Markets Walking a Tightrope

Sep 11, 2025 2:35 am

Hi ,

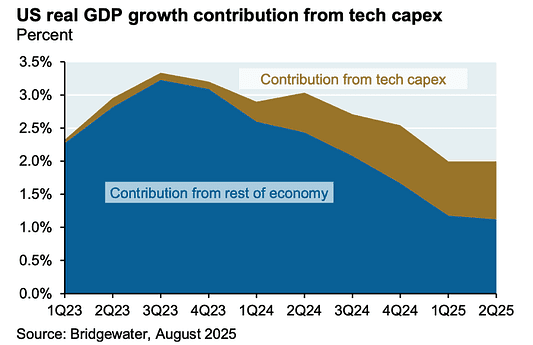

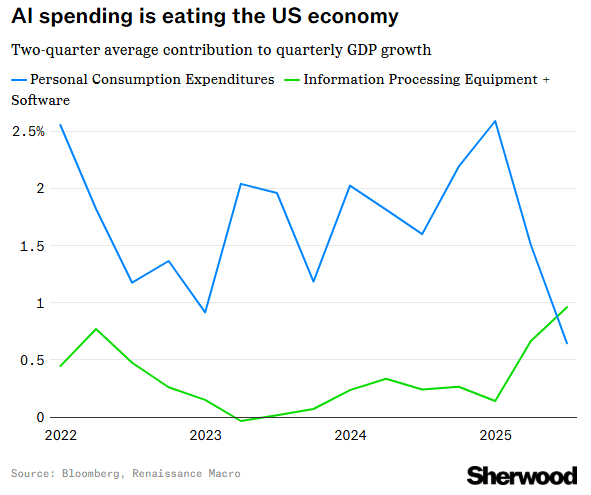

The U.S. economy is running on just two engines right now: government spending and the artificial intelligence (AI) boom. Meanwhile, the usual sources of economic strength like jobs, housing, and consumer spending, are showing troubling signs.

The Question Is, What's Keeping the Economy Going?

Right now, big technology companies are pouring enormous amounts of money into AI projects. Think of companies like Amazon and Microsoft building massive computer centers and buying specialized equipment to power AI systems. This spending is so large it's actually keeping our entire economy growing.

But here's the problem: no one knows for sure if all this AI spending will actually pay off in the long run. It's a bit like the dot-com boom of the late 1990s there were lots of excitement and investment, but uncertain returns.

The Job Market Reality Check

The job situation is more concerning than it first appeared. Government agencies have had to significantly reduce their estimates of how many jobs were actually created:

- They initially said we created many more jobs than we actually did

- Recent corrections show we've only been adding about 30,000 jobs per month from June to August. This shows economical weakness and slowdown in the process

- Over the past two years, job creation was nearly 2 million lower than originally reported

The Tale of Two Americas: Companies vs. Workers

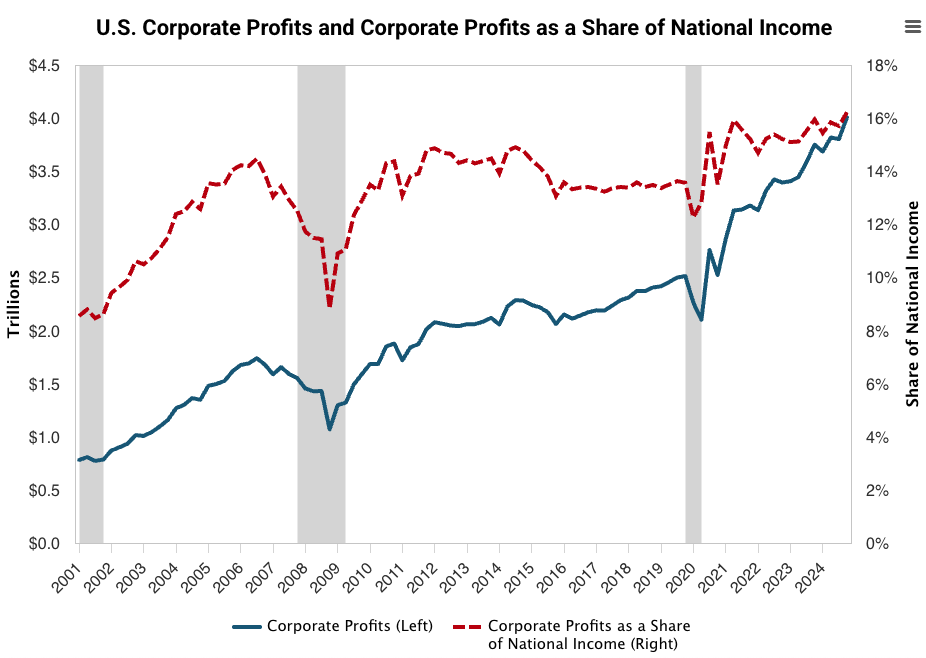

Here's a story that perfectly captures what's happening in our economy right now. Companies are making more money than ever before – their profits doubled since 2010 and hit a record $4 trillion last year. Wall Street experts are actually "amazed" at how well businesses are doing.

But here's the problem: while companies are getting richer, workers aren't sharing in that success. Imagine the entire country's income as a big pie. The slice going to corporate profits got much bigger after COVID, while the slice going to workers' paychecks stayed roughly the same size.

Where are all these record profits going? About three out of every four dollars goes straight to shareholders (the people who own stock in these companies). Very little goes to giving workers raises or investing in growing the business for the future.

This creates a big problem. Companies are making more money not by growing and creating more value, but by keeping their costs, especially what they pay workers, as low as possible.

When you hear experts celebrate that companies are "handling" higher costs from things like tariffs, what they really mean is someone else is paying the price, either workers get smaller raises, or customers pay more for goods.

Why This Matters?

When Americans don't have good jobs or rising wages, they spend less money. Since consumer spending makes up about 70% of our economic activity, this is a big deal.

Meanwhile, the stock market has become heavily dependent on just a few giant technology companies (often called the "Magnificent Seven"). These seven companies now represent about one-third of the entire S&P 500's value, up from just 12% in 2015.

The Big Risk

We're in a situation that looks remarkably similar to the end of the internet bubble in the late 1990s. Back then, a small group of technology stocks drove most of the market gains, until investor enthusiasm suddenly cooled.

If investors start having doubts about AI or if these massive AI investments don't deliver the expected profits, we could see significant drops in both the stock market and overall economic growth.

What This Means for Your Portfolio

Given these risks, we need to be thoughtful about how much of your money is tied to this AI theme. While the technology is promising, putting too many eggs in one basket especially when that basket is carrying most of the market, which may not be wise.

We are keeping a close eye on these developments and will adjust our strategy as conditions change.

Best Regards,

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.