Market Update: Global Trade Is Shifting Rapidly, but No Market Crash in Sight

Aug 21, 2025 2:02 am

Hi ,

I hope you're doing well! Last month I shared some concerns about trade wars, mixed corporate performance, and job market uncertainties. I wanted to follow up with some encouraging developments that address those very issues.

The World is Trading Differently Now

America is Less Central to Global Trade Think of global trade like a giant shopping mall. Twenty years ago, America was the biggest store that everyone had to visit. Today, it's shrunk from being 1 out of every 5 purchases to just 1 out of every 8. Other countries are finding new places to shop and sell their goods.

New Shopping Groups Are Forming Countries like Brazil, India, China, and Russia (called BRICS) are now trading more with each other than with America. It's like a group of friends who used to always hang out at one person's house, but now they're meeting at different places and inviting new friends to join.

China is Becoming the New Popular Store While America and China aren't trading as much with each other, China has doubled its sales to countries in Asia, Africa, and Latin America since 2015. Even when China's sales to America dropped, their overall business still grew 7% last year.

Countries Are Finding Backup Plans Smart countries aren't putting all their eggs in one basket. Brazil is selling more coffee to Africa and the Middle East instead of just America. South Africa is sending more fruit to China. It's like having multiple jobs instead of depending on just one employer.

Good News: The Economy Isn't Heading for a Crash

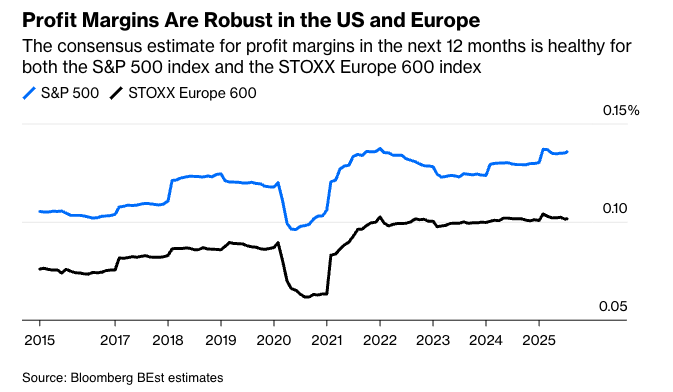

Companies Are Actually Doing Really Well Despite all the scary news, most businesses are making more money than expected. In fact, 8 out of 10 companies recently reported better profits than anyone predicted - the best performance in four years. And it's not just tech companies; businesses across all industries are doing well.

Businesses Are Financially Healthier Than Governments Here's something surprising: private companies are actually in better financial shape than many governments right now. The U.S. government owes $37 trillion (that's a really, really big number), while most companies have manageable debt and growing profits.

Companies Learned from the Pandemic During COVID, when interest rates were super low, smart companies borrowed money cheaply and saved it for later. Now they're in a strong position, kind of like someone who stocked up on groceries when they were on sale.

Very Few Good Companies Go Out of Business History shows that less than 1% of well-run companies actually fail, and most of those failures happened during the 2008 financial crisis. Today's companies are generally much stronger.

What This Means for Your Investments

The Big Picture: We're not heading for an economic disaster. Instead, the world economy is reorganizing itself, for example it is like rearranging furniture in your house to make it work better.

Three Key Points:

- The world is becoming less dependent on America - this creates opportunities in other growing markets

- Companies are healthier than expected - this is good news for stock investments

- Change creates opportunities - smart investors can benefit from these shifts

Bottom Line: While change can feel scary, the data shows that businesses are adapting well and the global economy is finding new ways to grow. This is more like a renovation than a demolition.

The key is staying diversified and not panicking about short-term news headlines. The fundamentals suggest we're in a period of healthy economic evolution, not collapse.

Feel free to call or email if you have any questions; I am here to help make sense of all this!

Best Regards,

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.