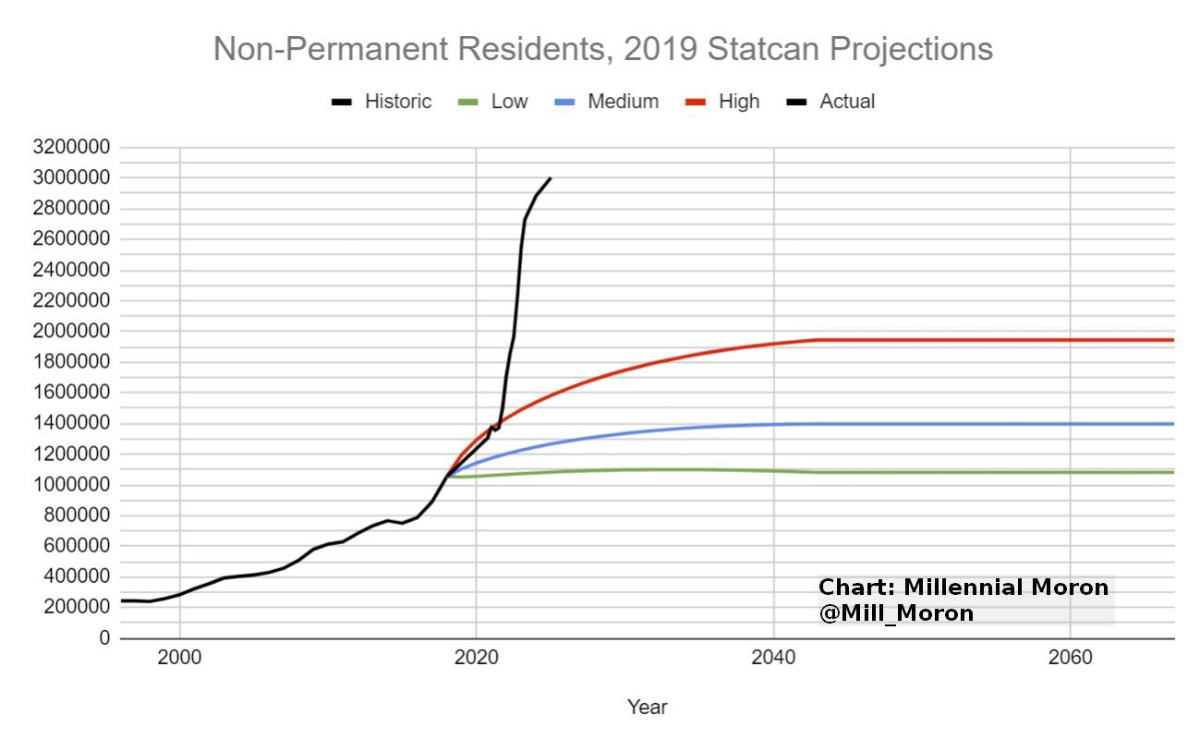

Last Sunday we picked up my wife and youngest daughter at the airport and we saw a LOT of people. I overheard some of the families talking and so happy being reunited with their loved ones that were moving to Canada. It is no surprise that many still choose to move and build their lives in Canada despite the many challenges that is going on in this country. I still believe that long-term, Canada as a country still has a lot more potential because it has so many things to offer - abundant in natural resources, breathtaking landscapes, unlimited opportunities and hardworking people. In terms of population growth, just look at the chart below, Canada now has 3 MILLION Non-Permanent Residents. Yes that is not a typo.

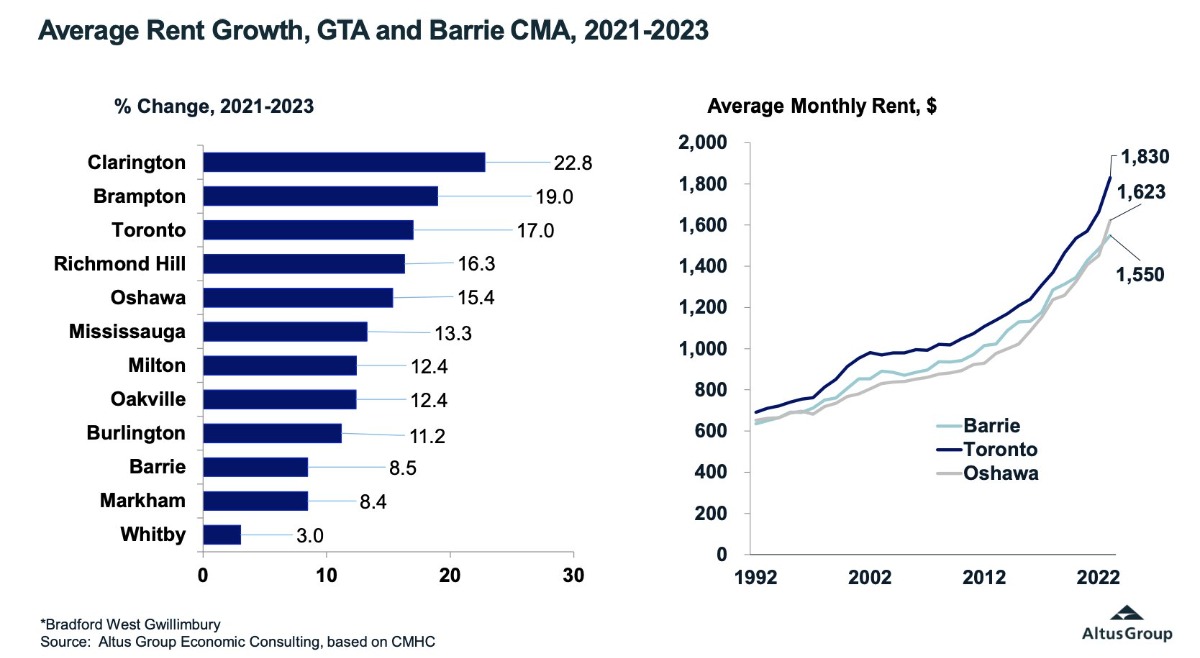

And because of this jump in the population, average rent is up too!

REAL ESTATE TALK:

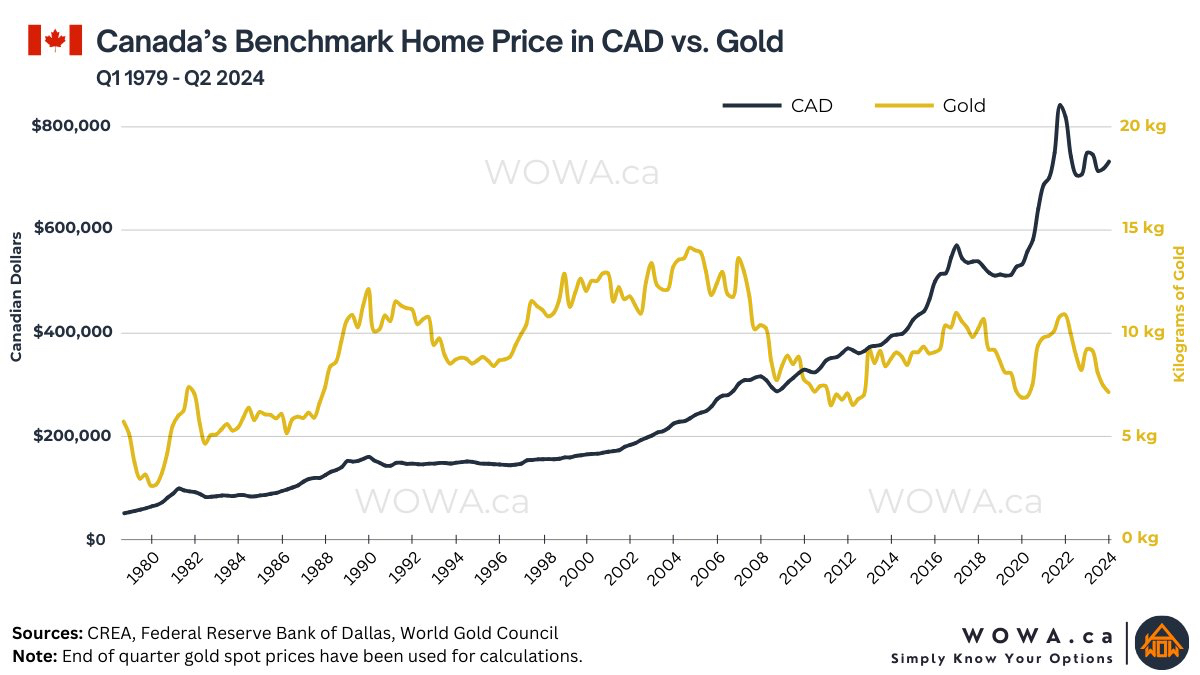

Over the past 20 years, the price of homes in Canada has significantly outpaced the rise in gold prices when measured in Canadian dollars. In 2004, the average house price in Canada was around CAD 227,000, while the price of gold was approximately CAD 525 per ounce. Fast forward to 2024, where the average home price has surged to roughly CAD 730,000, and gold is trading at about CAD 2,600 per ounce. This comparison reveals that while gold has quadrupled in value, the average home price has more than tripled. In practical terms, in 2004, it would have taken about 432 ounces of gold to buy a house in Canada, whereas today it requires around 280 ounces. This indicates that housing, despite its rapid appreciation, has become cheaper relative to gold over the long term.

One key reason behind the significant increase in real estate prices over time is currency debasement. As central banks, including the Bank of Canada, have steadily increased the money supply through measures like quantitative easing and low interest rates, the purchasing power of the Canadian dollar has diminished. This has led to inflation in asset prices, particularly real estate, as investors and homeowners seek to preserve wealth in tangible assets like property. Unlike fiat currency, which can be devalued through inflation, real estate tends to hold its value or appreciate in response to a weaker currency. The steady rise in home prices, coupled with the limited housing supply in major cities, has made real estate a preferred store of value, pushing prices higher over the long term

Just look at the chart below from WOWA. ca

FEATURED PROPERTY:

LOWEST MORTGAGE RATES:

VARIABLE: 5 YR HIGH RATIO P‐1.0%

5 YR CONVENTIONAL P‐0.65%

FIXED 1 YR: 5.89%

FIXED 2 YRS: 5.64%

FIXED 3 YRS: 4.69%

FIXED 4 YRS: 4.9%

FIXED 5 YRS: 4.24% (High Ratio)

FIXED 5 YRS: 4.89% (Conventional)

Call me at 416-670-8598 if you're looking for a debt consolidation loan to pay off your high interest credit card debt! Call us if your bank says no, we will do our best to help you.