The One Thing Most Homeowners Overlook…

Nov 07, 2024 10:08 am

Hi ,

Zest here! Hope you are well!

While home insurance is not compulsory in Singapore, it is highly recommended to protect your property and belongings.

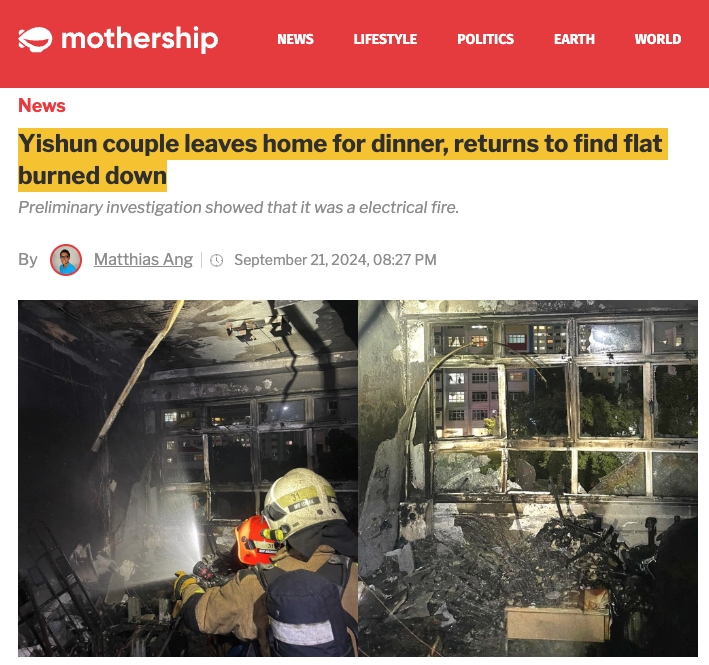

Take, for example, a recent home fire incident in Yishun caused by an electrical fault:

Imagine coming home from work or dinner only to find your home destroyed. The financial stress in the aftermath can be far worse than the cost of a basic home insurance plan.

In 2023 alone, there were 970 fires reported by the SCDF. Of these, 384 were due to unattended cooking and 276 were caused by electrical fires.

With the growing use of electronic appliances from online platforms like Taobao, often lacking the required SAFETY MARK, the risk of electrical fires is even higher.

Why Home Insurance Matters

Although home insurance isn’t mandatory, it provides critical financial protection in the event of unexpected incidents such as fires, floods, theft, or structural damage.

Important Distinction: Don’t confuse home insurance with HDB Fire Insurance, as they serve different purposes:

- HDB Fire Insurance is required for HDB homeowners with an HDB loan. It only covers structural aspects of the flat, such as walls, floors, windows, and doors in the event of fire damage.

- Home Insurance covers much more, including renovations, personal belongings, and damages beyond just fire.

Types of Home Insurance Coverage

If you’re convinced of the necessity of home insurance, it’s useful to know that there are two main types of coverage:

Insured Perils

- Covers specific events, such as:

- Fire

- Lightning

- Explosion

- Impact by road vehicles

- Bursting or overflowing of water tanks or pipes

- Theft by forcible entry

- Natural disasters (floods, windstorms, earthquakes, etc.)

- Riots and strikes

Any loss or damage not caused by these specified perils is not covered.

All Risks

- Offers broader coverage, including accidental damage.

Protect what matters most to you. If you’d like to learn more or discuss the best option for your needs, feel free to reach out.

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.