Retire at 55? The real cost may surprise you

Oct 01, 2025 9:34 am

Hi ,

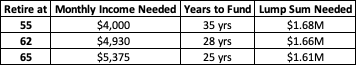

If you want $4,000/month in today’s dollars for retirement…

Here’s how much you’ll actually need, depending on when you retire (assuming 3% inflation):

Shocking, right?

Even though retiring later means fewer years to fund, inflation makes the income you need higher.

That’s why no matter when you plan to retire, you’re still looking at around $1.6–1.7M in today’s dollars.

The real difference isn’t the lump sum, it’s whether you can save and invest enough before you hit your target age.

Quick & Simple Rules to Check Your Progress

Here are 3 easy calculations that can give you a quick snapshot of where you stand:

1. The 80% Rule

- You’ll need about 80% of your pre-retirement income once you stop working.

- Example: If your household income is $100,000, you’ll need $80,000 in retirement.

- Subtract CPF LIFE payouts (say $36,000). That leaves $44,000 per year.

- Multiply by 25 = $1.1M needed in savings.

2. “X” Times of Salary

- By age 30 → 1× your annual salary saved

- Age 40 → 3× salary

- Age 50 → 6× salary

- Age 60 → 8× salary

- Retirement (67) → 10× salary

3. The Savings Rate

- To replace 50% of income (CPF LIFE covers the rest):

- Start at 20 → save 9% of income annually (with a 40-year horizon).

- Start at 30 → save 17% per year (30-year horizon).

- 👉 The later you start, the more you need to save — a clear case for the power of compounding.

If you’d like a more detailed and accurate way to calculate your retirement needs (including medical and long-term care costs), I’d be happy to help.

📩 Just hit reply with “Calculator”, and I’ll send you my Retirement Cashflow Calculator.

To your financial freedom,

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.