🎉 Two things you can do to stay motivated! - The Letter X

Dec 12, 2020 8:06 pm

THE LETTER X

ISSUE #34

Welcome to the final TLX of 2020. But don’t worry, we will be starting back up on January 9th 2021. I will be taking a break to focus on moving my family from Utah to Georgia and getting settled at EPM.

I wanted to start off by saying thank you to the readers of TLX. You have hung with me for 34 weeks and I appreciate your support and attention. I look forward to continuing TLX in the new year with some changes.

But enough about that, let’s focus on you. This industry is a vortex that sucks people in and keeps us here, so we ALL have that in common. I have seen that this time of year really brings out a rush of motivation to work towards planning for the new year so you can reach your goals.

It is a great feeling and my advice to you is: DO NOT LOSE THAT FEELING.

Easier said than done, but I have seen the amazing businesses that were built by originators who kept that feeling going. Life happens and motivation will come and go, but here are two things that I know will help you keep on track.

- Create a vision board - Nothing like having a visual of what you are working for.

- Write down your goals and your feelings in a journal - Look at it and use it every day to keep a constant reminder.

We are term limited in this business and in life. If you are doing what you chose to do, why not work to be the best? 2020 brought great success and opportunity to those in a position to grab hold. 2021 will be more of the same, even if it ends up being a down year.

Remember that business in our industry has always been done regardless of rate and economic environments. The only variable is WHO is the one doing the business.

With that, I wish you all a very Merry Christmas and a Happy New Year!

The Final Mortgage X Tip of 2020!

21 days left in 2020, and the one big mistake I see my loan officers, agents, and well pretty much everyone is NOT taking the time to learn the tools they pay for. Going a step further, taking the time to not just learn the basics but become a master at them.

Take these last days of 2020 to master your craft and the tools that help you. None of us knows what 2021 has in store for us but regardless of circumstances becoming an expert mortgage advisor will only increase your chances of success.

Enjoy this final TLX of 2020!

Say Yes Every Day

Laura Brandao - President of AFR Wholesale

This week Say Yes to HOPE! By definition hope is to expect with confidence. This week spread hope because we all have the ability to expect good things to come with confidence!

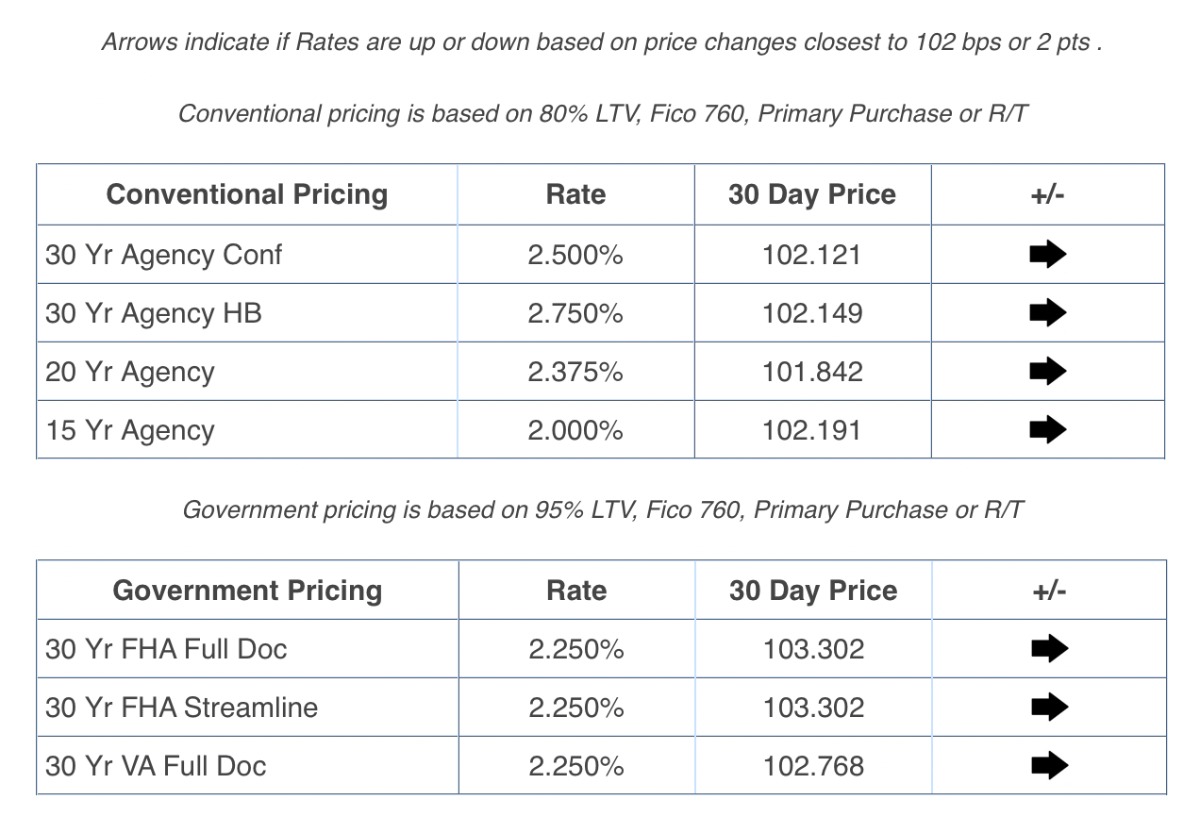

Mortgage Rate X

Lender Price Friday Rate Lookback

MBS X

Diana Bajramovic of MBS Highway

Equity Gains

This week I read an article from CNBC which mentioned that CoreLogic reported equity in homes with a mortgage, which represent about 63% of all properties, rose nearly 11%. Putting this into perspective, this equates to a collective $1 trillion gained in equity or roughly $17,000 per homeowner - the largest gain in over six years! With appreciation up 7%, combined with increased equity through amortization, 11% equity presents amazing refinance opportunities for your clients. As if you guys aren’t busy enough! If you have clients who currently have mortgage insurance, contact them and let them know they can take advantage of this opportunity so they will no longer need to pay mortgage insurance. Also be sure to take advantage of your clients’ monthly debts and obligations. You can greatly reduce their overall monthly payment and loan term by tapping into their equity, paying off debts, and eliminating mortgage insurance. Even if there isn’t a huge difference between their rate and the rate available, they may be able to better their financial situation.

Employment

Initial Jobless Claims rose 137,000 to 853,000 in the latest week, and this rising trend is likely due to the spike in COVID-19 cases and businesses running out of PPP money. Emergency claims are decreasing, which sound like a good thing, but unfortunately the decline is for the wrong reason, as these benefits are expiring. For so many businesses and workers, it's crucial that the vaccine is released and distributed as quickly as possible. The FDA will be meeting today to vote on approval of the vaccine and if it’s approved, distribution could start as early as Monday.

Follow up with this news with our Daily Morning Update on MBS Highway.

The News X Recap!

The Consumer Financial Protection Bureau on Thursday issued final rules related to qualified mortgage loans. The Mortgage Bankers Association provided preliminary summaries of the final rules.

Between past due rent, late fees and unpaid utility bills, Americans may collectively owe $70 billion by January, when the current federal eviction moratorium is set to expire.

Local and national experts in the homebuilding and real estate fields shared their predictions Thursday for 2021, expressing optimism but also some dread.

Research from Redfin revealed that pending home sales were up 54.1% year-over-year in U.S. counties with low concentrations of COVID-19 for a four-week period ending on Dec. 1, compared to 45.1% growth in counties with high concentrations.

The National Association of Realtors has issued an historic apology for its role in housing discrimination, but some say it falls short.

How the Biden administration could reshape the country’s housing market.

Special shout out to my friend Anthony Casa and his launch of UMortgage, a purpose driven national mortgage company centralized in Philadelphia, PA. I have no doubt this will be a company to watch in 2021.

Yesterday the Federal Trade Commission and 46 states filed two separate lawsuits against Facebook, and earlier this year the Department of Justice sued Google. It’s about time! While these firms seemingly offer free services, they are anything but. By chocking off any nascent competition, consumers end up with fewer alternatives, less privacy protection, reduced innovation, and because they charge advertisers, higher prices; we all pay more for the advertised products.

Through November, 93.6% of renters living in large, professionally managed market-rate apartment buildings paid their November rent. Last year, the percentage was 95.2%, a 1.6 percentage point decline. In October, the decline was 1.8 percentage points, in September 0.9 points, in August 1.3 points in July 0.9 points and in June just 0.1 points. While the deterioration is not huge, it is painfully apparent and steadily worsening.

While November net employment grew for the seventh straight month, it’s been declining for six straight, and from a peak of 3.6 million. Employment grew by 245,000, a number that normally would be lovely. While the unemployment rate fell, it was solely because labor force participation dropped. Given Sars-Cov-2’s resurgence and flagging stimulus (hello Congress?), this number is OK. Winter looks dark, but by spring things should start solidly rebounding.

Good things come to those who Mastermind! Have you joined the Mortgage X Mastermind yet? I would like to invite you to join our community that is 100% focused on helping MODERN industry professionals crush it.

The Vieaux

Brian Vieaux - President of FinLocker

5 Ways To Fill Your Pipeline With Millennial Homebuyers

At the conclusion of 2019, prior to the Coronavirus changing the way we live and work, Millennials - those born between 1981 and 1996 (turning 25 to 40 in 2021) – had a 47%1 share of primary home loan originations of the market.

As 2020 progressed, and office workers began working from home, with many arrangements now becoming permanent, Millennials seized on the opportunity provided by low rates to stop renting in expensive cities and purchase a home in an affordable suburban neighborhood or small town.5 This change has seen the year ending with Millennials now making up over 60% of home purchases.2

In 2021, a significant wave of millennials will be 30-353, the prime homebuying age for first-time buyers. How do you fill your pipeline with Millennial homebuyers and position yourself to capture their repeat business and referrals? Here is what we know about this group of homebuyers.

Millennials are struggling to save for a down payment.

Student loans, car loans, credit card debt, and increasing rents make it difficult for most homebuyers to save for a down payment. Debt delays 75% of buyers aged 22 to 29 from saving for a down payment or buying a home 1-3 years, and 48% of buyers aged 30 to 39 years are delayed 5 or more years.4 Yet for 85% of buyers aged 22 to 29 and 72% of buyers aged 30 to 39, their savings is the primary source for their down payment4. To become a homeowner, Millennials first need to learn to manage their debt and start saving.

Millennials are burdened by student debt.

According to the National Association of Realtors, 76% of consumers claim student debt impacts their ability to purchase a home5; 38% of homebuyers aged 30 to 39 years have student debt with a median amount of $34,0004.

Student debt often affects a homebuyer’s debt-to-income ratio, contributing to a low credit score. These two factors were cited by 55% of buyers aged 22 to 29, and 67% of buyers aged 30 to 39 as the reason their mortgage application was rejected4.

Millennials are tech-savvy and expect their vendors to be, too.

Millennials are keenly aware of the convenience of online shopping, digital tools, and apps. They expect the vendors involved in their home buying transaction to provide the same convenience. The first step of most millennial homebuyers as they begin the home buying process is to look online for properties for sale (43%), followed by looking online for information about the home buying process (17%), with few (7%) contacting a bank or mortgage lender first4.

Millennials need assistance overcoming the most difficult steps of the home buying process.

Millennial homebuyers in 2020 cited “finding the right property,” “paperwork,” “understanding the process and steps,” and “saving for the down payment” as the four most difficult steps of the home buying process. What’s more, 63% of Millennials found the home they purchased on the internet.4 The internet is filled with websites that Millennials can use to obtain homeownership education, but if they stumble across the lead gen resources created by your competition, how likely are they to return to you for their mortgage?

Millennials can be a top referral source.

An investment in customer satisfaction is an investment in your company’s future. Satisfied clients are more loyal and will be the promoters of your business. In 2020, 87% of consumers began their lender search with a referral or an existing relationship.6 How will you become the mortgage lender your clients recommend to their homebuying friends and colleagues? Stand apart from the competition by becoming a trusted advisor who provided your Millennial clients with the financial tools to improve their credit score, help them save for their down payment, and ultimately increased their purchasing power.

To find out how a custom-branded FinLocker can be used to attract more Millennial clients, contact us to schedule a demo.

1 Realtor.com, Q4 2019 Generational Propensity Report: Generation Z Enters the Housing Market

2 Ellie Mae, Ellie Mae Millennial Tracker

3 Deloitte Insights, U.S. Census Bureau International Demographics via Haver Analytics

4 National Association of REALTORS®, 2020 NAR Home Buyer and Seller Generational Trends

5 National Association of REALTORS®, The Impact of Financial Literacy on Homeownership: Student Loan Impact

6 STRATMOR Group, How to Become the Mortgage Lending Choice of Millennials

Lending, Leadership and Life

Eddy Perez – President & CEO of EPM

In this week's episode of Lending, Leadership and Life..

Communication - is it as important as people say? Can it be improved by just sending more emails? Check out the video below!

Non-QM X: Highly Qualified Non-QM News

Tom Hutchens - EVP of Production at Angel Oak Mortgage Solutions

The non-QM industry has rapidly adopted technology this year. 2020 catalyzed what was a gradual trend into an immediate necessity. Players in the non-QM space had a simple choice: adopt technology or risk losing business.

This stark realization has pushed the non-QM industry to create new products and tools driven by technology, including: online pricing and qualification applications, streamlined documentation processes and automatic bank statement review systems. These advancements are not anything brokers haven't used before. Why does it matter?

2020 is the year non-QM technology grew up. Over the past year, new non-QM technologies have advanced all aspects of the origination process, bridging the gap between itself and the agency space. By launching unique initiatives, originating a non-QM loan is easier than ever before and originators can really start to reap the benefits — especially if you work with the right partner.

Large non-QM players like Angel Oak are using technology to construct experiences that improve customer service and add value to originator’s businesses. These integrations will create more transparency, enable faster customer support, quick closing times and much more.

We expect non-QM lenders will continue to be hyper focused on tech in 2021, revolutionizing the mortgage industry and setting the standard for innovation. Originators who understand the value of mortgage tech and want to be on the forefront of innovation will likely be pleased with the advancements made in 2020 and beyond in the non-QM world.

If you want to learn more about non-QM technology, feel free to reach out.

Podcast of the Week!

NO BS Allowed: Watch Your Blindspots w/Matthew Boyce

Podcasts of the REAL Disrupt Network

Virtual Coffee with Estie Briggs

Mortgage Industry Professional of the Week

Dave Savage, CEO of Mortgage Coach

Make sure you tell Dave you saw him in The Letter X!

Beyond The Numbers

Fobby Naghmi, EVP, National Sales Mgr. of First Option Mortgage

Habits…where do they come from? We all have them. It’s said that habits can be triggered by the part of the brain where the primitive instinct of “Fight or Flight” is stored. So that when necessary, we don’t have to waste time thinking about what to do, we just do. They give us ability to survive at a moment’s notice.

Unfortunately, we can also develop bad habits and store them just as easily. Like staring at your cell phone even though there is nothing new to read. You know what I mean!

And then there are those habits that we don’t know where they came from. Like the story of a woman who cut the ends of a roast and tossed them in the trash before putting it in her roasting pan. Her husband observed the practice and asked why the waste of food. The woman stopped and thought for a moment. She responded, “I don’t know. My mother always did it.” She was so intrigued, she called her mother and asked why it was best to cut the ends off the roast. Her mother also paused and thought for a moment before replying, “I don’t know, sweetheart. My mother always did it.” The woman hung up and called her grandmother, “Grandmother, I cut the end off of my roast because my mom did it. She said she cut it off her roast because you did it. Can you explain it?” Her grandmother chuckled and said, “I cut the ends off the roast because my pan was too small.”

The Edumarketer

Ginger Bell, Founder of Edumarketing

Creating Powerful Partnerships in 2021

2021 cannot come soon enough for most of us and as we near the New Year it’s important to take time to create your 2021 plan. Here’s some ideas to get you started:

1. Figure out what you want to accomplish in 2021.

This is not about goals. This is what you want to ‘accomplish’. This may include things like create an educational video marketing plan, or record weekly videos for my YouTube channel. It could be developing new partners or learning about new loan programs that you can educate on. This could also be developing your branding and social media plan. This is your big picture stuff. Who are you, where do you want to be and how do you want to be seen, remembered and making a difference.

2. Write down your goals.

Once you have an idea about what you want to accomplish, then you can move on to writing out your goals. Begin with your annual goals and then break it down into your monthly, weekly and daily goals. Things like your fundings, how many real estate partners you want, etc.

3. Create your plan.

The devils are in the details. Planning means writing out your marketing plan. What are you going to talk about each week. Who is going to write your video scripts, who is recording, editing, producing and posting your videos. It’s the HOW to WHAT your are going to accomplish. Most people spend more time planning their vacation than they do planning their lives. Take this time at home to write out your plan. The past year has had most of us in reactionary mode. If you want to continue to grow next year, you have to make a plan.

Here's what your plan should include:

• How Will You Serve Your Customers and Deliver an Experience that Matters?

• What Does Success Look Like?

• What Strategies or Practices Will You Continue?

• What Strategies or Practices Will You Discontinue?

• Events That Could Throw You Off Track?

• What Time-Blocking Schedule Will You Commit To Working Each Day, Week, Month?

• What Will Be Your Habits to Achieve Your Plan?

Remember to include your team in your planning. This means your internal team and your partners. Want to have an impact on your partners? Think about holding planning meetings with your existing partners. They would probably LOVE to have help creating a plan.

Create a Power Partner Program

Yes, we know, every real estate professional has an “In-house” lender, but that doesn’t matter if you are focused on the long-term of relationship building. You have to think LONG-TERM when you are creating a Power Partner Program. So, what is a Power Partner Program? It begins with education. Engage with your partners. Spend some time researching who you want to do business with. Don’t just go for the spray method of marketing. Be strategic. Spend some time searching the type of agents you and your team work best with. Then, add value. We all need to drop the sales prospective. Everyone is sick to death of it. Instead make it about them. Plant referral seeds by building value. Give them things that they can share. For example, create videos that they can use to share with their buyers and sellers. You can go the extra step by inviting them to be a part of your video and interview them. Start a video podcast where you invite one realtor a week in to do a video with you. Produce the video with their branding and send it to them so that they can share it with their network. Want to see results from this? Stick with it. One of the biggest reasons your referral partner programs are not working is because you stop doing them. So, in 2021, make it a goal to stick with it.

Educate, Educate, Educate

Education is the best way to provide value to real estate professionals and financial planners. Showcases your expertise and demonstrates your expertise in an organic and non-intrusive way. Create your brand! Remember to leverage technology with services like Zoom, Gotowebinar, Skype for webinars and Webinar Jam and Ever Webinar for automated webinars

Want to create a plan for 2021? I’m holding a planning webinar on January 19th. Click Here to register for my 5 Steps to Sales Success in 2021 webinar

I wish all of you a safe, healthy and happy holiday season.

Mortgage X Marketing Manifesto

Understanding Click Through Rates (CTR) on Page 1 of SERPs (search engine results pages)

I'm going on 17 years in the digital marketing space, specifically working with mortgage and real estate professionals, and in that time, I'd say SEO has been one of the most popular yet least understood topics for LOs when it comes to online advertising.

I'm not necessarily an SEO guru, but I have a fair amount of experience with it. I did the SEO work for leadPops.com, where if you Google phrases like "mortgage marketing" or "mortgage lead generation," you'll find us near the top organically (usually in spots 1-3).

My last TLX, I talked a little bit about making sure you do your research into the keywords and competition you're going after if you're thinking about starting an SEO campaign.

Knowing who you're up against and what the search volume is of the keywords you're targeting is critical. All too often, people start going after keywords that have little or no search volume.

What good does it do you to get to page 1 (which is still hard for any mortgage-related keyword) if nobody is looking for what you're targeting?

Next comes expectations. Let's say you crack page 1 for a phrase that gets typed in 500 times per month. What can you expect to get from that?

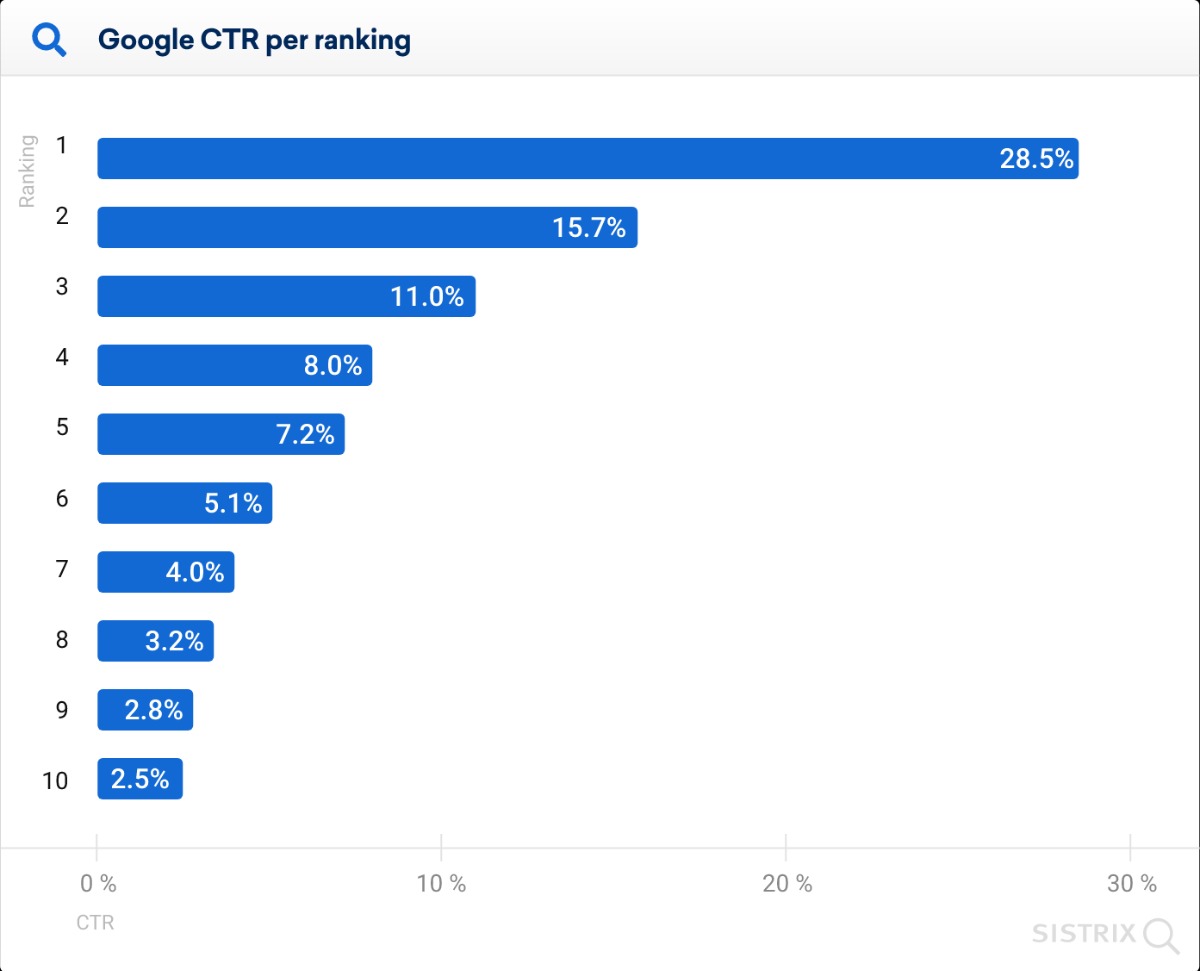

Which spot you place in, 1-10, has a dramatic impact on your click through rates (the % of people that are searching for a given phrase that actually end up clicking through to your website).

Check out this recent breakdown of the average Google Page 1 CTRs by Sistrix, a leading SEO research and data analysis provider:

This tells you that if you cracked Page 1 for a phrase that gets typed in 500 time per month, and you made it to spot #4 (which is respectable), you'd only receive 40 clicks per month (on average) from that keyword.

Then you have to, of course, factor in your website's conversion rate of clicks to leads... and what your conversion rate is on leads to closed loans, and by the time it's all said and done, you could expect to get very little from that effort.

You'd need a whole bunch of those types of keywords, which, over time, is doable. But it's highly competitive and will take considerable investment in time, effort, and money to get there.

I'm not saying SEO isn't worth working on/investing in as a long-term, ongoing part of your digital marketing strategy, but having the right expectations is key.

Understanding what the search volume is on keywords, who your competitors are, and what you can expect in terms of clicks if you do make it to page 1, helps you understand the potential ROI and whether or not it's worth it for your business.

Thanks, and I'll catch you on next YEAR’S The Letter X!

I hope you enjoyed TLX #34! Have a great weekend.