The Biggest Bubble of all Time?: Invest With Pete Weekly Update 24 Jan 2022

Jan 24, 2022 2:21 am

Hi there,

Here's my weekly update for Jan 24, 2022...

Stock Market

The NASDAQ is down 11% so far in 2022 and if it continues the current trend it seems like it will rival that of 2008 GFC.

Famed investor, Jeremy Grantham, also spoke about the all asset bubble in his latest article. In his view, the market crash has started and based on his estimate, the US markets will drop another 43% or so.

He compared the US market to the Japan market in 1980 which resulted in a lost decade that saw Japan market not recovering even till today.

Grantham is famously known to have predicted the last two crash accurately so I will heed his advice on this matter.

However, it is also important to note that he has been calling a bear market since 2019. I say this with the utmost respect for him, but if I keep calling bear market, I will definitely be right one day.

Having said that, I think Grantham is right in terms of valuation. People are chasing high multiples of 100x PE and 60x sales in the stock market. We also saw the rise of meme stocks and NFTs which I believe almost 90% of them will end up in tears.

So what is Pete's view?

I think the market is long overdue for a correction so having some cash on the side is definitely useful. However, I don't believe in exiting totally. Grantham believes the same as well? His GMO fund is still heavily invested in the US markets. You can see his top holdings here.

I am about 65-70% invested now and keep the powder dry for a steeper correction.

The natural question is "Why don't you sell everything if you think the market will drop further?"

Answer: "Because I am not 100% certain!"

For all we know, the market can rise tomorrow sharply and if I were to exit 100%, I will miss out on all those gains.

My best strategy is to adjust the investment level.

At 70% invested, I will still benefit if the market recovers. At 30% cash, if the market continues to crater, these 30% will be my warchest and it could easily double.

So either way, I win :)

Crypto Market

BTC has dropped to $35,000 in the last week! As mentioned in my latest video, I explained that now BTC is still a risk on asset. This means it will sell off together with other risky assets such as tech stocks and NASDAQ.

While I view BTC as a hedge against rampant monetary policies, it doesn't mean it will hedge the stock market. It is important to note the difference.

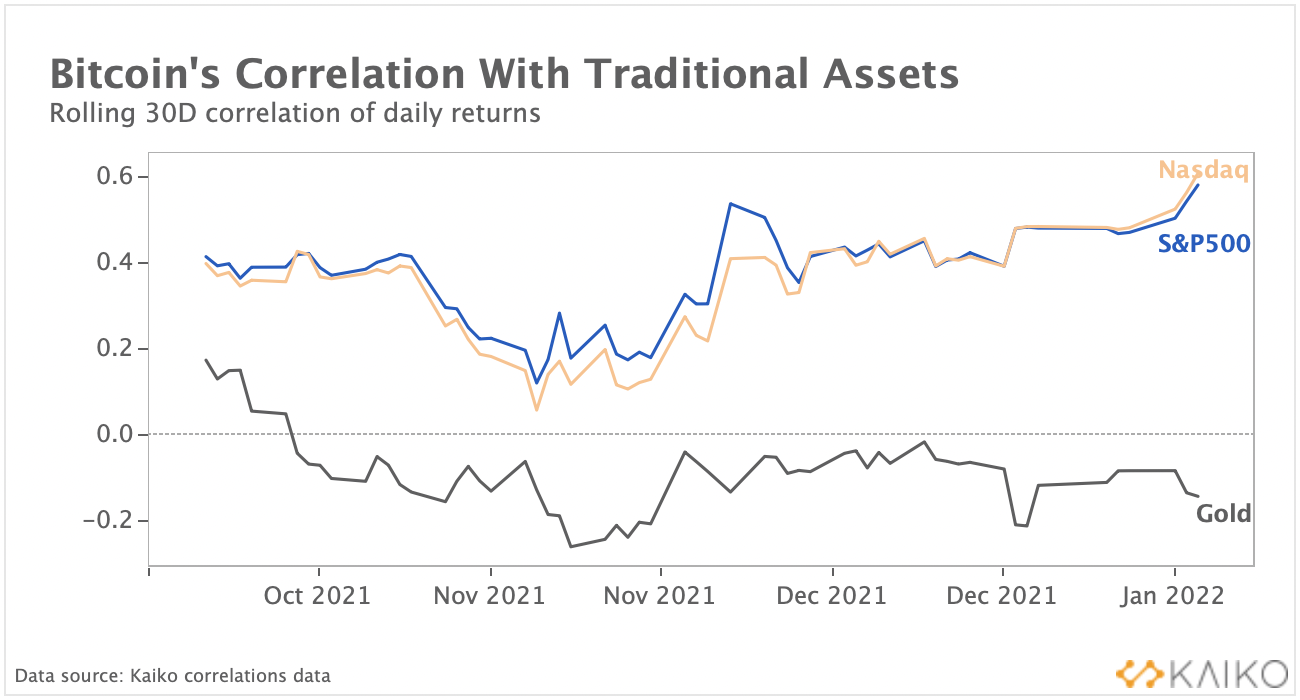

In fact, the correlation between BTC and NASDAQ has never been higher!

With that, it helps me to sleep better when BTC is crashing with the market. My strategy is simple, continue to DCA into BTC and ETH until it hits my preferred allocation.

Having said that, I do see BTC dropping further, the previous floor price in 2021 is $30,000. I have placed some limit orders there to buy some.:)

Below are two guides I did for FTX and Hodlnaut to help you invest in crypto better:

🎥 Ultimate Step by Step Guide for Transfer Funds to Crypto Exchange | Sending USD to FTX

How to transfer funds most efficiently to a crypto exchange?

Answer: Transfer USD to FTX using DBS Remit

◆ FTX Account |Get 5% fee discount on your trades FOREVER:

https://ftx.com/#a=investwithpete

🎥 Should You withdraw from Hodlnaut? | Interest Rate Dropping in Feb 2022

Property Market

Singapore property continue to be strong! The recent land sales indicate that the future new launch in Lentor to be $2000psf and in Tembusu to be $2400psf.

This is AFTER the cooling measures implemented on 16 Dec 2021. This means developers are still confident of the market demand.

Also the demand for space continue to surge, Belgravia Ace, a strata landed project, sold over 90% of units released on Day 1.

What does this mean for Property Investment?

Property investment is a boring investment that is not going to attract millennial but they will flock to property once they reach a more mature lifestage. Afterall, you need a place to stay.

This boring investment will likely continue to rise at a steady pace of 4-6% on average (yup don't expect 14% return every year like 2021)

Also property has very low volatility which makes it a perfect vehicle for most untrained investors who are fearful of fluctuations.

How does it compare to other assets?

A member of IWP asked me recently, "I can invest in crypto stablecoins and get 8% return, why should I invest in property?"

This is a good question but also shows the lack of understanding of risk.

Indeed, stablecoins right now in Hodlnaut or Haruinvest, can give up to 12% annually. However, what is the risk?

Crypto (which I am invested in it too) has regulatory risk. The government can literally ban crypto tomorrow including stablecoins.

Property on the other hand, while has some regulation risk like cooling measures, it is unlikely to be outlawed by the government and it is a physical asset backing.

Therefore, I am comfortable putting millions in property and achieve the 4-6% annual return. But the same cannot be said for stablecoins, even if it is giving 12%. Given the risk of stablecoins, maybe I will put in $200k?

6% in 2million = $120,000. 12% in $200,000 = $24,000. Which one is better in your view?

Furthermore, I can stay in the property but I cannot live in stablecoins :)

Below is my in-depth analysis on Normanton Park and why I think it is so undervalued!

If you need 1-on-1 property consultation, apply here.

🎥 🚀 Best New Launch for 2022 | Normanton Park

✅ Apply for 1 on 1 real estate consultation with Pete and his team:https://bit.ly/propertywithpete

I did a real estate sharing back in 19 Dec 2021 and I shared my best new launch for 2022 and the reasons why I think this is a great buy for both investment and ownstay.

Enjoy, Pete Tan