🔥 Is anyone moving to Parler? - The Letter X

Nov 14, 2020 9:08 pm

THE LETTER X

ISSUE #30

I am sure NOBODY saw any of those posts this week, right? All of a sudden everyone created a Parler account this week and in my opinion the last thing we need is another twitter.

If you are unhappy with Facebook's nonsense, which I am 100% in agreement with you, then I would spend more time on LinkedIn or check out MeWe. But my vote is for LinkedIn!

As of today there are 47 days left in 2020 and hopefully you all are working to finish the year out strong. 47 days equates to 7 work weeks left and starting with this issue I will be doing a tip each week.

This Week’s Mortgage X Tip!

Work an automated calendar/scheduler into your workflow. Spending your time on less mechanical duties is key to working less and making more. This helps tremendously when it comes to time management and quick appointment setting.

I personally use OnceHub for my production team, but using Calendly is another great option. You can’t go wrong with either solution. These integrate directly into 365 or Gsuite and most landing page lead forms.

Now go automate your appointment setting and enjoy this week’s edition of The Letter X!

Say Yes Every Day

Laura Brandao - President of AFR Wholesale

This week Say Yes to staying curious! Questions breed curiosity and curiosity is an antidote to anxiety. It’s very hard to change what you’re not curious about.

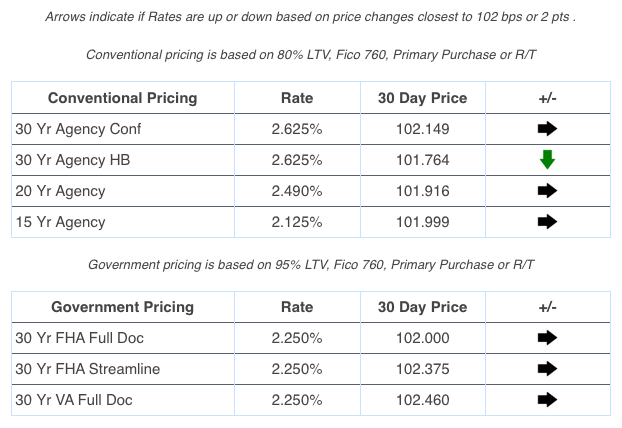

Mortgage Rate X

Lender Price Friday Rate Lookback

I am signing up a lot of brokers to Lender Price due them being unhappy with Loan Sifter - Remember that if you use my NON-AFFILIATE link you will get both the PPE and Digital Mortgage platform for only $62 a month.

MBS X

Diana Bajramovic of MBS Highway

Tame inflation

The Consumer Price Index (CPI) came in flat for the month of October, with the year over year Headline reading dropping slightly from 1.4% to 1.2%. The Core reading, which strips out food and energy prices, was also flat month over month, with the year over year reading dropping from 1.7% to 1.6%. We ask the question, “why are we starting to see inflation cool a bit?” With the spike in COVID-19 cases across the country, states are starting to put more restrictions back in place, which could be causing consumers to be a bit fearful. This could lead to inflation numbers remaining tame for some time. November seems to lead us into a similar predicament, but we will continue to monitor the situation on the MBS Highway Daily Morning Update.

Rents

Rents across the U.S. are rising 2.7% year over year, which is much lower than when rents were rising 3.8% year over year not too long ago. This tells us that the effect of COVID-19 could be hurting those on the more modest end of the income scale who tend to be renters. Many landlords are worried about rents not coming in or receiving partial rents each month.

Jobs

Like every week, we received Initial Jobless Claims, which measures the amount of individuals filing for unemployment benefits for the first time. As we’ve been reporting, this number has been improving for the last several weeks, seeing 709,000 new claims last week. Continuing Claims, on the other hand, measures the amount of individuals continuing to receive unemployment benefits, and came in around roughly 6.8 million, which was also an improvement. Continuing Claims were coming in at 13 million not too long ago.

The News X Recap!

NAR passes “controversial” changes to their professional standards on Friday. Realtors who use harassing or hate speech could face fines by the National Association of Realtors, according to a proposal approved by the NAR Board of Directors at its 2020 Realtors Conference & Expo.

Mortgage credit availability increased in October after falling to a six-year low in September, the the Mortgage Bankers Association reported this morning.

Mortgage rates rose last week, according to a Freddie Mac survey released Thursday, amid a mixed stock market sparked by investors reacting to a breakthrough coronavirus vaccine and a growing caseload.

Housing stocks are standing on shaky ground. That’s according to Matt Maley, equity strategist at Miller Tabak, who says that while the group looks great fundamentally, some weaknesses are beginning to form.

Fannie/Freddie Adopt Not-so-New Credit Score Model. Tried and true has won out over shiny and new, at least when it comes to GSE credit scoring. And at least for the moment.

When the coronavirus pandemic hit, city dwellers fled to the suburbs. But that trend may be slowing, according to some experts.

The 2020 election isn’t quite behind us as turmoil around the result continues, but for all intents and purposes, Joe Biden is the president-elect. Now, markets are beginning to react to that and news from drug giant Pfizer revealing that it has a strong candidate for a COVID-19 vaccine.

Before Covid-19, employment in foodservice and drinking places peaked at 12.3 million in 2/20. Employment bottomed in 4/20 at 6.3 million, slightly lower than the 5/91 post-dot-com level! There has since been a recovery, and employment is now 10.2 million, the same level as in 2/13. Of the 9.9 million economy wide jobs lost, 2.1 million or 21.2% are in restaurants. Hopefully, a mild winter keeps outside dining possible.

638,000 net new jobs in October, a rise in the labor force participation rate from 61.4% to 61.7%, and a steep fall in the unemployment rate from 7.9% to 6.9% in the face of waning fiscal stimulus are excellent indicators. But measured by job losses, the unemployment rate, or the number of unemployed, we are only half-way home. Despite rising Covid-19 cases, and slowing job growth, I remain cautiously optimistic.

With a stimulus bill to help small business, households and others probably not arriving until February, and its size likely to be relatively small, Covid-19 cases rising, and the spring 2020 stimulus wearing thin, the Fed is increasingly likely to step up. This will take the form of easing the terms of its Main Street lending program, buying more Treasuries (and specifically longer-dated Treasuries), thus driving down long-term rates.

Good things come to those who Mastermind! Have you joined the Mortgage X Mastermind yet? I would like to invite you to join our community that is 100% focused on helping MODERN industry professionals crush it.

The Vieaux

Brian Vieaux - President of FinLocker

We are in the homestretch of 2020 with the holidays on the immediate horizon. It is easy to have a narrow focus, with an eye on your current pipeline and another on winding down the year. I would challenge you to add another area of focus. Use the remaining weeks in the year to build your plan for 2021 and beyond.

How are you going to replace the refinance volume that is surely going to fall off?

We know that there will be a massive drop in volume as those who could refi most likely did. You will not be the only one trying to replace this volume. The largest lenders have been planning for this for years, especially those who are tech enabled.

Your challenge is to find ways to create a pipeline of next year’s home buyers and engage those prospects with tools to help them prepare. Specifically, look for opportunities to nurture and groom the next wave of first-time home buyers.

Create stickiness by proving them with value, including coaching, education, and a guided journey towards homeownership. The investment, both in time and dollars that you put in now will pay off in the next 6-18 months, and beyond.

Lending, Leadership and Life

Eddy Perez – President & CEO of EPM

In this week's episode of Lending, Leadership and Life, Eddy speaks on the topic of affirmation in the workplace. WHY is it important from a leader perspective and how can you exercise it?

Non-QM X: Highly Qualified Non-QM News

Tom Hutchens - EVP of Production at Angel Oak Mortgage Solutions

When the refi boom dries up, where will you turn? I’ve shared some of my best tips on marketing and building your non-QM business, now let’s talk about some of the core products that borrowers are turning to:

Bank statement loan

Bank statement loans account for about 60% of non-QM originations. Right now, these loans typically rely on a borrower’s 12 or 24 months worth of bank statements to determine whether they qualify and assess a borrower’s ability-to-repay. These loan products are suited for self-employed borrowers (business owners, gig economy workers) who are unable to prove ATR via tax returns and/or W-2 forms.

Investor Cash Flow Loan

Professional investor loans, also known as investor cash flow loans, are for property investors specifically. These loans qualify a borrower’s ability-to-repay based on the Debt Service Coverage Ratio (DSCR) which uses the property’s value, rental analysis and the income the property will eventually generate. With single-family rentals increasing in popularity, this product is growing in tandem.

No personal income or employment information is required to qualify. It helps you close more loans and diversify your clientele. It also helps property investors grow their portfolios faster.

Portfolio Select Products for borrowers with credit blemishes

Going forward, there will likely be a higher demand for true non-QM loan products that are sensitive to a borrower's credit score. These loans could grow in necessity in the future as borrowers could have taken dings to their credit score due to the economic impact of COVID, preventing them from qualifying for an agency loan.

Please remember that I and the Angel Oak family are always here to help if need be!

Mamapreneur: Real Talk with a Side of Mom Jeans

Jess Vogelpohl Southwest Coaching

Turnover Sucks:

❗️❗️Employees who do not feel they are developing and being developed in a company are 12 times more like to leave. ❗️❗️

12x.

Investing in YOUR team is the smartest business decision you could make.

✅Leads to higher morale

✅Less turnover

✅Increased productivity

✅Increased revenue

Happy employees equals happy customers which turn into loyal customers.

One leader I spoke to said turnover costs them close to $4️⃣0️⃣k!

Think you can’t afford development, training, coaching for your team?

Can you afford turnover?

Podcast of the Week!

The Mortgage Industry is NOT for the Weak w/Dixie Sanders

Podcasts of the REAL Disrupt Network

Virtual Coffee with Estie Briggs

Mortgage Industry Professional of the Week

Joe Hancock - The Digital Mortgage Guy!

Make sure you tell Joe you saw him in The Letter X!

Beyond The Numbers

Fobby Naghmi, EVP, National Sales Mgr. of First Option Mortgage

Have you ever gone on Google and searched for something you had no interest in finding out about? Or ordered an item from Amazon that you just hated? If you said yes, I’m very worried for you!

All kidding aside, the vast majority of us don’t do either of those examples. But when we allow negative thoughts to occupy our thoughts, we are inadvertently doing just that. You may or may not have heard about the Law of Attraction (books on this topic: The Secret; Think and Grow Rich, etc.), it allows anyone to attract exactly what they think of into their lives and does so in a timely manner. While most people are focused on the positive side of this law, the Law of Attraction also applies to negative thoughts we allow into our mind.

In short, the universe will deliver to us exactly what we are focusing on, good or bad. We should all be conscious about what thoughts we allow to stay with us for too long, make sure it’s really what you want. Similar to Amazon, with the Law of Attraction…refunds are not always possible.

ANDYGRAM – 75 Hard Thoughts

Create a Story That People Want to Hear

Andy and his Chevelle

It seems like social media has become a competition of who has the “saddest story.”

People post every day about how difficult and sad their life is.

They do this to get sympathy from others...

But what they don’t realize, is while people may act like they feel sorry for them...

Nobody really fucking cares.

If you are one of these people...

Realize we all have sad stories.

All of us.

Competing for who has the saddest story isn’t going to help you or me or anyone else.

The only thing that's going to help you...

Is doing whatever it takes to overcome adversity.

That's the story that people really want to hear anyway.

So go create that story.

Go create the story that shows the next generation what’s possible.

Go create the story that gives hope to people when times are tough.

Go create the story you’ve always seen in your head but were too shy to tell anyone.

Go do that.

That’s worthy.

That’s noble.

That matters.

Mortgage X Marketing Maifesto

Interested in SEO for Mortgage? Do Your Research First!

I've seen way too many mortgage originators and companies get into lengthy,

expensive SEO contracts only to find that they KEYWORDS were never

determined upfront.

SEO companies are notorious for fancy proposals with charts and graphs

and a lot of gobbly-gook language that looks impressive, but doesn't mean

a whole lot.

Here are some key questions you want answered before you sign:

- WHAT is it that you're going to be targeting placement for (what exactly are the keywords)?

- Who's already placing on page 1 for those keywords (who are you competing with)?

- How often do those keywords actually get typed in (what's the monthly search volume)?

I suggest using tools like SEMrush.com and SpyFu.com to do an analysis on your

competition and the keywords you're going to be targeting FIRST.

Most of the time, once the keywords are provided, though they might SOUND good,

when you run them through a tool that tells you the search volume...

You'll find that they don't get typed in enough, and/or are too competitive and not worth it.

Any time you see page 1 organically filled with Zillow, Bankrate, LendingTree, QuickenLoans

and NO other small website, chances are you're not going to break through any time soon.

And if the monthly search volume is less than 300 searches per month, getting to page 1 is

really not going to bring you a lot of traffic (unless you're in the top 3 spots).

To be clear, 300 searches per month is not high search volume by any means, but it's something --

and a lot of times, keywords I see people going after don't even register ANY volume!

The CTR (Click-Through Rate, if you paid attention to last week's acronym breakdown) on page 1

of SERPs (search engine results pages) goes down dramatically from the #1 to the #10 spots, with

almost nobody making their way to page 2.

I'll talk a bit more about that next week.

I'm not saying SEO is never a good investment, but don't fall for the fancy proposal and tech jargon --

do the research and ask key questions to help you figure out if it's going to be worth the time and

money. In my experience, the answer is usually no.

Thanks, and I'll catch you on next week's The Letter X!

Thanks for checking out this week's tips, and I'll catch you on next week's The Letter X!

I hope you enjoyed TLX #30! Have a great weekend.