Rising Healthcare Costs & What It Means for Your Retirement

Nov 18, 2025 7:07 am

Hi ,

Hope you have been well. Since you downloaded my retirement planning guide, I wanted to share an important update that directly affects long-term retirement readiness in Singapore.

The Straits Times recently reported that six out of seven insurers have raised Integrated Shield Plan (IP) and rider premiums for 2025.

The main reasons: higher claims, rising medical inflation, and expanded treatment coverage.

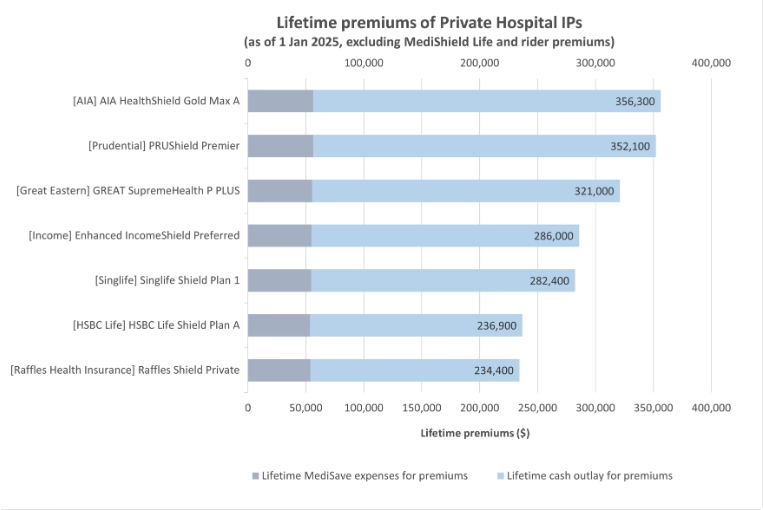

At the same time, MOH released a comparison of lifetime premiums for Private Hospital plans, showing that long-term healthcare costs can easily add up to hundreds of thousands of dollars over a lifetime.

This matters because:

Healthcare is one of the largest (and fastest growing) expenses in retirement.

And unlike lifestyle spending, healthcare costs cannot be postponed or reduced if something happens.

Why this is important for your retirement planning

Some people may think, “I’ll just downgrade my plan when I’m older.”

Before doing that, here’s a recent case that The Straits Times highlighted:

- A woman waited 5 months for a colonoscopy appointment at SGH

- Fearing cancer, she chose not to wait

- She saw a private specialist within days

- The scope was done within a week

- It confirmed advanced colon cancer that had already spread to her liver

This example shows that in retirement, the ability to access timely medical care can be just as important as affordability.

Medical inflation + longer lifespans → makes healthcare planning a critical part of retirement planning.

If you would like, I can help you review:

- How rising healthcare costs may affect your retirement income

- Whether your current coverage fits your future needs

- How to plan for medical inflation without overspending on premiums

- Simple ways to protect both your savings and your access to care

If you’re open to a quick review, simply reply “Review” and I will send over a personalised breakdown.

Warm regards,

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.