HSAPAY's week 12 of 30 funding for Baby Plan

Mar 27, 2023 7:37 pm

Welcome back ,

Here's HSAPAY's weekly update for March 27th, 2023 that'll help you and your growing family navigate the complexities of utilizing and investing in your HSA.

HSA Weekly Roundup

- Congested Baby == Unhappy family!!!

- Healthcare debt is rapidly on the rise

- 💕💓Hearts are melting for baby Heartbeats! 💗💕

- Caregivers Face Financial and Mental Burdens, New Survey Shows

- How CMS, CVS Health Are Tackling Maternal Health Disparities

Macro Minute & Precious Metals

- Late Fed Hike Comments

- S&P 500 has been falling, but for Euro and GBP investors, it hasn’t been quite so bad

- Why did a regional US bank failure lead to financial market turmoil?

- Lithium price is diving as EV metals battle a double whammy

- Wheat price forecast: Favourable supply, demand dynamics

3-6 Month HSA Investment Return Entries

- Buy this risky cruise stock Carnival (CCL) before earnings next week, Stifel says

- BofA's Hartnett sees commercial real estate as the 'next shoe to drop'

6-9 Month HSA ETF Investment Entries

- Industry Growth Could Propel This Leveraged Semiconductor ETF

- QQQ Quality Purview Right for the Times

Congested Baby == Unhappy family!!!

| ||

| ||

Baby having trouble with congestion and sleepless nights. Help soothe your baby's congestion with FridaBaby vapor wipes that don't leave your little one greasy all over and finally get the rest you deserve. Don't forget to save when you shop with your HSA!! #hsapay | ||

1:03 AM · Mar 25, 2023 | ||

HSA's are there for whenever you need them, and so is #hsapay.

Healthcare debt is rapidly on the rise

| ||

| ||

Of people with medical debt, 61% owe more than $1,000 and 21% owe $5,000 or more, according to new research from the Urban Institute.

| ||

8:03 PM · Mar 24, 2023 | ||

💕💓Hearts are melting for baby Heartbeats! 💗💕

| ||

| ||

There's nothing more captivating than seeing & hearing your baby's heartbeat for the first time. For many soon-to-be parents, this moment can bring endless hope when there is uncertainty. #hsapay | ||

2:41 AM · Mar 19, 2023 | ||

Find out how you saving with your HSA can make these experience even more wonderful. #hsapay

Caregivers Face Financial and Mental Burdens, New Survey Shows

About 28% of Americans consider themselves to be caregivers, and 22% are unpaid, according to a new survey from CVS Health and Harris Poll.

These caregivers are facing financial and mental health struggles: 47% said that being a caregiver is a financial burden and 49% said their mental health suffers from being a caregiver.

How CMS, CVS Health Are Tackling Maternal Health Disparities

Studies have demonstrated significant racial disparities in maternal health within the United States. According to the Kaiser Family Foundation, Black and American Indian and Alaska Native women experience pregnancy-related mortality rates that are two to three times higher than those of White women. Unfortunately, access to maternal healthcare has become increasingly challenging following the Dobbs v. Jackson decision, which overturned abortion access via Roe v. Wade.

At the CMS Innovation Center, the primary focus is on promoting states to expand Medicaid postpartum coverage, as stated by Dr. Dora Hughes, the center's chief medical officer. Via a state plan amendment, the American Rescue Plan Act of 2021 enables states to extend Medicaid postpartum coverage to 12 months. Currently, 29 states (including Washington

“Many of these moms are lost to care after the actual delivery of the baby.”

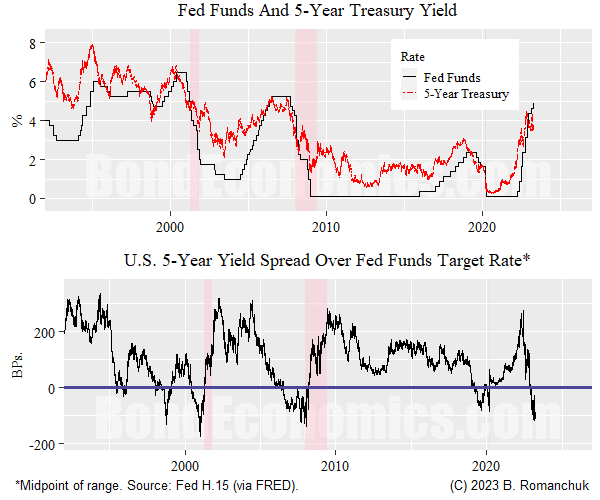

Late Fed Hike Comments

The Federal Reserve increased the policy rate by 25 basis points this week, with differing opinions among forecasters. This hike may be considered 'dovish', although the Fed aims to take a temporary pause to evaluate the impact of their recent hiking campaign. However, there is concern that pausing may be interpreted as a sign of panic among the financial community, particularly if inflation remains high.

The Fed's previous inflation forecast misses have made it difficult to justify a pause based on activity data. The challenge for bond bulls is that bond yields are currently low relative to Fed Funds, without a clear recession signal. Although there are some fluctuations in the real economy, it does not appear to be experiencing significant issues at this time.

S&P 500 has been falling, but for Euro and GBP investors, it hasn’t been quite so bad

As we move towards the end of Q1 of 2023, let us take a pause and look at how the stock market has performed thus far this year.

Obviously, 2022 was a year from hell for investors, as prices fell more than any year since the infamous 2008.We saw the most rapid pace of […]

The post S&P 500 has been falling, but for Euro and GBP investors, it hasn’t been quite so bad appeared first on Invezz.

Ford CFO is optimistic on EV business despite its big loss in 2022

Shares of Ford Motor Co (NYSE: F) ended slightly in the red today after the legacy automaker said its electric vehicles business lost $2.1 billion in 2022. Ford’s EV unit to remain in loss this year On Thursday, the car company also guided for another $3.0 billion of adjusted operating loss for that segment […]

The post Ford CFO is optimistic on EV business despite its big loss in 2022 appeared first on Invezz.

Why did a regional US bank failure lead to financial market turmoil?

In recent years, the global economy experienced a prolonged period of low inflation and even negative inflation in some countries, which economists consider detrimental to stable economic growth. Central banks responded by lowering interest rates to their lowest point and some even introduced negative interest rates, which they maintained for several years.

Commercial banks responded by investing in bonds, as bond prices increased as yields decreased. The COVID-19 pandemic further exacerbated this trend, resulting in increased monetary and fiscal policies by governments and central banks globally. However, this approach has recently resulted in negative consequences.

Lithium price is diving as EV metals battle a double whammy

Oh no! 😢 The price of lithium has taken a big hit lately, dropping by more than 50% in just three months! 😱 It's now at its lowest point since January 2022. According to TradingEconomics, the price of lithium carbonate is now only 284,5000 CNY per ton, down from last year's high of 590,608 CNY.

😔 This is a real concern for the supply and demand of lithium and nickel, which should be thriving as the world moves towards electric vehicles. But unfortunately, things aren't looking great right now. 😕

Wheat price forecast: Favourable supply, demand dynamics

🌾 The wheat price has been on a 📉 downward trend in the past few months, even as the Russia and Ukraine war rages on. Currently trading at $689, which is about 50% below the highest point in 2022.

🌎 Despite demand continuing to outstrip supply, wheat price has been one of the worst-performing soft commodities in the market. This decline has intensified after Russia and Ukraine agreed to continue wheat shipments from Ukraine.

✅ However, there are reasons to believe that wheat prices will rebound and remain at an elevated level. First, demand remains robust around the world. The 🌍 population is still growing, standing at over 8 billion people, up from 7 billion a few

Worthington stock is up 20% on Thursday: explained here

🎉 Exciting news! Worthington just declared a quarterly dividend of 31 cents per share, causing its stock to rise. 💰 For Q3, the company reported an adjusted per-share earnings of $1.04, beating expectations of 73 cents per share, and brought in $1.1 billion in revenue.

📈 CEO B. Andrew Rose expressed optimism for the future, saying that their key markets will remain healthy. 😊 Worthington's stock is up 35% since the start of 2023, and Wall Street rates it as a "hold". 🔍 Notably, the company's Steel Processing revenue declined by 28% YoY to $757 million due to lower prices. 💰

Buy this risky cruise stock Carnival (CCL) before earnings next week, Stifel says

Stifel is betting this cruise operator's stock will get a lift when it reports earnings next week.

If you are risk adverse adding Carnival to your HSA portfolio would be highly ill-advised. #HSAPAY

BofA's Hartnett sees commercial real estate as the 'next shoe to drop'

"Commercial real estate [is] widely seen as next shoe to drop as lending standards for CRE loans to tighten further," Bank of America's Michael Hartnett said.

What's not helping is the fact that occupancy rates in offices across the country are still far from their pre-pandemic levels. According to Hartnett, office occupancy rates are still less than 50% as work-from-home trends persists.

The weakness in commercial real estate is evidenced in current market prices for stocks and debt tied to the sector.

Industry Growth Could Propel This Leveraged Semiconductor ETF

🌟 The semiconductor sector is back on track and could be headed for long-term success! Last year, it struggled alongside the tech industry, but this year things are looking up with a 20% increase in the S&P Semiconductors Select Industry Index. 💪 Despite concerns about inflation, the global trend towards relying on computers is driving growth. The U.S. government is also supporting the industry by focusing on domestic chip manufacturing. 🇺🇸 However, one challenge remains: finding the right talent to drive further progress. 🤔

🚀Micron plans to spend $100 billion to build a semiconductor-manufacturing campus in the area, starting construction in 2024 and beginning production in the second half of the decade.🏭

QQQ Quality Purview Right for the Times

The Invesco QQQ Trust (QQQ) and the Invesco NASDAQ 100 ETF (QQQM) are prime examples of mega-cap growth exchange traded funds, but another factor — that being quality — could give investors good reason to examine these ETFs.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Share the gift of the best & only HSA newsletter with friends, family, and colleagues. https://sendfox.com/hsagrow

Enjoy,

frank