HSAPAY's week 26 of 40 Baby Fund Plan

Jul 05, 2023 1:30 am

Welcome back and Happy 4th,

Here's HSAPAY's weekly update for July 7th, 2023 that'll help you and your growing family navigate the complexities of utilizing and investing in your HSA.

HSA Weekly Roundup

- Xray's are covered by your HSA

- Say AHHHHH to an HSA!

- HSA's give you so much more!

- Medicare will allow pharmaceutical companies to publicly discuss drug price negotiations

Macro Minute & Precious Metals

- Inflation blame game: UK economic woes set government and central bank on a collision course

- Key Fed inflation measure shows prices rose just 0.3% in May

- Vol is High by the Fourth of July

3-6 Month HSA Investment Return Entries

- Nike posts first earnings miss in three years as lower margins hit sports apparel giant

- Yahoo CEO says the company plans a return to the public markets

- ‘We’ve never seen this before’: Millionaires are doing something unusual to preserve their wealth — and you can do the same

- Dow Jones Newswires: German retail sales seen falling more than expected in 2023 as inflation bites

Xray's are covered by your HSA

| ||

Say goodbye to that frustration with our portable HSA! With our plan, you can take your HSA with you wherever you go, giving you peace of mind and flexibility. Invest in your health and your future with our portable HSA. Click the link to learn more and sign up today | ||

6:39 PM · July 3, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

Say AHHHHH to an HSA!

| ||

Did you know that your HSA can cover all your dental expenses, including preventive, restorative, and orthodontic treatments? A healthy smile is priceless, but taking care of it doesn't have to break the bank. Don't let dental expenses hold you back from a brighter smile. #HSAPAY | ||

5:22 PM · July 2, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

HSA's give you so much more!

| ||

Attention all budget-savvy individuals! Are you tired of choosing between the benefits of an HSA and a regular FSA? We have the solution! Our revolutionary limited-purpose FSA allows you to have the best of both worlds. Say goodbye to the hassle of choosing and hello to... | ||

6:22 AM · June 29, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

Medicare will allow pharmaceutical companies to publicly discuss drug price negotiations

Hey guys! Big news in the pharmaceutical world! 🎉 Medicare just dropped a major confidentiality requirement that banned drug companies from discussing drug prices that are set to start this fall. 😱 In simpler terms, Medicare is now allowing companies to publicly disclose information regarding ongoing negotiations if they so choose. 💁♀️ This is a big win for drugmakers who had previously sued the federal government, arguing that the previous requirements violated their First Amendment rights. 🤑 In the past, Medicare had forbidden companies from publicly disclosing any information about the lower price initially offered by the government for drugs targeted under the program, as well as the government’s reasons for selecting that price point. 😤 They also prohibited companies from disclosing any verbal conversations during the negotiation period. 🤫 Additionally, Medicare required companies to destroy any information within 30 days if the drug is no longer selected for negotiations.

Inflation blame game: UK economic woes set government and central bank on a collision course

At the time, inflation was high but most economists thought it would decrease naturally. The government made a pledge that seemed easy to achieve. 🙅♀️ But in May, inflation didn't go down and even got worse. Wage growth increased and the job market was hot, but the economy didn't grow and debt went up. 💔 It's been a tough time for the U.K. 🇬🇧 with sickness hurting the workforce and inflation causing problems. But let's stay positive and hope for better days ahead! 🌞

Key Fed inflation measure shows prices rose just 0.3% in May

💰 The personal consumption expenditures price index (aka the Fed's fave), excluding food and energy, went up 0.3% for the month. Core PCE inflation increased 4.6% on the year, but the headline number only went up 3.8% 🤔. Spending only rose 0.1% for the month (not great 👎), while personal income accelerated 0.4% (yay 💸). Including food and energy, inflation only went up 0.1% on the month and 3.8% on the year (not too shabby.

Vol is High by the Fourth of July

🌽🌾 Summertime brings a gentle breeze that makes the cornstalks sway, and the smell of corn-fed dogs grilling is in the air. Agriculture is at the forefront of our minds, especially for American farmers. The weather, planting, harvest, and stocks all impact field crops throughout the summer, which makes it the most unpredictable season for U.S. corn. 😬

In 2023, things got even crazier as drought in the corn belt and geopolitical instability caused Corn volatility to soar to historic levels.

😱 Corn has a seasonal pattern, with demand and supply changing over the course of the year. Farmers plant corn in the spring and harvest it in the fall, but the timing depends on the year's conditions. 🌱🍂

Nike posts first earnings miss in three years as lower margins hit sports apparel giant

👟 Nike's Q4 revenue smashed Wall Street's expectations, but unfortunately, their profits didn't quite meet the mark. Their profit margins decreased by 1.4% during the quarter. As a result, their shares dropped by over 2% in premarket trading 😔. However, the company's sales increased to $12.83 billion, up 5% from the previous year 🙌, and they beat revenue estimates for the seventh consecutive quarter. Despite falling short on earnings, Nike still had a strong quarter overall 💪.

Yahoo CEO says the company plans a return to the public markets

🌟 Yahoo, a pioneer of the Internet boom, is back and better than ever! CEO Jim Lanzone shared in an interview with the Financial Times 💬 that the company is "very profitable" and ready to make a comeback with an initial public offering. Yahoo was a big player in the dot-com boom of the 1990s, and its ticker symbol "YHOO" became well-known. Recently, Apollo Funds bought Yahoo from Verizon Communications Inc. Earlier this year, Yahoo announced that it would be laying off over 20% of its workforce, but don't worry, it's only in areas where the company isn't making a profit. 🙏 Yahoo competes with big names like Alphabet Inc. (parent company of Google) 🤖 and Meta Platforms Inc. (parent company of Facebook), but it's ready to take on the challenge and make a splash in the market once again. Yahoo is definitely one to watch! 👀

‘We’ve never seen this before’: Millionaires are doing something unusual to preserve their wealth — and you can do the same

🤑 Is it time for a millionaire money makeover!? This year has been a real struggle for investors 💸, especially for those with a lot of cha-ching 💰. The uncertainty of the economy and the constant talk of recession has led high-net-worth individuals (HNWIs) to change their investment habits 📈. Instead of investing in stocks, they're keeping their money in cash and cash equivalents 💵 at the highest rate in over a decade.

Over the past 12-18 months, the Federal Reserve has increased interest rates 📈 at the fastest pace in history. This is a big change from the previous 30 years, where interest rates were on a long decline from 15% in 1981 to under 1% in 2021 📉. According to Paul Karger, co-founder and managing partner of TwinFocus, a wealth advisory firm, this increase in rates created an opportunity for savers to earn a yield on their investments.

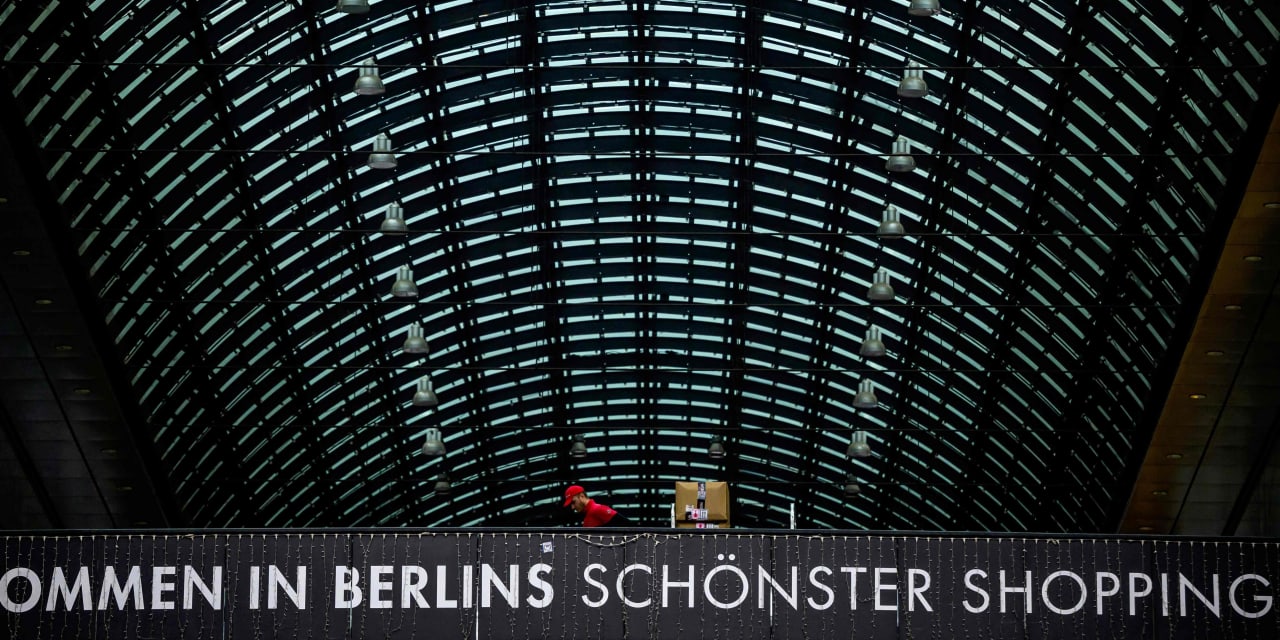

Dow Jones Newswires: German retail sales seen falling more than expected in 2023 as inflation bites

Oh no! The German retail federation HDE predicts that retail sales will fall even more than previously thought in 2023 😔 The high inflation is expected to squeeze consumer spending and retail sales are now expected to fall by 4% in real terms 😱. This year is unfortunately going to be the worst in many years 😢. But HDE President Alexander von Preen is optimistic that things will brighten up in the second half of 2023 and become more stable in the future.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Share the gift of the best & only HSA newsletter with friends, family, and colleagues. https://sendfox.com/hsagrow

Enjoy,

frank