It Is About Time...

Aug 15, 2024 7:06 am

In case you missed my previous email, I would like to share some additional insights with you.

It's highly likely that the U.S. will cut interest rates next month in September, which could create an opportunity for bonds in your short- to mid-term savings strategy.

Let me explain why...

Imagine you own a rental property that generates a certain amount of rent each month. If other properties in the neighborhood with larger spaces suddenly start offering higher rent close to yours, your property becomes less attractive to new renters unless you lower your rent.

Consequently, the resale value of your property drops since it fetches lower rental income. This is similar to what happens with bonds when interest rates rise.

Here’s how it works:

- When interest rates rise, new bonds offer higher payouts (like higher rent).

- Existing bonds, which pay out less, become less attractive (like the property with similar rent but smaller space). To make them more appealing, their prices drop.

- Investors start looking at other options that offer better returns (like properties with better-paying rentals), so demand for the old bonds decreases, lowering their prices further.

But here’s the good news: Imagine the situation flipping. The rental market changes, and new properties start offering lower rent. If your property is still locked into a higher rental rate contractually, it can fetch a higher rent than others, making it more valuable.

Similarly, when interest rates fall, new bonds offer lower payouts. If you already own bonds with higher payouts, those bonds become more valuable.

Investors are willing to pay more for them, which causes their prices to rise.

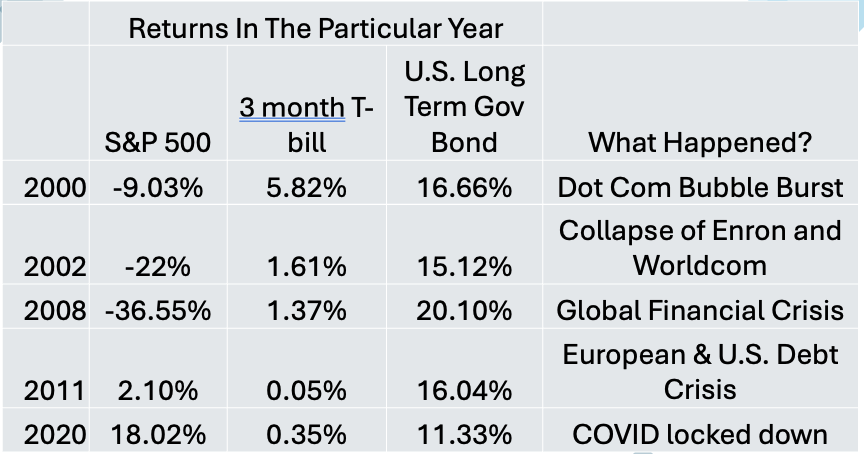

This isn’t just a theory; it has happened many times historically. I've reviewed the years when U.S. 10-Year Government Bonds had double-digit returns.

This presents a great opportunity for your mid-term savings, especially if you’re planning for near-future expenses like:

- Home improvements or renovations

- Saving for a down payment on a new home

- Saving for your child’s education

- Paying off a loan

This presents a great opportunity for your mid-term savings, especially if you’re planning for near-future expenses such as:

- Home improvements or renovations

- Saving for a down payment on a new home

- Saving for your child’s education

- Paying off a loan

Investing in long-duration bonds now could help you grow your savings in a stable manner and capture high returns when interest rates start coming down.

It’s hard to give all the details over email. However, if you’d like to discuss which bonds might be suitable for you and how long to invest, I would be happy to tailor a strategy to fit your specific needs.

Let’s schedule a quick chat, or feel free to reply directly to this email.

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.