Are You Sure About Your Retirement Numbers?

Aug 30, 2024 7:41 am

Hey ,

As we approach the final quarter of 2024, it's a great time to reflect on the past 8 months. Have there been any concerns on your mind, whether about your career, family, or even your retirement plans?

"The more we ponder, the more we realize how little we truly know." ~ Socrates

I recently had a discussion with a client, Sam, who's 48 and planning for retirement at 60.

He meticulously calculated his future expenses, covering everything from food and transport to hobbies like his passion for nature photography. But there was one crucial expense he overlooked: medical-related costs, particularly hospital insurance.

Know your costs to enjoy your retirement

Many people don’t factor in the rising cost of healthcare, especially as we age. I’ve seen this firsthand when my mom had a minor stroke in 2022. The ongoing costs to manage her condition, along with her hospital insurance premiums, have been significant.

Sam, too, is on a premium hospital insurance plan that covers private hospital wards. With the upcoming premium revision in September, he wanted to know how much he would need to set aside to maintain his coverage during retirement.

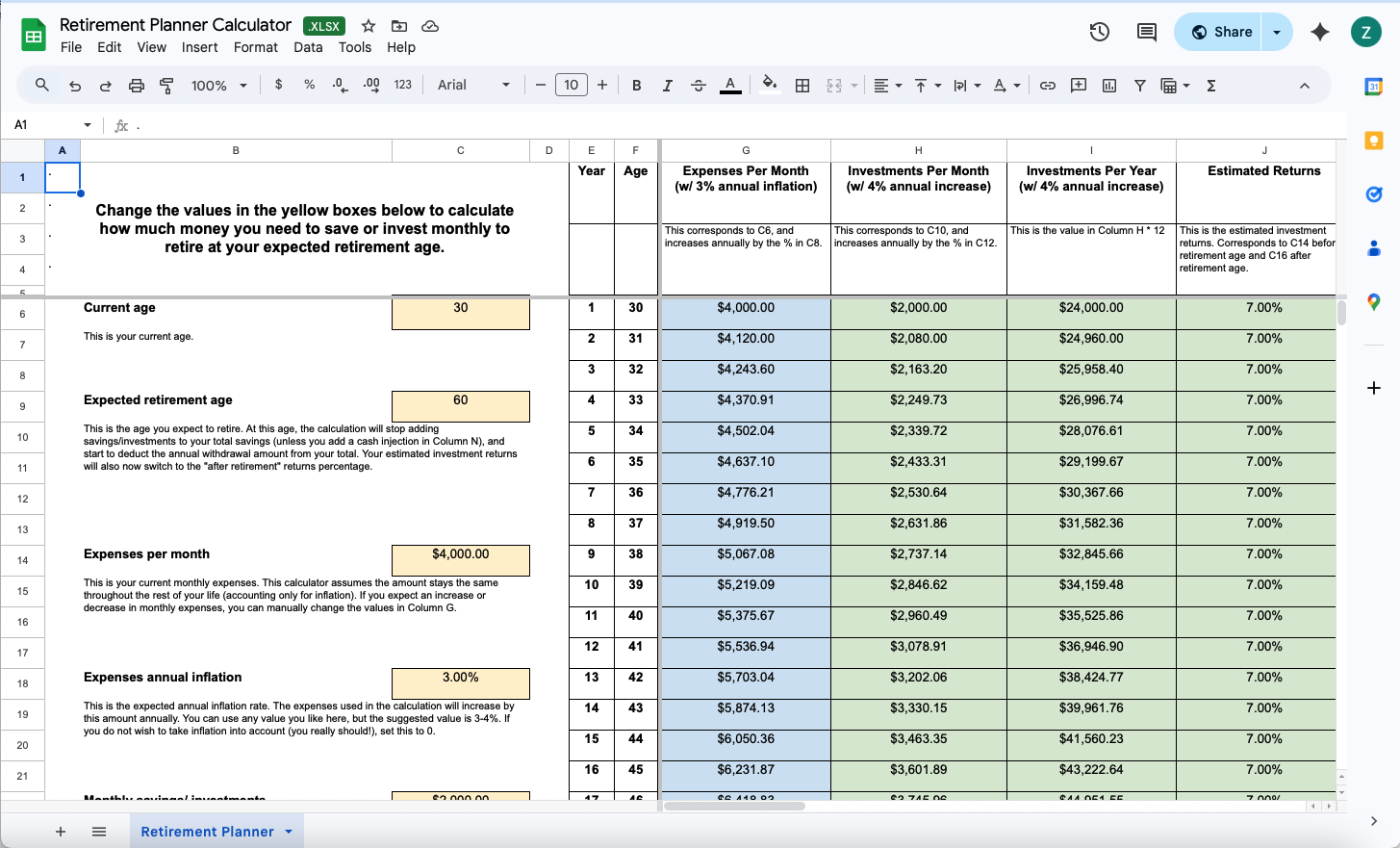

GoalsMapper can help to calculate total premium payable during retirement years

Using GoalsMapper, a financial planning tool, I calculated that from age 60 to 87, Sam would need to prepare $390,000 for his premiums, of which only $60,000 would be covered by CPF. That leaves him needing $330,000 in retirement funds just for his hospital insurance. And this doesn’t account for inflation.

With this input, Goalsmapper help to project the total future premiums after inflation

With a modest 2% inflation rate, the amount could inflate to $648,000.

Sam was shocked by how much he had underestimated his retirement needs. Though he could downgrade to a lower-class ward coverage plan, his past experience with long wait times at public hospitals made him determined to keep his private coverage.

Thanks to this process, Sam now has a clearer picture of his retirement needs and what needs to be done to cover the gaps.

Do you want to see how would your chart looks like?

Let's have a chat!

Zest Chia

Executive Wealth Consultant | Associate Estate Planning Practitioner |

Licensed General Insurance Advisory

DISCLAIMER;

This message contains privileged and confidential information from Infinity Financial Advisory Pte Ltd. If you are not the intended recipient of this electronic message, please do not disseminate, copy or take any action in reliance on it. We request you notify us immediately before deleting this message. Any views expressed in this message or attachment/s are those of the individual sender and are not necessarily the views of the company. Infinity Financial Advisory Pte Ltd uses virus scanning software and while due care and attention is taken; the company excludes all liability for any loss or damage caused whether directly or indirectly by any computer virus or other defects transmitted with any email and any attachment(s), to the extent permitted by law. It is sent on the strict condition that the user carries out and relies on its own procedures for ensuring that its use will not interfere with the recipient's systems including but not limited to scanning this email and any attachment(s) for viruses and defects before opening or sending them on. The recipient assumes all risk of use and releases the sender from all responsibility and liability for any direct or indirect consequence of use.