U.S. Fed Makes Big Interest Cut – What’s Next for Your Money?

Sep 24, 2024 3:34 am

Hi ,

"  "

"

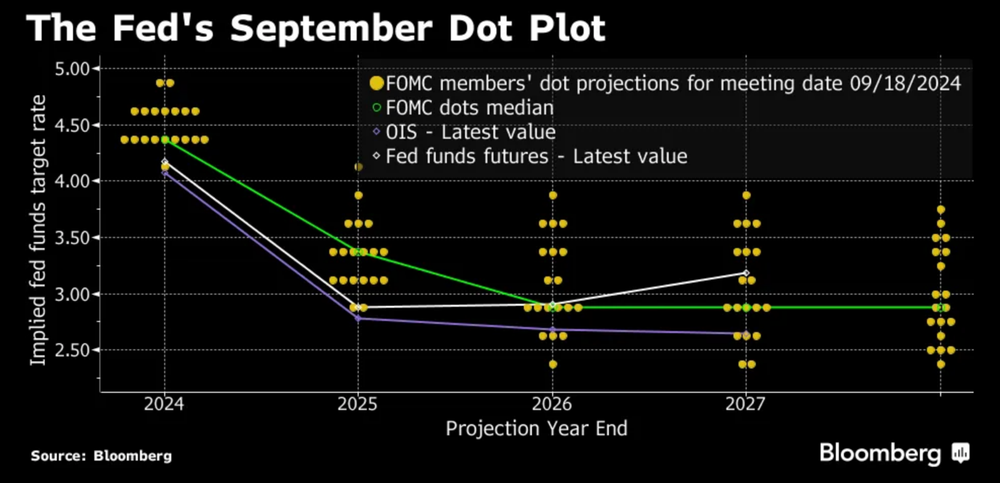

You may have seen the news last week— the U.S. Federal Reserve cut interest rates by 0.5%, bringing rates down to a range of 4.75% to 5%.

According to the Fed’s projections, another 0.5% cut is expected by the end of 2024, followed by an additional 1% cut in 2025. This would bring interest rates down to around 3.25% to 3.5%.

" What’s Next for Your Savings?

In response, fixed deposit and savings account rates have already begun to decline. The best 1-year fixed deposit rate has dropped to 3.2% p.a., and the best 3-month rate now stands at 3.15% p.a. as of 16 September.

With declining rates, reinvestment risks could arise when your T-bills or fixed deposits mature. Now might be the perfect time to transition from cash to bonds, which were issued during the higher interest rate environment and still offer competitive yields above 4% p.a. for bonds maturing in the next 3 to 5 years.

" Lock In Stable Yields with Bonds

Take, for example, this NETFLIX corporate bond maturing in April 2028, offering a 4.05% yield—giving you fixed interest over its duration. Bonds can also appreciate in price, so your returns may potentially exceed 4.05% p.a. over time.

How Can You Access These Bonds Without a Large Capital Investment?

You can access these types of bonds through bond funds, which invest in a wide range of corporate bonds. Here’s an example of a typical bond fund’s holdings (see the attached image).

This could be a great opportunity to generate additional income while protecting your capital.

Client Case Study: Passive Income with Dividend Stocks & Bonds

Let me share how one of my clients was able to create a steady 6% annual passive income to offset her monthly expenses (like groceries and utilities) without exposing her savings to market volatility.

I helped her build a low-risk bond portfolio that has been generating consistent monthly payouts.

How This Could Work for You:

- Stable Income: A portfolio designed to generate reliable income, perfect for covering living expenses or saving for future goals.

- Low Risk: Peace of mind from the bond portfolio, which shields you from the volatility of the stock market.

- Perfect Timing: With interest rates falling, now is the time to lock in higher yields before rates drop further.

If you would like to explore setting up a similar income stream, let’s chat!

Looking forward to hearing from you!

Best regards,

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.