🔥 🎃 Do you like scary movies? - The Letter X

Oct 31, 2020 7:02 pm

THE LETTER X

ISSUE #28

Halloween and Friday the 13th are always great days to have the first name Jason. It was more fun as a kid as it wasn’t too weird to walk around with a hockey mask and a machete. It is a little different now in exec meetings. With Halloween you can add the names Michael, Freddy, and leatherface….well maybe not the last one. But I digress…

Speaking of scare movies, you’re in luck because we could have a scary and crazy one in the making after next week’s election…..with rates….and other stuff. But let’s focus on rates.

I have seen a LOT of rate talk and questions this week about what we think will happen after the election. MND did a great summary of how a look back at 2016 Reminds Us How Completely Crazy Next Week Could Be For Rates.

I wanted to go with a little more straight talk so I talked about it with one of the smartest market minds I know, Phil Mancuso who is the CRO of EPM.

There are several factors that will impact rates over the next 30-90 days. Specifically the potential for a COVID 2.0 and nearly as importantly prepay speeds from Q1 and Q2 vintage. You’re seeing that generally suppress Ginnie pricing to begin with already. I think it would be smart to expect some turbulence. My greater outlook continues to be that notwithstanding a C19 2.0, the recovery is clearly intact and V shaped, yet the Fed is in it to win it, so we are in a perfect storm situation for rates for the time being as one would expect a brisk appetite for CO, RT and purchase business.

Even with the best expertise and forecasting, the 2016 reaction was a surprise to the market and 2020 may be the same, or not (don’t you love our industry?).

My point? Focus on what you can control, listen to the experts who you have come to trust over the last 24 months, and make the decisions based on your expertise. At the end of the day business will get done in good and bad markets if you are the one grabbing attention and making an impact in your market.

Enjoy this week’s edition of TLX!

Say Yes Every Day

Laura Brandao - President of AFR Wholesale

This week say yes to new surroundings! When we change our surroundings we also change our perspectives which leads to creativity and an increase in productivity. This week change it up a bit by shifting or changing your environment because a fresh perspective can truly enlighten you.

Event Highlight

I love having Laura contribute each week to TLX and speaking of Laura she will be moderating the BYE Leading Ladies of Mortgage Virtual Mastermind Part 2 coming up next week on November 4th from 9am – 3pm Central.

EPM is proud to sponsor this event and I am excited to be a co-host with my man Mitch Peek. Check out the awesome lineup below and register TODAY for this FREE event.

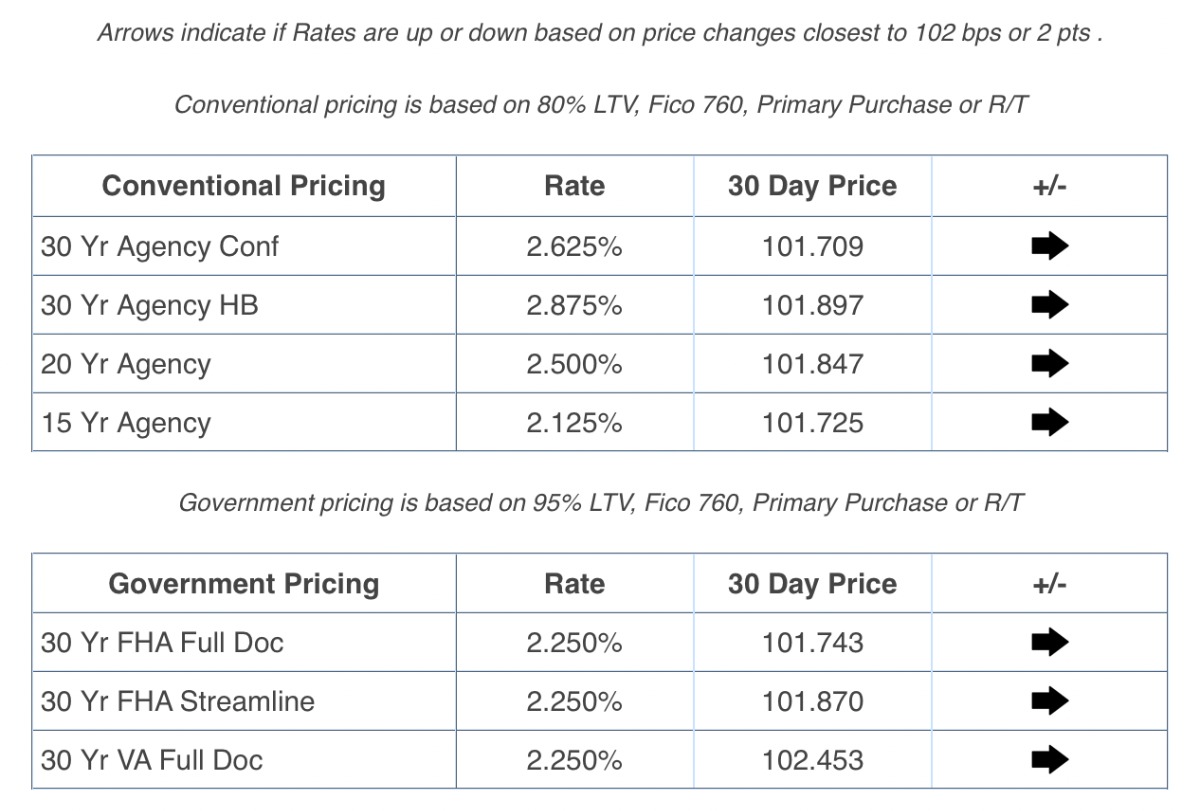

Mortgage Rate X

Lender Price Friday Rate Lookback

MBS X

Diana Bajramovic of MBS Highway

Appreciation Continues to Stay Strong

The Case-Shiller Home Price Index is widely viewed as the “gold standard” measure of appreciation. As we’ve been discussing, appreciation has been consistently strong. Case-Schiller reported an increase from 4.8% in July to 5.7% in August. Our forecast at MBS Highway was between 5.5% and 5.6%. To put into perspective how strong these numbers are, imagine your customer is looking to purchase a $300,000 home. If they were to see 5.7% in appreciation, that would equate to $17,100 in just the first year. Also consider how other factors like amortization would increase the equity they have in their home even more. Case-Schiller’s 20-city index also showed an increase in appreciation from 4.1% to 5.2% year over year. Some of the top markets in the 20-city index were Phoenix where prices rose 9.9%, Seattle where prices rose 8.5%, and San Diego where prices rose 7.6%.

The FHFA (Federal Housing Finance Agency) House Price Index measures the appreciation of homes with conventional mortgages, and typically speaking, these loans are in the lower price range. The report came in at 8.0%, rising greatly from the previous reading of 6.5%. A reason we might be seeing such high appreciation, especially in the lower priced homes, is that there is little to no inventory within that price range.

Mortgage Applications

Mortgage Applications are up 1.7% week over week, with purchases relatively flat, rising only 0.2% last week, while still increasing 24% year over year. Refinances jumped by about 3.0% last week and are up a very healthy 80% year over year. Part of the reason we see this rise in refinances is that rates are currently around 1.0% lower than they were this time last year. Refinances now make about 67% of all loans, which is up from 66.1% last week.

Refinance Opportunity

While rates are currently at extremely low levels, we have to consider the effect that a potential rise in inflation would cause on the Bond Market, because, as we know, inflation erodes a bond’s buying power. We’re fat and happy now, but what happens if rates start to tick higher? How can we combat this and still keep refinance volume high? Use tactics like Debt Consolidation to show your customer how you could not only pull cash-out of the equity they’ve built in their home as well as consolidate their debts to reduce their mortgage term by many years and greatly increase their net worth and savings. Be a true Advisor and act as a debt manager to not only increase your production, but greatly change the lives of your customers and their families for the better.

The News X Recap!

Starting off with some Real Estate news, Redfin has been accused by the NFHA of redlining in a lawsuit filed on Wednesday.

COVID19 is taking a toll on the island real estate market with declining home inventories, few closed sales, and fluctuating median sales prices.

What goes down must come up: after the coronavirus resulted in a staggering record drop in the second quarter, the U.S. economy bounced back somewhat in the third quarter, according to the first (advance) estimate of gross domestic product.

A federal judge ruled against landlord groups who were seeking to block the U.S. Centers for Disease Control’s national moratorium on evictions due to the coronavirus pandemic.

ARM Rates are now falling below Fixed Rates, so are the adjustables making a comeback?

Pending home sales faltered a bit in September, like new home sales announced earlier this week, the decline ended a four-month winning streak. The National Association of Realtors® (NAR) said that its Pending Home Sales Index (PHSI) fell to 130.0, a 2.2 percent retreat from the August level.

A new Fintech startup with Zillow roots? You betcha! Ex-Zillow execs launch digital mortgage startup with $40M seed round. Called Tomo, backers include Trulia co-founder Pete Flint and Spencer Rascoff.

And is some fun but not news we have real life agents appraising famous haunted houses. Happy Halloween!

After declining by a record 9%, or 31.4% if annualized in 20Q2, 20Q3 GDP has come in at a simply stunning 7.4%, or 33.1% if annualized! At this point, the US economy is 3.5% smaller than it was on 12/31/19, and about 4% smaller than it was in mid-March before the onset of Covid-19. While 4% seems small, that was the magnitude of the decline during the 2008/2009 Great Recession!

In 12Q1, corporate profits surged and hit $1.88 trillion. Real corporate profits have never been higher since, despite recently lower tax rates. It’s because of the business cycle. Early in the cycle, when unemployment is high, wages stagnate and capital captures increases in worker productivity, boosting profits. As unemployment falls, wages rise, labor does better, but profits stagnate. This suggests profits should be good in 2021, wages, not so good.

Over long periods of time, I suspect income inequality will systematically worsen. When first entering the labor force, workers generally know little and get paid poorly. However, labor productivity of educated, skilled workers steadily rises due to technological improvements. Thus, all else equal, skilled workers should earn more than their predecessors in the same job. Moreover, with longer lifespans, high-income workers can earn higher incomes longer.

Good things come to those who Mastermind! Have you joined the Mortgage X Mastermind yet? I would like to invite you to join our community that is 100% focused on helping MODERN industry professionals crush it.

The Vieaux

Brian Vieaux - President of FinLocker

Happy Halloween from the FinLocker Team! The mortgage, as a product is just a commodity. Every lender has an “online” app, is available via the web 24/7 and from a pricing perspective is more or less “in the same range”. When selling a commodity, where price is table stakes, the differentiator for an originator is what they bring in value beyond the product.

Young first-time home buyers will continue to make up a significant % of the market. These are tech enabled young professionals who prefer and expect to “self-serve” as much as they can. They do and expect to be able to connect with a person when they need a specific question answered, or advice, etc. This is a segment where the local originator can win if they are bringing value beyond the mortgage product/process.

If you can engage with these consumers very early in their journey and become their trusted advisor your chances of earning their business will be greatly enhanced. There are several technology tools in the market competing with you for the attention of the consumer. Partner with technology vendors and solutions that will enable you to provide “early journey” tools that help with education, preparation, while keeping you connected at the same time. The local mortgage and real estate professional are still best positioned to win.

Enjoy the Halloween Weekend and don’t forget to reset your clocks….really? Who still has clocks?

Lending, Leadership and Life

Eddy Perez – President & CEO of EPM

Are you having a ham and cheese sandwich today?

The ham and cheese analogy is one of my favorite sayings.

As you’re looking at a problem ask yourself: are you keeping things simple or overcomplicating them?

Non-QM X: Highly Qualified Non-QM News

Tom Hutchens - EVP of Production at Angel Oak Mortgage Solutions

The refinancing boom has kept everyone in the mortgage business busy with short-term opportunities for business growth. But, what are you doing to get ready for 2021 and the upcoming purchase market? Get ready to focus on purchase products, like non-QM.

Become the expert in non-QM

If you are not known as the go-to non-QM expert in your region, someone else will be. Gain expertise in all aspects of the products. Understand how to sell it. Reach out to those who need it. Establish thought leadership pieces. Promote non-QM on social media. Create a non-QM resource page on your website.

Be a storyteller

Non-QM can sound complex to those who are unfamiliar. As a non-QM expert, you should not only understand how these products work, you should also understand why they exist. These purchase products are a vital part of the mortgage landscape. Differentiate your business by taking the time to explain the need in the market, how the overall economy is evolving, why that should continue and how you can get them involved.

Protect your referral network

You’ll need referral partners after the rush to refinance is over and becomes increasingly circumstantial. If you do not prioritize your existing relationships and help them, you’re essentially doing so at your own peril. Eventually, these individuals, or someone they know, will need to get a deal done. Don’t you want to be the non-QM originator who does it? If you don’t, a competitor will. Then you’ll not only lose the deal, but also the future business from them.

Now is a great time to prepare for the end of the refi boom. We’re here to help.

Mamapreneur: Real Talk with a Side of Mom Jeans

Jess Vogelpohl Southwest Coaching

🧨What are YOU willing to sacrifice in pursuit of your goals?

🏋🏼♀️ Lazy muscles for sore ones?

🍕Pizza for salad?

😬Fear of rejection for putting yourself out there?

🖥Netflix for prospecting?

⏰ Snooze button for an early wake-up?

We will always have to sacrifice something.

Are you willing to make that sacrifice for your goals?

❌ Yeah, pizza rocks, but in pursuit of weight loss, a healthy mindset and better habits - I can't go eat it non-stop.

❌ Yeah, it's scary to be rejected but if you are in sales and your commission depends on relationships - you have to put yourself out there.

✅ How badly do you want it? Enough to sacrifice what's comfortable?

Podcast of the Week!

Not Letting Fear Hold You Back from Success w/Skylar Welch

Podcasts of the REAL Disrupt Network

Virtual Coffee with Estie Briggs

Mortgage Interrupt

Mortgage Industry Professional of the Week

Cindy Ertman – Mortgage Master Pro

Make sure you tell Cindy you saw her in The Letter X!

The Edumarketer

Why Isn’t Everyone Producing Videos all the Time?

We know that right now, the reason no one is producing videos all the time is because everyone is slammed. But this is not going to last forever and creating videos and having a plan for creating videos is important for 2021. The real reason everyone is not producing video all the time is that they do not have a plan for creating videos. Many originators set out to add video to their marketing strategy without having a clear idea of how much it's going to cost them or a clear idea of the process.

The truth is that the most important part of the creating videos happens before you hit record.

Planning and figuring out what you are going to talk about is really where most of the magic happens. This is long before you hit the “record” button.

You can’t create knockout videos without first making a plan of what you are going to talk about. You can hire a professional video production team who comes in and shoots video and you can hire editors who will edit and produce your videos, but most video production staff do not have the industry expertise to help you create your content. Taking the time to plan your videos will not only save you time, but money, too.

Over the next several weeks, I am going to share with you my top tips to creating video content.

Let’s begin with tip number one:

Figure Out Your Audience

We offer a lot of different products in the mortgage industry and you cannot make a video about everything, so knowing who you are targeting as your audience to is critical. We have first-time homebuyers, investors, veterans and retirees. There are those who want to refinance a home and those who want to buy a home. You can create content for consumers or real estate agents. Don’t ever fall into the trap of assuming that all consumers want to see the same content. They don’t and they are looking for different information online. So, dialing into a specific audience for your video is important. You can make different videos that speak to different audiences.

After all, your audience is made up of more than just one customer with one interest. The group of people you’re targeting is likely to have overlapping interests that you can exploit when planning your video content.

If you are struggling in figuring out your audience for your video, answer these questions:

1. What are their challenges?

2. What are their fears?

3. What are their questions?

4. What are their goals?

Narrowing down your video to a specific audience, rather than a generic audience will help you create a much more targeted and effective video.

Too often, video campaigns are built to include everyone but result in interesting no one. Be sure to create your video message to your targeted audience. Find out what will interest them, answer their questions and position yourself as the expert.

In my next article, I will share how to make your message crystal clear.

ANDYGRAM – 75 Hard Thoughts

ANDY FRISELLA

Are You Living or Existing?

If you are not working to leave the world a better place…

If every person you talk to doesn’t feel like the interaction with you was the BEST interaction they had in their whole life…

If you are not DOMINATING each and every competition in your life…

If you are not pouring ALL your heart and soul into everything you do…

If you are not acting with your FULL INTENT in your daily tasks…

If you are not trying to be the BEST IN THE WORD at whatever it is that you do…

What are you even doing with your life?

Are you living your life to the fullest potential?

Or are you just existing?

Focus on helping 1 person.

If you make an impact on 1 person, they will tell their friends how you helped them…

Which gives you a chance to impact more people.

And over time…

You’ll be making an impact on thousands of lives … just like you set out to do.

Mortgage X Marketing Manifesto

Andrew Pawlak, CEO of Leadpops

The difference just 1% can make...

Let’s say your website gets 1K visitors per month.

Through basic conversion rate optimization, you can rather easily get a 1% lift in visitor-to-lead conversion rates.

That’s an extra 10 leads per month = 120 additional leads per year.

If you close just 5% of those, that’s 6 extra closed loans

If you average $3K in commission per deal, that’s $18K in 1 year for making some simple tweaks to marketing you're already doing.

The most simple CRO tactics you can test?

1. Review your call-to-action (CTA) buttons and make sure they STAND OUT. If they blend in, can't be found, or aren't compelling (AKA anything with "Apply"), take a look at a company like Veteran's United to see how they do it, and do something similar.

2. Link those CTA buttons to an easy-to-answer lead form that asks good questions in a way that doesn't scare people off (don't go for the jugular by starting out with "Name, Email, Phone Number" or "Create An Account")

3. Reward people with a thank you page that has a BombBomb video on it (or any other type of video), thanking them, explaining what your next steps are, and how you'll be following up. Include a link to your calendar and some great reviews on your TY pages as well.

4. FOLLOW UP FAST -- within 2 minutes at most -- with a TEXT MESSAGE. If you call and get their voicemail -- hang up (don't leave a message) and call right back. You're going to want to make anywhere from 5-10+ attempts over the next 30 days with calls, emails, and texts, so be sure to...

5. Connect your forms to an awesome CRM that will keep you in front of your prospects with personalized, relevant messaging for weeks, and months, and years to come.

Thanks for checking out this week's tips, and I'll catch you on next week's The Letter X!

Remember to share your personal referral link below for a chance to win a $50 Amazon Gift Card! I hope you enjoyed TLX #28! Have a great weekend.