💯 Two phrases that NEED to die - The Letter X

Dec 05, 2020 8:21 pm

THE LETTER X

ISSUE #33

To be honest there are more than two but these two, in my opinion, have been an excuse for those in mortgage to not do more, to not innovate, and let mediocrity reign supreme

Quick note before I get started. This will be a different type of TLX this week as we wind down 2020. Next week will be the last issue of 2020 as I will be spending the rest of the year driving and moving across the country to my new home in Atlanta.

As you know I try to keep things different so will be mixing it up this week and next. If this is your first time here, well...you are in for a treat. Now let’s get the first phrase that needs to die.

If it’s not broke, don’t fix it.

Trust me it’s broke. If your model or way of doing business isn’t broken, then disruption does not happen at the rate and pace that it has in our industry. I know from experience coming from a group of disruptors that changed the way we communicate and socialize online.

Too many years, the “experts” and “leaders” told us that consumers “wouldn’t do this” and they “wouldn’t be comfortable doing that..” and they were wrong. And some of them are still holding on to the way things used to be. Enough is enough.

This mentality has been the root cause for the weak tech we deal with in our industry. Yes there are some diamonds in the rough in Mortgage, but a majority is legacy tech that wouldn’t survive in any other consumer facing vertical.

It is the reason there has been lack of innovation and instead a focus on iteration. It is the reason we have easily allowed outsiders to come in and grab consumer attention to where the tradition model is an afterthought. Enough is enough.

Time to put that phrase out to pasture and time for all of us collectively to demand more of the industry and our service providers. Stop creating processes and software for mortgage using the same people who brought us the legacy crap to begin with.

Instead, start designing processes and software for the modern marketplace and more importantly, the modern consumer.

The next decade in our industry will be won by change creators, disruptors, and those who truly innovate. You can bet sure as shinola that I will be driving that every day at EPM until I die or they find someone better and I hope you all do the same at your respective companies.

Let’s win together!

As for phrase #2, I will get into that later in this issue.

That countdown continues!

As of today there are 26 days left in 2020! What are you going to do with them?

Let’s be honest, there is no logical or real difference between Dec 31 and Jan 1st, but where is the fun in that? We as humans love ends and beginnings. Nothing wrong with thinking about it in terms of reset.

For most of us, 2020 was “uber cray cray” in our industry and some of you are taking a nice well deserved break. For all of us, I implore you to take some of these last 26 days to do a business plan for 2021. The market will be different and will shift (it always does). So make sure you take some time, look at some of the forecasting, and plan accordingly.

This Week’s Mortgage X Tip!

Stop focusing on flyer creation as being a “value prop” either as a lender trying to recruit or a MLO trying to partner with agents. Talking about flyers as some sort of value proposition is like Hotels talking about having beds and bathrooms as a differentiator.

True value props or adds SHOULD be about growing business or achieving goals WHILE standing out in a noisy crowded commoditized market. Flyers ain’t doing that.

Told you this would be different! Now please enjoy this week’s edition of The Letter X!

Say Yes Every Day

Laura Brandao - President of AFR Wholesale

This week Say Yes to planning, we are in the final 4 weeks of 2020, it’s time to create our vision, develop our strategy and set forth our action plan for execution because we all have the ability to create our best year but it starts with planning and executing.

Event: Mortgage Bankers Association NJ

Mid-Atlantic Conference

Excited to be representing EPM and joining my good friend Laura Brandao, President of AFR Wholesale at the MBA NJ Mid-Atlantic Conference to talk about Originating in the Modern Era - aka #Originator2021

About the Session:

The mortgage industry can no longer drag its feet on becoming a Web 2.0 player. We have a tremendous opportunity to leverage and take advantage of the consumer's focus and need to conduct business online. This session will provide real world tactics of how to create an online marketing strategy that works in times of crisis as well as using today's tools to take the offline, online.

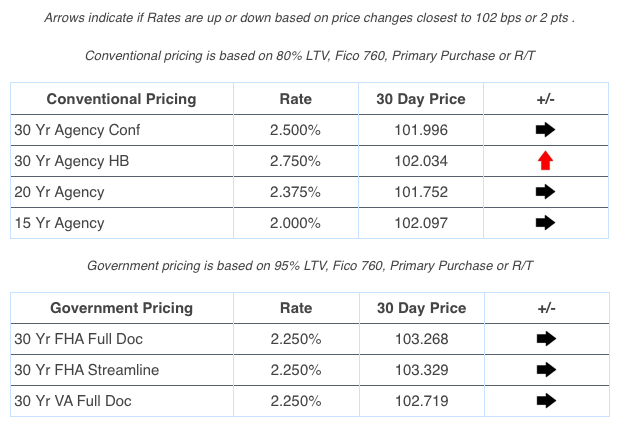

Mortgage Rate X

Lender Price Friday Rate Lookback

MBS X

Diana Bajramovic of MBS Highway

Pending Home Sales came in, measuring signed contracts on existing homes for the month of October. We expected to receive a good number, and it was strong year over year up 20%, but month over month it was expected to be up 2% but was down 1%. As you could imagine, this gave the media a lot of excitement to use it in a way to create panic, claiming that affordability is an issue. I know we’ve spoken about this recently a handful of times, but this is very important to understand to better help your customers.

Diana Olick reported pending home sales and said that realtors are claiming that affordability is becoming a problem because the median home price is up 15.5%. Let’s break the real story down. The level of inventory today is down about 20% since last year. Fewer homes are available on the market, meaning that the number of sales will be somewhat limited. It’s like if Apple releases a new iPhone, but they run out of inventory. People will be lining up at the doors to purchase it, but if there’s no inventory, they can’t meet the demand, lowering the number of sales.

Considering the situation we’re in, the recent Pending Home Sales number is quite strong. We know the housing market is vibrant and will continue to be, so don’t listen to the media and allow them to strike fear in your clients and referral partners.

Appreciation according to Case Shiller is at 7%. Incomes are increasing by about 5.5% per year, keeping close pace with affordability, but remember that you don’t use all your income to make your mortgage payment. We could see 15-20% appreciation, and homes could be even more affordable as long as interest rates remain stable.

We continue to track this information daily in our Morning Update.

The Vieaux

Brian Vieaux - President of FinLocker

We have reached the final lap of 2020. Last week I shared how thankful I am for having gone through this unprecedented time. While inconvenient it has provided opportunities for me and FinLocker. This week during my calls/meetings a common theme emerged. Fatigue!!!

For obvious reasons people have not been able to unplug and get away to recharge during the pandemic. Many of us are literally spending 24/7 inside our homes. This has resulted in a lot of people on the brink of burnout. You need to take care of yourself and find time and ways to recover and recharge for what will be another very strong origination year in 2021.

The pandemic has changed our lives beyond work. It is more challenging to workout at a gym, eat out and even shop. While we are working from home, helping our kids with remote learning, we have had to also find new ways to burn off steam. I have discovered Peleton and find myself looking forward to the 60 minutes away from my email, texts, etc. While the workout is grueling, I am forced to put 100% focus on the bike. Find something that will allow you to disconnect and recharge every day. Your physical and mental health will thank you!

By the way if you are on Peleton following me @ BVSpinLocker.

The Launch of Originator 20201

I am sure that screenshot looks familiar :-). This past week I had the pleasure of being a speaker at Christine Beckwith’s “What’s The Big Deal?” Business Planning Super Event!

I joined some amazing speakers like Christine, Laura Brandao, Barry Habib, and Mike Kortas to talk to hundreds of originators across the country. In my session I launched Originator 2021. Let me know if this sounds familiar to you.

It's no big deal, they only have 3% of marketshare

It's no big deal, they only have 6% of marketshare

It's no big deal, they only have 11% of marketshare

Guess what? When a new business model is trending upwards, it means the "traditional" model is trending downwards.

We have seen it in Travel, Taxis, and Music, just to name some of the bigs. I talked about this during my session. The mortgage industry, for the last decade, has been ok with "perfect competition" and for settling for the leftovers.

It is time for that to end. For the status quo mentality to die.

That is what #Originator2021 will be about. It isn't a coaching program, or a course, or sales mastery, but instead a way of doing business. A new mentality or movement if you will.

In my opinion, a mindset/mentality check is what has been missing. Based on the feedback from my presentation, I am not alone.

This is just the beginning and I look forward to helping and working with modern MLOs that feel the same.

To be a part of the Originator 2021 Movement, make sure to join the Mortgage X Mastermind.

Lending, Leadership and Life

Eddy Perez – President & CEO of EPM

In this week's episode of Lending, Leadership and Life Eddy is talking about getting into the suck. What do we mean by that? Check it out.

Non-QM X: Highly Qualified Non-QM News

Tom Hutchens - EVP of Production at Angel Oak Mortgage Solutions

If you’ve been following my weekly columns, you understand the need and practical use of non-QM to prepare your business for the upcoming purchase market rebound. The MBA predicts purchase originations, including non-QM, will increase to a record of $1.54 trillion in 2021. That’s a projected 8.5% bump in growth.

Is your business ready to tap into that? Advancements in non-QM lending have made adding these purchase products easier than ever.

Simple to do

New technology, streamlined processes, online pricing and qualification have made non-QM loans just as easy as agency ones. Brokers can expect quick turn times when working with the right non-QM partner and expand their purchase product business as a result.

And just because it's fast and streamlined doesn’t mean these loans are poorly underwritten. They are still high quality loans that have proven to perform.

Partner with an expert

Attentive non-QM experts are a call away. For those who are hesitant to get involved, they can lean on AEs throughout the loan process. Non-QM loans may seem complex, but AEs can help brokers understand the products, the borrowers they serve, how to structure a loan and any other questions you might have. Have an interesting borrower with a story? Tell your account executive – that’s why they are there.

You don’t need to be the expert when they can partner with an AE who is. It can save time and help you grow your business. They can also help you present to Realtors. Just ask!

Looking to learn more about non-QM and how it can help prepare your business for the future? Feel free to reach out!

Now for the SECOND phrase that needs to go the way of the dodo.

“Work smarter, not harder.”

Don't get me wrong. You should of course endeavor to work smart and not overthink challenges making the solutions harder than they need to be.

BUT...

What has happened is that people have used that as an excuse to not work hard in general and look for the easy way out. I see this in posts and ads all the time in our industry, where it isn’t about winning, success and results, it is about easy, cheap, and fast.

This is the “set it and forget it” mentality that has done NOTHING to drive our industry forward for the better. My friends, success IS hard and good things take time.

I know people tend to dislike the “work hard” or “hustle culture” that has come up, but guess what? Some of us are built this way and believe it or not you can find a balance to be happy.

So I submit that we embrace the spirit of both by saying "Work smarter AND work harder!"

Because if you do that, I can guarantee you that you will fare better than those looking for the shortcuts and reasons to NOT put in the work.

Beyond The Numbers

Fobby Naghmi, EVP, National Sales Mgr. of First Option Mortgage

“God, grant me the serenity to accept the things I cannot change, the courage to change the things I can and the wisdom to know the difference” Writing these words makes we wonder if the Spanish Flu of 1918 motivated theologian Reinhold Niebuhr to write this little prayer a some years later. It definitely could have been written in 2020!

Commonly known as the Serenity Prayer, it’s made its way into most of our lives in some manner. Too often for me the focus of this prayer has been on the acceptance of people, places, or things around us that we can’t control. We are told if we can practice acceptance, then we will know serenity. I agree with that 100%.

But why does courage get overlooked? It’s said that Niebuhr had originally placed courage first when he wrote this in 1932. If you really take a close look, it’s courage that allows us to change who we are; to acknowledge our flaws; to become aware of thoughts that no longer serve us; and then to become willing to let them go.

Being courageous is no easy task, especially when we can’t control the people places and things around us.

The Edumarketer

Ginger Bell, Speaker, Author, Learning Expert @ Edumarketing

Make Your Message Crystal Clear

In a previous article I talked about the three E’s of content marketing. Creating great content that aligns with the three E’s begins by knowing your audience. Although the importance of knowing your audience and narrowing down a target market is critical, clearly defining your message is just as important. In other words, don’t try to cram everything into a single animated explainer video.

Create Tailored Videos

We offer a ton of programs in the mortgage industry. It’s not just one widget. So, you’ll need different videos for each of these. For example, you might need:

· An explainer video to give basic consumer application process

· A more complex video overview of VA Home Loan Benefit qualifications

· A powerful TED Talk-type of message from your CEO

Don’t try to explain what your company does, what programs you offer and the great service you provide all in the same video.

Take the time to create a tailored video with a specific message and a specific goal. When you do this it will be much more effective.

The best way to do this is to write down your audience. For example, you have people who want to buy a home and people who want to refinance a home. In the people who want to buy a home segment, you have people who have never bought a home, want to buy a second home, want to buy an investment property, want to buy a condo, want to buy using their VA entitlement. You get the picture. Always get crystal clear on your audience. This doesn’t mean you have to specialize in just one area, this means, you just need to have a clear message in that one video or article.

Think about what questions this type of person may have. If you don’t know, you can search online to see what types of questions are being asked. The website, Answer the Public allows you to type in a word or question and it will deliver to you exactly what phrases or keywords that are being searched. You can use those queries to create content answering those questions.

Write First – Shoot Second

You wouldn’t go on vacation without knowing where you are going, making plans, visiting the place online and maybe even creating an entire itinerary. Same holds true for shooting video. Have a plan! This means that you should write out your content before you shoot your video. Even if it is just an outline. This will help you stay on topic. I like using the top three things you should know about…. This way you stay focused and only answer those three things. Shorter content delivered over time is much more effective than a long article. People’s attention spans are short, so stay tight on your message and get crystal clear for your audience.

In my next article, I will share how to set a realistic budget for video production.

Need help honing your message?

Reach out to me today! My team and I can help with any aspect of your video production from creating an outline to having a producer edit and produce your videos. But if you never start creating videos, none of this will help you. So, get out there and start recording, and let me know how it goes!

I hope you enjoyed TLX #33! Have a great weekend.