🦉 WoW #63 - Happy Birthday to Me 🦉

Apr 07, 2021 6:24 pm

Happy Wednesday, Wise Owl Nation!

We're in my favorite month of the year, April!

April is my favorite month of the year for a few reasons:

- My birthday is on April 9

- My favorite author tends to publish new books in April

- I had the chance to interview that author on Friday, April 2nd of last week!

In fact, I almost decided to take the week off to see what skipping a week of Wise Owl Wednesday would be like. In the end I decided that was a silly thought and that if I could write this newsletter last year on April 8th, that I can certainly write it again this year on April 7th.

So here I am, writing my thoughts to you again.

This week I am going to cover a few different topics:

- Why learning from peers may be better than learning from mentors

- How simple yet psychologically complex losing weight can be

- Five mental principles of Investing and how they relate to Crypto

Let's get into it.

You can find all past issues (including this one) here.

_____________________________________

Was this email forwarded to you?

_____________________________________

🧠 Wisdom Focus Tips of The Week: Peers may be better teachers than Mentors

I read a quote from James Clear last week and it inspired a long stream of thoughts.

The premise is this - learning from a peer that is a few years ahead of you is likely far better than trying to learn from a mentor that is a few decades ahead of you.

We live in an every changing world and life evolves at a rapid pace. The lessons someone learned several decades ago may or may not apply to you or your situation, but the lessons a peer learned just two years ago are far more likely to have direct resonance with what you are working through.

This is such a weird and counter intuitive mental exercise for me personally. For my entire life I have been coached or taught by people that are usually far, far older than I am.

However, the more I think on this, the more I realize that the people that have had the biggest impact on me in how I actually act, are people that are on the same path as I am, just a few steps ahead.

In college, my biggest unofficial role model was a guy name Aaron. He was my Resident Assistant in my first year of college, and then became a close friend of mine for the rest of my time at Texas Tech. He worked hard, worked smart, and never seemed to let the magnitude of events touch him. He carved the path that I inevitably took through college.

In the past twelve months I've become a dramatically better poker player. I didn't do it by reading the books of the old greats. I did it by watching and studying how the current day studs are playing poker on Twitch. Then I went and found the resources they used to improve, and started learning from there.

Finally, this realization is extra powerful because the people that are only one or two years ahead of you are far, far easier to connect with than long established "gurus" or "subject matter experts."

So find someone a little farther ahead of you on the path, and see what they did to succeed. Reach out to them, let them know what you're up to. People are far more willing to help than you may realize.

Cool App I Found:

Keeping this in here another week because of how cool it is. Normally I don't share cool apps I've found until I have found several, but this tool has won me over in the short time I've played with it.

Sleek Bio - It is one of those tools that lets you put a lot of your links in one place. This tool, however, was built by the same team that built Sendfox, the email software I use to send you all this email. The two tools integrate seamlessly, and allow someone to subscribe to your newsletter within the tool without having to click out to the newsletter landing page!

It also let me embed the interview I did with Travis right there. It is the best version of this kind of tool I have found so far.

You can check out my minimalist sleekbio profile here.

🥑 Health Thoughts of The Week: Two Comedians on Health

Very rarely do I read or hear something around weight loss that makes me pause and really self-reflect. At a certain point you can get numb to too much of the same kinds of information.

I listen to the Joe Rogan Podcast because I like that interesting people get to sit there and talk for three hours. It's hard to stick to your talking points when you have to talk for that long, and inevitably something interesting crops up.

Well, Joe interviewed a talented, but relatively unknown comedian named Lara Beitz. I doubt she stays unknown for long.

The episode covered a wide variety of topics, but one of the most interesting parts of Lara's story, is that once it was known that obesity increased the mortality rate of COVID-19, she decided not to be obese anymore and she has lost around 50 pounds.

She looks like a completely different person now.

What struck me with this particular interview is that Lara just made a decision and did the following things:

- She started cooking and became amazing at cooking healthy foods in a way she enjoys eating them

- She found an exercise routine that works for her and is repeatable

- She measures her food always and ensures that she maintains a caloric deficit of around 250 calories per day.

- She learned that consistency is the only metric that mattered, and that her weight chart would not be a linear graph down. It goes down, up, down a lot, up a little, down again.

This episode has inspired me to step it up with how I think about and consume food.

💲 Wealth/Crypto Thoughts of The Week: Five Mental Powers of Investing

I found this article via another newsletter I like to read and it struck a chord with me. It espouses five investing powers you need to succeed at investing, and lately I've found myself trying to talk to people about these sorts of mental powers as it pertains to cryptocurrency.

So I thought it would be a great thing to shorten, condense, and give a crypto spin.

The Five Investing Powers:

1 - Develop a high tolerance for FOMO (fear of missing out).

According to this article, if you feel a strong urge to buy a an investment because the price has recently gone up, then there is a strong chance you have no clue why the price went up. Buying this kind of investment for this reason makes it much, much more likely you will sell if the price starts to drop.

Good investing ignores these rises and falls and sticks around as long as possible. This is especially true in Cryptocurrency, where the price swings are generally more dramatic than the price swings in the stock market.

In 2018 I watched my crypto portfolio tank more than 75%. Seriously. But, because I understood the true value of crypto, I felt comfortable continuing to steadily buy-in each and every week.

This strategy might miss some of the wild gains, but it is literally impossible to predict the stock or crypto markets, and trying to do so is a recipe for disaster.

2 - Know what game you're playing. Your investment goals are different than other peoples.

There are many different kinds of "investors." I use this term loosely here because I am going to mention day traders. Under normal circumstances I don't ever consider day traders to be investors, but for this example they are included, because they are often buying and selling the same coins, stocks, etc. that long term investors are.

Look at this list of "investors":

- Day traders

- Endowments

- Hedge Funds

- Venture Capital

- Angel Investors

- You

Every single one of the listed bullet points above have different goals, risk tolerances, and timelines. If you don't know what game you are playing, you run the risk of trying to copy the playstyle of someone playing a completely different game than you.

This pairs well with the FOMO power I mentioned above. FOMO can lead you to try to play someone else's game. Don't.

My Crypto game - I am a long-term investor in cryptocurrency focused on ETH accumulation. Everything I do right now is built around the accumulation of ETH. Because I am playing the long-term ETH staking game.

I want my ETH to generate enough passive income each month to cover my expenses. To do that, I need to acquire as much ETH as possible while the price is so low (and yes, $2k is still low).

3 - Patience vs Stubbornness.

According to this article (and me, I guess) it is true that every asset eventually goes through temporary out-of-favor downswing periods. It is also true that the world changes, and some things/investments fall permanently out of favor (Blockbuster).

The point being is that eventually some investing strategies stop working. Even after decades or centuries of working just fine. Figuring out when you are being stubborn versus when you are being patient boils down to your own ability to combat cognitive bias' like confirmation bias or optimism bias. (link to article defining many cognitive bias').

One strong example from my past is my stubbornness to stick with a crypto token called ZRX. This is the governance token for the 0x protocol, which has a powerful use case, but not a use case that lends value to the token.

You could stake ZRX and earn ETH. I thought this was really cool until I realized that ETH was the core base asset that really mattered. Then I learned as much as I could about ETH and the Ethereum network. It took time, but slowly I realized that the best long-term approach for me was to hold and accumulate as much ETH as possible.

4 - Become comfortable with misery.

This is a tough one for all of us.

Misery has many facets:

- Losing money can be miserable

- Luck based investment success can be miserable

- Giving friends or family advice that doesn't end well is miserable

- Giving friends or family advice that does end well, but leaves them asking you for more advice forever can be miserable

The trick is to become comfortable with the discomfort. This is a trick that applies to all facets of life. You want to get strong? Get comfortable with the discomfort of lifting weights. Want to lose weight? Get comfortable with the discomfort of eating foods you don't crave. Want to become an author? Get comfortable writing stories that you hate.

All growth happens outside the comfort zone, and investing is no different. There are at least five people that invested in crypto because of my advice. They invested right as crypto completely crashed in 2018. A few of them sold and took their losses. A few of them held on and are now loving their profits.

I have had to learn to be comfortable with all of it.

5 - Align your peak-wealth years with a lot of terrible economic stuff happening.

We are experiencing a generational collapse in interest rates, a federal reserve that has become comfortable with quantitative easing (printing money like wild people), and falling marginal tax rates. Basically, there are a lot of forces at play that are slowly but surely eroding the long-term value of the US Dollar.

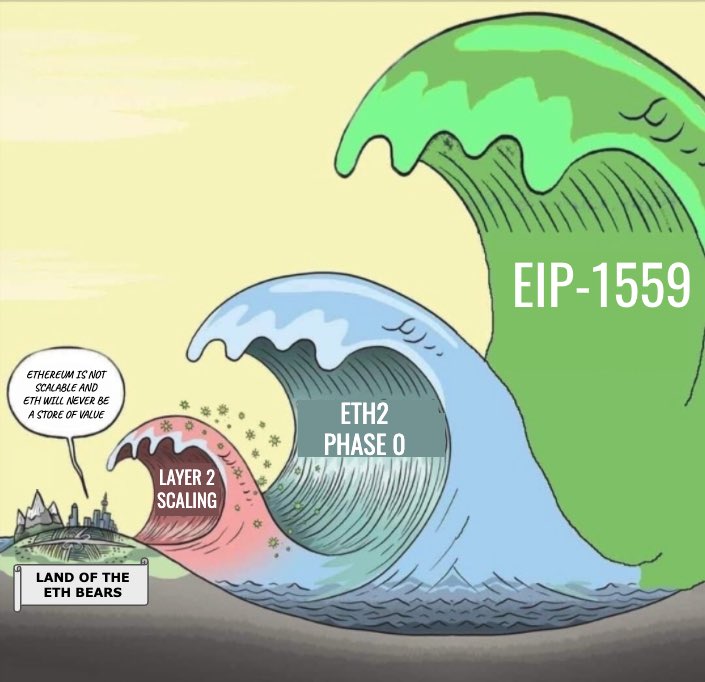

This is where Cryptocurrency has found such a powerful narrative in our culture. Both Bitcoin and Ethereum have economic policies built in to their code that are dramatically better than what the Federal Reserve and other banking institutions have established.

We are seeing a combination of the dollar weakening and Bitcoin, Ethereum, and other cryptocurrencies strengthening. That is one of the reason so many crypto coins are increasing in value right now.

Quote/Meme of the week:

Have a great week!

This concludes our issue this week, I hope it gave you some perspective or injected a little motivation into your life!

If it helped, let me know! I read every newsletter response I receive, and I absolutely love hearing from all of you. This newsletter is for you, so I need your help to make it as great as possible.

If you'd like to show me some love for writing all this free stuff, you can always buy me a coffee.

More Resources

I will be adding to this section over time as we find resources that will help you all.

- Check out the Wise Owl Store

- All Wise Healthy Wealthy Articles on Medium

- Start your own Sendfox Newsletter

- Free products to help you level up

Crypto Resources

The Bankless Podcast: This is a link to the bankless podcast on Spotify. Start from the very beginning and learn why I am so positive about the power of Crypto and Ethereum in particular. You can find the podcast easily on the internet, but I am linking to episode 1 on Spotify for your convenience.

Buy your first ETH or BTC:

- On Coinbase - this is the easiest starting place for the newest beginners

- On Gemini - Another great option founded by the Winklevoss brothers. They are based out of New York.

- On Kraken - Kraken has a bit of a harder user interface, but they already have ETH staking enabled with the push of a single button.

Earn interest on your crypto

- BlockFi - Currently, you can earn 6% interest on BTC, 5.25% interest on ETH, and a whopping 8.6% on stable coins like USDC. Use the referral code b09f24fd to support the newsletter.

Other tools:

- Argent Wallet - This is the best mobile wallet for Ethereum, Defi, and all things on the Ethereum network, including staking. They even have plans to implement Layer 2 to remove network fees.

- Ethhub - this is a weekly newsletter that lists out all the interesting news, articles, and tweets that have happened in Crypto that week. It's free and awesome.

- Ethdashboard - A simple dashboard to look at various metrics in the ethereum space. I mainly use this as a quick tool to check ETH gas fees.

- Cointracker - this is one of the better tools for tracking all of your various crypto across all of the various wallets, exchanges, etc. You can also use them to do your crypto taxes each year.

- Metamask - this is a crypto wallet that you can access from your browser and allows you to easily interact with blockchain apps online.