"Forecasting is like Astrology": Why I’m Ignoring the 2026 Headlines (And you should too).

Dec 19, 2025 4:20 pm

The hardest part of buying your first home isn’t the money. It’s the patience.

More than 15 years in this business taught me one thing:

Discipline beats luck every single time.

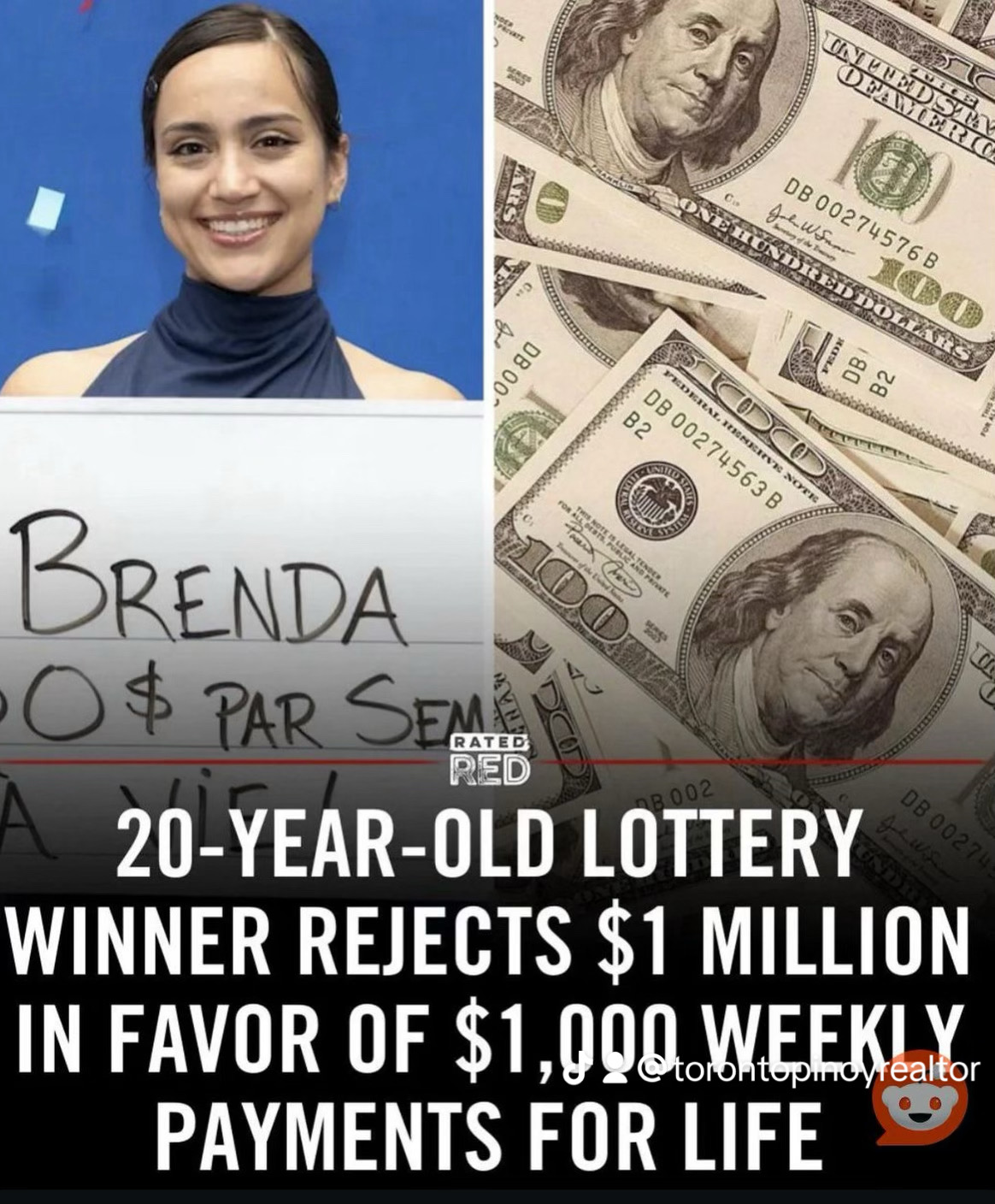

This young woman, Brenda, just gave a masterclass in discipline.

Turning down an instant $1,000,000 check takes guts. It takes a maturity rarely seen at 20.

It means she understands that instant gratification is the enemy of lasting wealth.

And that is the exact mindset required to become a successful homeowner in today's challenging market.

Saving for a down payment isn't sexy.

Skipping the new car to boost your credit score isn't fun.

Paying down a mortgage over 30 years feels slow.

But like Brenda's weekly payments, homeownership isn't about the flash in the pan.

It’s about the slow, boring, unstoppable accumulation of equity.

The lump sum gets spent.

The steady drip fills the bucket.

Build your foundation first.

The luxury can come later.

What's your take: Would you have the discipline to turn down the million?

-----------------------------------------------------------------

Headline: 2026 isn't a Rebound. It’s a Reset. (And for my buyers, that’s the best news in years).

If you’ve been glued to the headlines waiting for the "perfect time" to buy, you might be feeling whiplash.

Royal LePage just released their 2026 forecast, predicting a 4.5% price dip for the GTA.

But before you panic (or celebrate), let’s look at the track record before we put too much stock in the percentages.

The "Expert" Track Record (2023–2025): For 2023, they predicted a price drop; the GTA market actually rose over 5%. For 2024, they forecasted a 6% boom; prices finished flat (down <1%). And for 2025, they called for a 5% gain; instead, we saw a ~3.5% dip. That is three years of missing the mark—not just on the number, but on the direction.

But hey! Prediction is a hard business. And the late John Kenneth Galbraith once said "The only function of economic forecasting is to make astrology look respectable."

Here is the truth that my years of experience in this business has taught me: The "Market" doesn't buy homes. YOU do.

While the headlines obsess over forecast accuracy, here is what’s actually happening on the ground for First-Time Buyers right now:

The "Blind Bidding" Era is Paused: We are finally seeing conditions on offers again. Inspection? Financing? Status Cert review?

They are back.

Condos are the Entry Point: With condo prices projected to soften further, the ladder to homeownership is lower than it has been in 5 years.

Clarity over Chaos: We are moving from "panic buying" to "confident planning."

To my clients and partners: This "Reset" means we stop reacting to fear and start acting on fundamentals.

It means buying a home because it fits your life and budget, not because you’re scared you’ll be priced out forever next month.

Real estate shouldn't be about stress; it should be about the confidence that comes with clarity.

Resources for the Data-Minded:

The Royal LePage 2026 Forecast: https://blog.royallepage.ca/a-reset-is-in-store-for-canadas-housing-market-in-2026/

TRREB Market Watch (The actual numbers): https://trreb.ca/market-data/market-watch/

Download or share the ✅ The 2026 Reset: A Clarity Guide for First-Time Buyers

or

Book your free 15 MIN. MEETING

No boring pitches. Just clarity.

Talk soon,

Fred Camingal