From Surviving to Belonging: The Power of Community in Canada

Dec 09, 2025 11:21 am

From Surviving to Belonging: The Power of Community in Canada

This is my community in Canada. Picture was taken at our annual CFC Christmas Party.

Having a community in Canada matters more than people realize.

Many of us arrive with big dreams but very small circles. A solid community becomes your support system when family is far away.

It gives you people to lean on, a place to grow your faith, and friends who understand the challenges of building a new life here.

It keeps your marriage and family grounded, reduces stress and isolation, and reminds you that you’re not alone.

In a new country, community isn’t just “nice to have.”

It’s what turns Canada from a place you moved to… into a place that finally feels like home.

_______________________________________________________________________

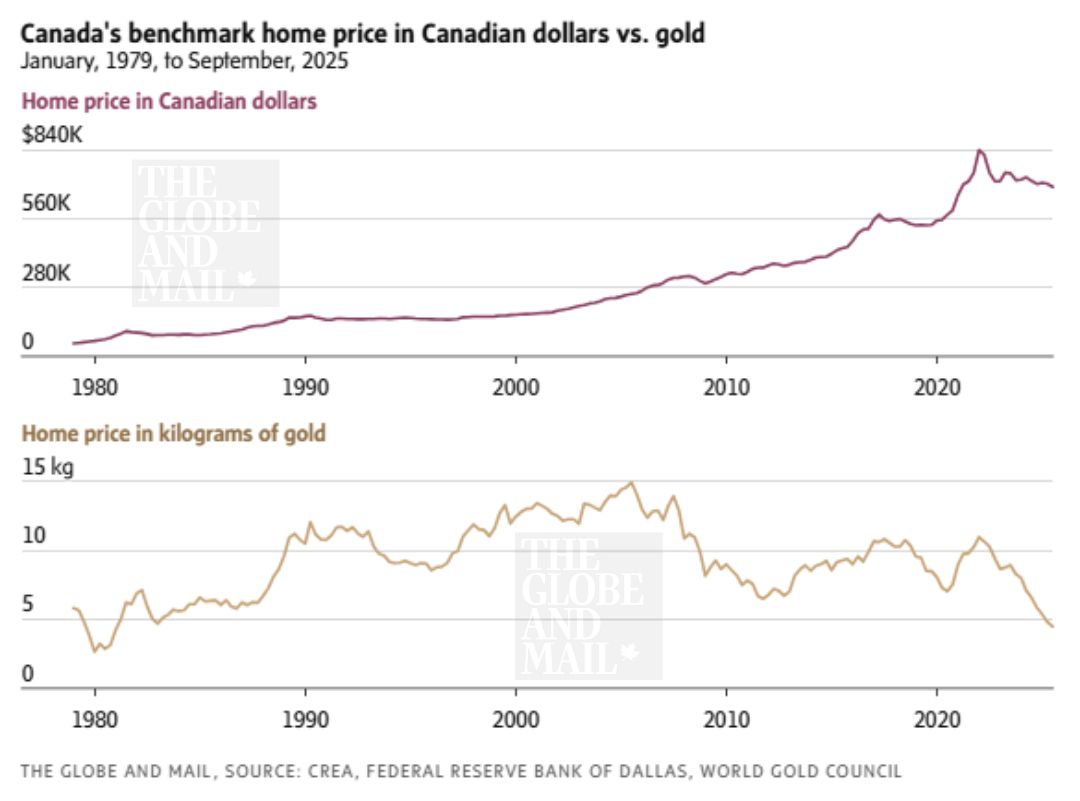

Are homes really getting more expensive… or is our money simply worth less?

This may be the most important mindset shift for buyers in 2026.

Every headline screams “unaffordable.”

And yes — prices in Toronto have grown faster than incomes. But here’s what most people never hear:

If you measure Canadian home prices in gold, the average home today costs about the same amount of gold it did in 1981.

Read it again... RIGHT?

Not more.

Not less.

Almost identical.

So why does it feel like everything is getting pricier?

Because the value of our money has changed.

And you can feel it every time you go grocery shopping.

A Simple Example: Groceries Tell the Story

Think back 10 years.

A $100 grocery trip used to fill a cart.

Today… it’s barely a basket.

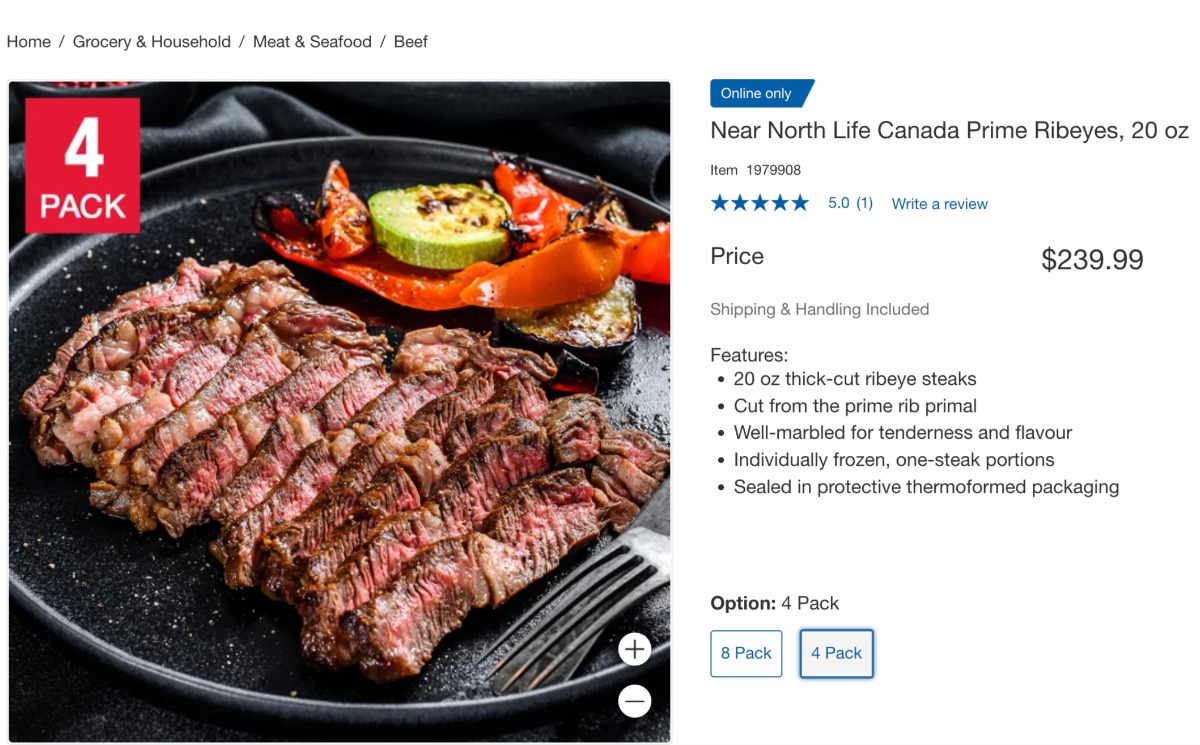

Here’s a concrete example:

- Ribeye steak in 2015: approx. $12.99/lb

- Ribeye steak in 2025: often $18–$22/lb in Toronto stores

The steak didn’t suddenly become a luxury food.

Your dollar shrank.

This exact same force is happening in real estate.

How This Ties Into Canada’s M2 Money Supply

This is the missing piece of the conversation.

M2 money supply = cash + chequing + savings accounts + easily accessible money circulating in the economy.

Over the last 20 years in Canada:

- M2 grew 7.3% per year on average

- The economy grew only ~4.1% per year

- Wages rose under 3.5% per year

- Consumer inflation averaged ~2.2%

When money supply grows faster than the economy, you get inflation — not just at the grocery store, but in assets like housing.

This is why homes look “more expensive” in dollars…

…but not when measured against long-standing stores of value like gold or silver.

It’s not that homes got dramatically more valuable.

Our money buys less.

So Why Are Smart Investors Still Buying Real Estate?

Because they understand this exact principle:

Real estate is one of the most reliable hedges against currency inflation.

Here’s why experienced investors stay active even when headlines sound scary:

Real estate tracks long-term inflation

When the dollar weakens, hard assets rise in nominal price.

This protects purchasing power over decades.

Land is scarce in cities like Toronto

Population grows.

Immigration remains strong.

Land doesn’t expand.

Demand consistently outpaces supply — even with short-term dips.

Rent follows inflation

Rents tend to rise as living costs rise.

This creates income that also adjusts with inflation.

Mortgages are fixed, but inflation is not

Inflation erodes the real value of debt.

This means investors pay back their mortgages with “cheaper dollars” over time.

Wealthy families use real estate as a long-term store of value

Even during high interest rates or market uncertainty, real estate remains one of the few assets historically tied to long-term wealth preservation.

This is why you don’t see seasoned investors panicking.

They understand the math behind the headlines.

What This Means For You:

If you’re a first-time buyer, this isn’t about rushing or panic-buying.

It’s about understanding the landscape so you can plan with confidence.

Because if the value of the dollar continues to erode — as it has for decades — then waiting for a giant crash may not work the way many people hope.

Real estate isn’t “running away.”

The dollar is.

If you want clarity on:

- your budget,

- your buying power,

- or whether waiting makes sense…

I’m here to walk through the numbers calmly and step-by-step.

Download or share the First-Time Homebuyer Guide to someone you know.

or

Book a 15-minute clarity call — no pressure, no sales pitch.

Book your free 15 MIN. MEETING

Just clarity.

Talk soon,

Fred Camingal