🔥 Cancel Rent & Mortgage Payments? - The Letter X

Nov 21, 2020 9:02 pm

THE LETTER X

ISSUE #31

We have all heard that statement come from various people during the beginning of the pandemic and now it is coming back up again, including from some of those in congress, as rent and mortgage protections wind down.

Better safe than sorry!

We do not know what the next few months will bring, but you should prepare yourself for some potential turmoil in the industry that is not related to rates & capacity. Hopefully you have squirreled away some revenue from the record production to get you through the lean times that may in fact be on the horizon.

Next week's TLX will be a special Thanksgiving edition so be on the lookout for that!

As of today there are 40 days left in 2020! The big “Four Oh!”. What are you going to do with them? This week I have been focused on making a point to MLOs to not sleep on keeping in front of your database and more importantly your client relationships. I challenge you this week to make meaningful contact with those in your database. And remember…

This Week’s Mortgage X Tip!

Rank the contacts in your database from 1,2,3 or A,B,C. Ranking you contacts gives you a quick look on which contacts are strong referral sources, which ones have potential, and those that you need to work on. Doing this type of database management allows you to spend time on the right relationships.

Now go and “Rank & Bank” your database and enjoy this week’s edition of The Letter X!

Say Yes Every Day

Laura Brandao - President of AFR Wholesale

This week Say Yes to attracting, all of us have the ability to attract energy and opportunities, as we start the week of Thanksgiving share your gratitude and appreciation with your family, team and loved ones and start attracting positivity into your life!

The Edumarketer

Ginger Bell, CEO of Edumarketing

2020 has been a hard year to navigate for all of us. Most of society has turned to virtual experiences to stay connected during a time when we need to be distant for our safety.

We have seen many unique ways to create a sense of normalcy through going virtual for many events. Thanksgiving is usually a time to all come together and share a meal. That is not a reality for most this year.

We wanted to help spread a feeling of gratitude by creating a video that you can share on social media!

From our family at Edumarketing, to yours, we are grateful for the perseverance of our communities, the continued commitment of our first responders and health care providers and the hope of tomorrow.

Happy Thanksgiving!

Click HERE to get your Thanksgiving Video to share on social media! Simply complete the form and we will email you an MP4 video that you can share on social media or post on your YouTube channel! It’s our gift to you!

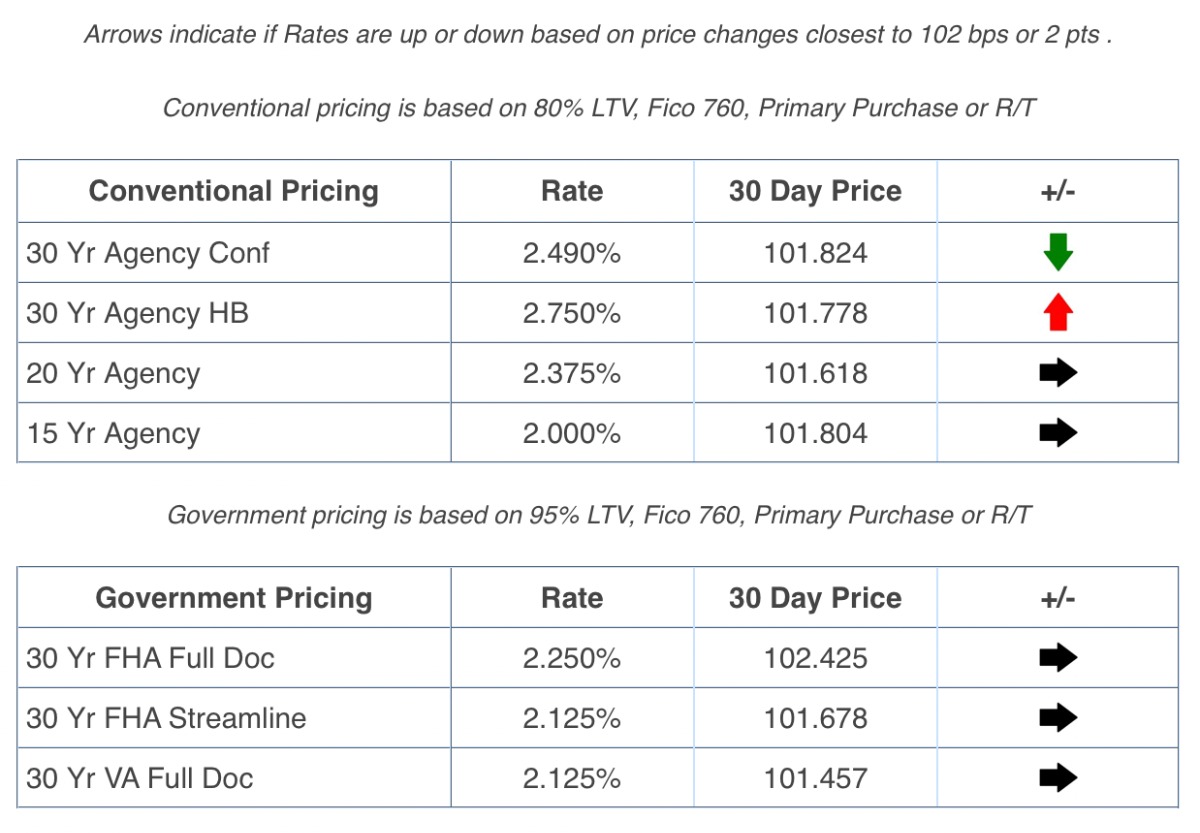

Mortgage Rate X

Lender Price Friday Rate Lookback

MBS X

Diana Bajramovic of MBS Highway

Housing

As we’ve been saying for a very long time, the housing market is extremely strong. We anticipated that Existing Home Sales would come in hot, and it did! Expected to decline 1.2%, they came in up 4.3% in October!

As I mentioned a few weeks back, the number of home sales is at an all-time high since 2006. But remember, in 2006 there was twice the amount of inventory as there is today. Since just last year, we are down 20% in inventory, so it’s safe to say that homes are rapidly coming off the market, especially considering that homes are only staying on the market for 21 days on average. 75% of these homes sold in under 30 days. Why are the other 25% of homes not selling as quickly? That’s because they are probably not reasonably priced. Homes sit on the market when they are priced too high. The homes that are priced appropriately are flying.

Affordability

The median home price came in at a record $313,000, up 15.5% year over year, but this does not mean that homes are becoming less affordable. Hats off to Diana Olick for finally reporting this number correctly this morning. She stated that the median home price is rising because more higher priced homes are selling since there is very little inventory in the lower priced market available.

If you are an MBS Highway subscriber, HERE is an article written by our team that breaks down the median home price and how income affects affordability. We also released a new Social Studio script, “The Real Scoop on Affordability,” that will help you explain to your clients why now is a great time to purchase a home as affordability continues to stay at a healthy level.

The News X Recap!

Housing prices are surging across the country as people rush to take advantage of record-low mortgage rates.

After creeping up last week, Freddie Mac's Primary Mortgage Market Survey reported that mortgage rates reversed course, hitting a historic low for the thirteenth time this year. The 30-year fixed-rate mortgage averaged 2.72% for the week ending Nov. 19, 2020, down from last week's average of 2.84%. The 30-year fixed-rate mortgage averaged 3.66% for the same period in 2019.

The forbearance plan rolls expanded slightly over the past week, reversing two weeks of falling numbers.

Tech giants Facebook and Google are pulling out their checkbooks to back a modular housing startup.

On Thursday, the Department of Justice filed a civil lawsuit alleging that NAR "put illegal restraints" on the way agents who sell real estate can compete.

The Federal Housing Finance Agency issued a final capital rule for Fannie Mae and Freddie Mac. According to the FHFA, the final rule has a few changes to the originally proposed rule published in the Federal Register on June 30, 2020.

“Quotable” - Rich Barton, CEO of Zillow Group

“I think that this feels like a long-term trend, to me, towards digital,”

Consumers, Barton explained earlier in the conversation, want to shop for homes digitally, more than ever before, the company’s own user data suggests. Zillow.com set a traffic record in the third quarter of 2020, beating a record set the quarter prior.

From 1945 through 1980 there were eight recessions, never did it take longer than 24 months for employment to surpass its pre-recession peak. The 1982 recession was different, it took almost 30 months before the pre-recession peak was bettered. Each of the three subsequent recessions has taken increasingly long to recover, with it taking over six years for employment to surpass its 12/2007 high following the 2008/09 housing bust.

For the nine months ending 3/20, 14% of all homes purchased were priced at $500,000 or more. Between 4/20 and 6/20, that percentage jumped to 25%! Relatedly, since the start of Covid-19 home buyer median income is $110,800 compared to $94,400 for pre-pandemic purchasers. Not surprisingly, the percentage of first-time buyers was just 31% for the year ending 6/20, down from 33% during the prior 12 months. Affordability problems mount.

Headline Y-o-Y Personal Consumption Expenditure inflation (PCE) is running at a benign 1.4%, and core PCE inflation, the Fed’s favorite inflation measure, is up a weak 1.5% Y-o-Y, and economy wide GDP inflation is just 1.2%. Relatedly, employment cost inflation has been steadily falling over the past several quarters, suggesting that Covid-19 is unsurprisingly lowering employer labor costs. Lastly, consumer expectations of inflation through 2025 are flat to declining.

Good things come to those who Mastermind! Have you joined the Mortgage X Mastermind yet? I would like to invite you to join our community that is 100% focused on helping MODERN industry professionals crush it.

Lending, Leadership and Life

Eddy Perez – President & CEO of EPM

In this week's episode of Lending, Leadership and Life Eddy is talking about getting into the suck. What do we mean by that? Check it out.

Non-QM X: Highly Qualified Non-QM News

Tom Hutchens - EVP of Production at Angel Oak Mortgage Solutions

You’ve been reading my articles and decided you want to take the plunge into non-QM. The next step is to find a non-QM origination partner that’s right for your business. Be careful though, not all originators are created equal.

So how should you pick a non-QM partner?

Do your due diligence

As the non-QM comeback continues so does the resurgence of originators. You’ve probably noticed several companies claiming they’re experts in non-QM when that might not be the case.

With more players entering the space, it’s important to ensure that the partner you choose originates quality non-QM loans. Especially during a time when the pandemic is taking a toll on many borrowers' credit scores and finances. How has that originator navigated the pandemic?

Proven track record & expertise

Your non-QM partner should have a solid track record and expertise to get these loans done – and done efficiently. Focused non-QM originators can have the bandwidth, technology and know-how to be an effective and trusted partner.

Look for originators who focus solely on non-QM. Typically, these entities have a close relationship with the secondary market and an intimate understanding of the products. Their streamlined capabilities can help you close quality non-QM loans quicker and easier.

How much non-QM volume do they do?

This is the most important question to ask yourself when choosing a non-QM partner. The amount of volume a company does should tell you how dedicated they are to non-QM. I’d argue that the more non-QM volume a company does, the better.

Volume + experience + track record = Your next non-QM origination partner.

Please remember that I and the Angel Oak family are always here to help if need be!

Mamapreneur: Real Talk with a Side of Mom Jeans

Jess Vogelpohl Southwest Coaching

Get. A. Coach:

📣If you started TODAY - what would your business look like in a year?

Jeff's leader books a FREE workshop with us ➡️ Jeff enrolls in coaching with us ➡️ Gets paired with his coach➡️Decides to be committed ➡️ Remains coachable➡️ Income GROWS by 150%.

Yeah, yeah - money is nice but what about the non-tangibles...

Jeff now has:

+more balance and joy

+more time with his family

+more fulfillment and purpose

+more systems in place

Our average client increased their income by 25%.

Yup, coaching costs some dollar bills.

Some dollar bills that you work hard for.

But...⬇️

Don't you think if you were going to do it on your own.

🔆If you were going to achieve the vision you have for you.

🔆For your family.

If you were going to FINALLY hit that income level

🚀 Your potential

Take the dream vacation 🏖

🏡Afford the dream home

Don't you think if you were going to do it on your own.....you would've done it by now?

Coaching is an investment in YOU. Your biggest asset. For one second, stop focusing on the cost and focus on what it could give you!

Can you afford to do it? Better question - Can you afford to NOT do it.

Podcast of the Week!

Please, Allow Us To Reintroduce Ourselves!

Podcasts of the REAL Disrupt Network

Virtual Coffee with Estie Briggs

Mortgage Industry Professional of the Week

Nicole Peraino - Creative Director of AIME

Make sure you tell Nicole you saw her in The Letter X!

Beyond The Numbers

Fobby Naghmi, EVP, National Sales Mgr. of First Option Mortgage

In this year where so many people are telling us what matters, I propose one more,

GRATITUDE MATTERS.

We’ve all heard about how adopting an attitude of gratitude will allow us to remain calm and peaceful in matter of great disturbance. But recently I heard a speaker challenge us to practice gratitude at the exact thing that was angering us and do it for 10 days. I rose to the challenge. The first few days were ok, but then it happened. My son had been asked to bring the groceries in and he continued playing whatever video game with a group of virtual friends. I went from calm to enraged and back down to a boil before I barged into my sons’ room to issue a final warning before storming out. I later looked back at that moment and wondered if I had screwed up my 10-day challenge. I felt a slight tinge of failure.

But a thought came from somewhere: What I could be grateful for in that moment? 1) My son had never been rude 2) we did have bags of groceries to bring inside our home 3) we had a car that had our groceries 4) I could hear my son’s laughter enjoying life in the age of a pandemic. I am not gifted enough to describe the feeling that overcame me right there and then, but I knew in my heart that gratitude truly mattered.

ANDYGRAM – 75 Hard Thoughts

Are you investing in yourself?

If you’re not, it’s time for you to start.

No matter who you are and what you do…

You have 30 minutes a day to put into your personal development.

When I talk about personal development…

I’m not talking about taking night classes, or buying some crazy program.

I’m talking about reading 10 pages a day.

Every single day.

That’s it.

When I say to “read 10 pages” … I’m not talking about reading 50 Shades of Bullshit...

I’m talking about a nonfiction/personal development book.

If you do this consistently, you’ll start to notice things changing in your life.

Your career will get better.

Your relationships will get better.

Your circle of friends will evolve.

You’ll be more confident in yourself.

Your life will completely change over time.

Do it or don't do it.

I hope you do...

...but stats say you probably won't.

Either way, understand this...

What you do at your job pays your bills today.

But what you do outside of your job to invest in yourself dictates your future.

Readers win.

Mortgage X Marketing Maifesto

Google Ads (PPC) for Mortgage: OWN Your Own Branded Keywords

If you're not going after your own company's keywords (or your own name) with

Google Ads, chances are pretty good your competitors are.

That means if someone types in your company, let's say, "XYZ mortgage" — you'll

often find competitors — other big mortgage companies and companies that sell

leads — are placing at the top with Google Ads for YOUR keywords.

Whether it's them specifically targeting and going after your name as part of their

strategy, or they've got their settings on "broad match" and you're just getting caught

up in the wide net they're casting...

They might be eating your lunch as a result.

Think about it: a consumer is typing in your name or your company's name into

Google after speaking with a Realtor and getting a recommendation to reach out

to you...

Then Quicken loans comes up at the top of the search for your branded keywords

and swoops in with a compelling ad pulling that consumer into their Lead Funnel.

I know, I know, the Quicken phone sales jockey doesn't hold a candle to your amazing

service, knowledge, let alone how much they'll end up overpaying by going with them...

But when this kind of hijacking happens, you don't even get a chance to speak with

the consumer in many cases.

Google yourself -- your name + the words "mortgage" or "loan officer" or whatever

you have on your business card, and your company's name — see what comes up

on page 1.

There are a variety of searches consumers might be doing that will pull up different

results. See who and what is placing organically and with Google Ads.

It's important to know what you're up against. Only then can you start working on

strategies to Take Back Your Leads.

Thanks, and I'll catch you on next week's The Letter X!

I hope you enjoyed TLX #31! Have a great weekend.