Trade Truce, Market Boom & What 2026 Could Bring for Investors

Nov 03, 2025 3:29 am

Hi ,

Markets have been busy again, so I’ve put together a quick update to help you cut through the noise and stay focused on the big picture.

Market Snapshot

The world’s two biggest economies, the U.S. and China, recently agreed to a one-year trade truce. This pause means fewer new tariffs and restrictions for now, which helps calm global markets.

But beneath the surface, things are still changing. China is learning to handle trade tensions better, and the US is becoming more focused on protecting itself by raising import taxes and tightening its borders.

Meanwhile, the US stock market has been on fire this year, rising almost 40% since the April lows, mainly because of excitement about artificial intelligence (AI).

Zest’s Take

What we’re seeing now is a world with two stories happening at once:

- U.S. market looks strong, but its prices are already very high.

- Other parts of the world like Asia and Europe are quietly catching up as trade patterns shift.

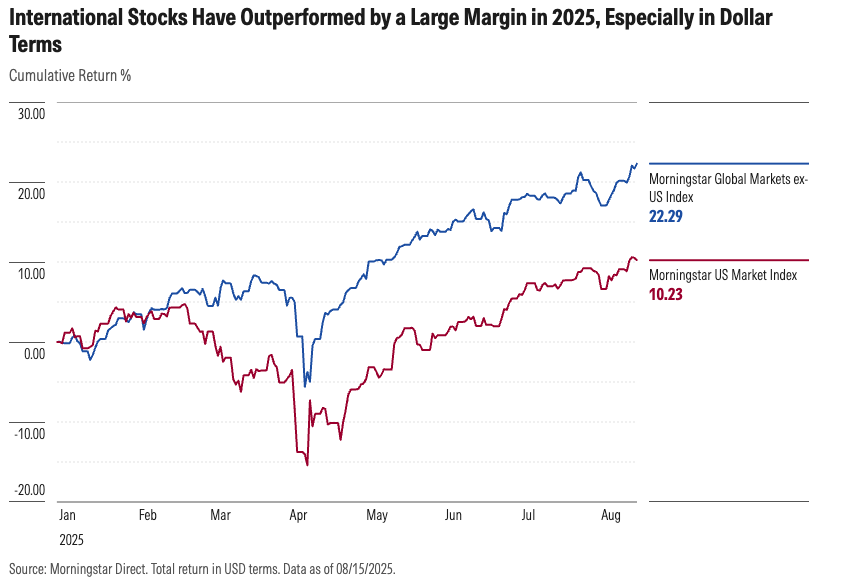

International Stocks Have Outperformed This Year

That’s why I continue to believe in diversification, spreading your investments across different countries and types of funds. It helps protect your wealth when one area slows down.

What’s Driving the Market

- Trade Shifts: China’s exports to other countries are growing, even though it trades less with the US.

- AI Boom: Tech companies like Nvidia are leading the stock rally, but prices are getting expensive.

- 2026 Changes: A few new things may shape the next year:

- “Trump Accounts” — a new savings plan for children, where the government gives a $1,000 start-up bonus.

- Digital or “tokenized” stocks — the US may soon allow stocks to trade using blockchain, like crypto.

- Looser trading rules — regulators may make it easier for smaller investors to trade more often.

What We Are Watching Next

- Whether the US and China will extend their trade peace beyond 2026.

- Whether inflation will stay high, making it harder for interest rates to come down.

- If the AI stock rally keeps going or starts to cool off.

- New ways for investors to save or trade as 2026 policies roll out.

What This Means for You

For most Singapore-based investors, these global changes are a reminder that no single market stays on top forever. The U.S. remains strong, but high prices and policy shifts mean it’s wise not to rely only on one country.

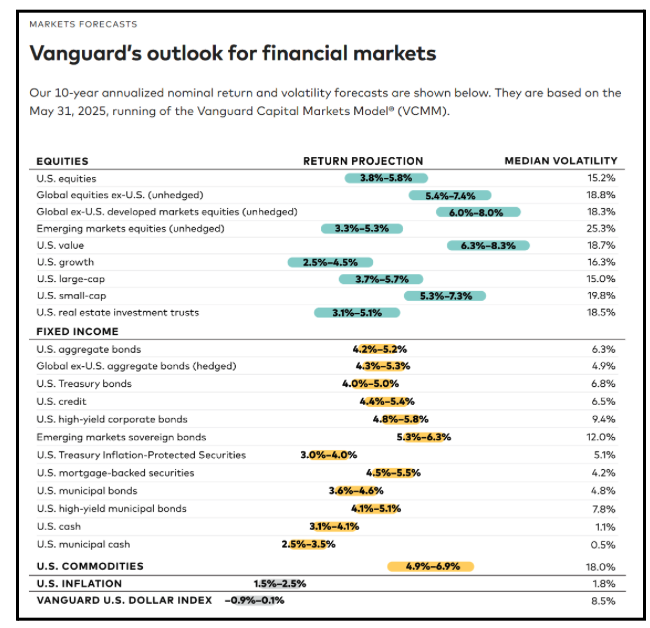

Here is Vanguard's Outlook for Financial Markets

Your current portfolio’s mix of Singapore, Asia, and global funds helps you stay balanced, capturing growth from rising Asian economies while still benefiting from opportunities in developed markets.

If you’ve been keeping extra cash in the bank or in T-Bills, this may be a good time to explore income-generating options such as bond or dividend funds that can provide steady returns while interest rates stabilise.

Investing is like brewing coffee the aroma doesn’t come instantly, but patience brings out the richness.

The world is changing fast trade rules, technology, even how stocks are traded but the principles of good investing remain the same: stay diversified, stay invested, and let time do its magic.

Warm regards,

Zest Chia

Executive Wealth Consultant

Infinity Financial Advisory

☕ Brewing Financial Freedom, One Kopi Chat at a Time

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.