The most over-rated concept in finance (plus: my new investment)

Jul 22, 2023 5:06 am

Welcome!

This month, I'm:

- Sharing my latest investment

- Slagging off the 8th wonder of the world

- Attempting to live forever

- And more!

You're receiving this monthly email because you signed up for it at robdix.com, or you opted in after reading my book The Price Of Money. If you don't enjoy it, there's an unsubscribe link at the bottom.

🏡 An investment that improves every year

Last week I completed on a new property. The numbers look like this:

Purchase price: £247,500

(Discount from market value: £20,500)

Total cash in: £74,595

Projected annual cashflow: £5,043 (5% mortgage rate)

ROI: 6.7%

Is this wildly exciting? No... not this year. But where might it stand after 10 years, if inflation has averaged 3% (that's lower than the past decade), and both the rent and value of the property have risen in line with it?

Firstly, my rental ROI will have improved to around 9% – assuming my mortgage cost doesn't increase, and excluding a few small things I can't be bothered to work out.

And the capital gain? The property will be worth £332,000 – and as the mortgage will have remained static, my equity will have nearly doubled (increased by 94%, in fact).

Gotta love an investment that gets better every year, only relying on inflation – the most fundamental economic force there is – continuing to exist.

(Of course, the property market could drop off a cliff soon and take more than a decade to recover. Feel free to forward this email back to me with some schadenfreude if that happens.)

But there's one important factor this leaves out: my time.

If it'd taken me 50 hours to put the investment together (research, viewings etc) then random issues kept popping up and affecting my productivity in future, the true numbers would look an awful lot worse.

Luckily, the entire acquisition took less than 5 hours and I'll have nothing to do with the management in future. It took me 15 years to get to this point, but I believe investors should put in the work to crack a "hands off" system much earlier.

My little shortcut: you can tell a lot about the general quality of a new home by just looking at the bathroom

💰 Compound interest: over-rated

When people wax lyrical about the power of compounding, they like to tell an 11th century story about a clever inventor who asks the king to pay him by placing one grain of rice on the first square of a chess board, then doubling it on each successive square. The king laughs at what a great deal this is… not realising that after 64 doublings, he will owe eighteen quintillion grains of rice.

A more modern (and actually true) story that’s often used to make the same point is that Warren Buffet – one of the wealthiest people in the world with a net worth of some $114 billion – made 95% of his wealth after the age of 65, even though in recent decades he’s not done much other than sit around reading and drinking Cherry Coke.

But for most of us, compounding won’t be the answer to all our financial prayers...

(This is a big topic in my next book, which I'm working on now – so let me know how you feel about this type of very long-term compounding, because your feedback will help me write a better book.)

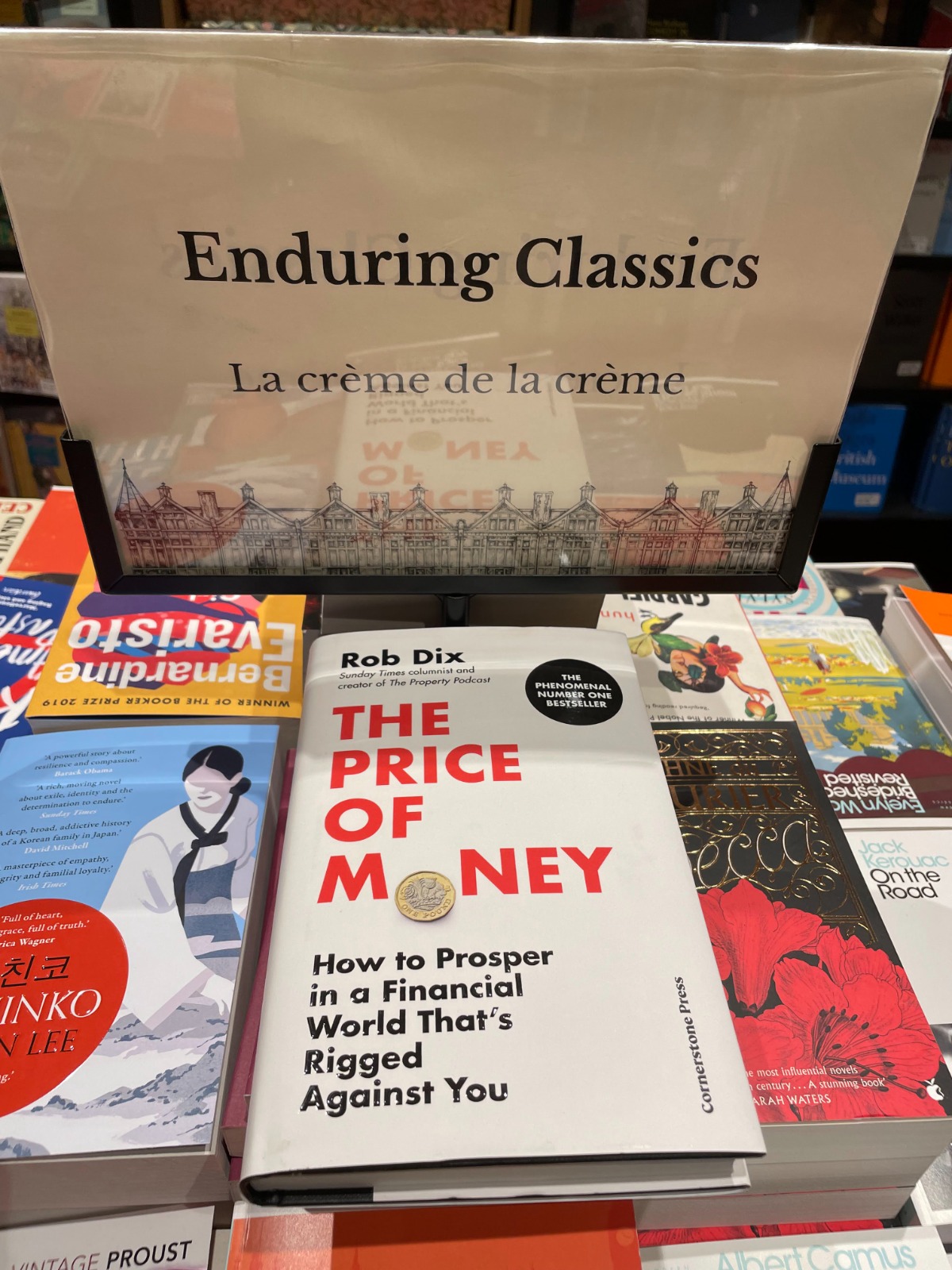

Do you think anyone has ever been banned from Waterstones for life before? With the amount I "improve" their selections, I must be pushing it.

🩴 Meeting "my people"

A few weeks back I spoke at an event with 106 successful entrepreneurs.

Hanging out with them was amazing, and reminded me that business owners are just… different. In a good way.

Compared with most people I bump into, they were uncommonly:

- Generous. People were happy to spend time helping me with my business challenges, with no expectation of anything in return.

- Vulnerable. Yeah, therapy-speak I know. But within 30 seconds we were openly sharing our insecurities and challenges, rather than trying to project a perfect version of ourselves. The conversations were so much better as a result.

- Scruffy. No-one had anything to prove, so comfort was the priority. Also, entrepreneurs don't do logos.

- Respectful. Everyone checked if you actually wanted advice before offering advice – which is rare, and refreshing.

To some extent these character traits probably contribute to success, to some extent they're enabled by success, and to some extent they're present in everyone but emerge more readily in a high-trust environment surrounded by similar people.

Above all they felt like "my people", and hanging out with them gave me a motivation and satisfaction boost that's lasted for weeks. Your people might be different – but you should go out of your way to spend time in person with them, whoever they are.

With a group of scruffy (with notable exceptions in case any are reading and get upset), non-branded entrepreneurs.

🔗 Odds and ends

🍿 A couple of months back, I ran a series of online events called The Wealth Sessions for the select group of beautiful people who pre-ordered my book, The Price Of Money.

But hey, you're beautiful too – so here's a recording of one of the most popular sessions, with bestselling personal finance writer Andrew Craig. (I won't be making the rest public, but the ideas in this one are so important I believe they need to be shared.)

👌 I can't heap enough praise on Die With Zero by Bill Perkins. Even if you've read the book multiple times like I have, this interview on Modern Wisdom is a must-listen. Bill just gets better and better at articulating his powerful concepts.

🚴 According to this calculator from the ONS, I have another 44 years to live. Which I'd be very happy with. But critically, how many healthy years of life do I have yet?

Outlive by Peter Attia is based around the goal of maximising the activities you can enjoy in the last decade of your life. Scarily, it points out that given our inevitable decline, we need to be far stronger and fitter than we'd expect now if we want to be active into our eighties and beyond.

I loved this book: for me, it was the perfect blend of practical advice backed up with easy-to-understand science. And now I'm off to do an hour on my static bike.

That’s it for now! Feel free to write back and let me know what you've been up to.

Cheers!

Rob

p.s. You can also follow me on Twitter or Instagram.