HSAPAY's week 25 of 40 Baby Prep Plan

Jun 26, 2023 7:53 pm

Welcome back ,

Here's HSAPAY's weekly update for June 25th, 2023 that'll help you and your growing family navigate the complexities of utilizing and investing in your HSA.

HSA Weekly Roundup

- HSA's are shockingly powerful!

- Expanding dental coverage to your HSA is easy

- Survey: 58% Of Americans Had at Least 1 Issue With Health Coverage In the Last Year

Macro Minute & Precious Metals

- Are You Leaving Income Opportunities on the Table?

- Treasury Yields Snapshot: June 16, 2023

- Crude Prices Extend Gains as Active U.S. Oil Rigs Fall

3-6 Month HSA Investment Return Entries

- Nvidia is the top AI pick and the stock could jump 15%

- Nucor Anticipates Earnings Surge from Steel Mills Segment

HSA's are shockingly powerful!

| ||

Did you know that if you have coverage under SCHIP, you may not be able to contribute to an HSA? Don't let this hold you back from securing your family's financial future. Speak to a financial advisor today about your options and take control of your healthcare.... | ||

10:40 AM · June 20, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

Expanding dental coverage to your HSA is easy!

| ||

Did you know that you can use your HSA funds to cover your dental expenses? That's right - whether you're in need of a routine cleaning, a filling, or even orthodontic treatment, your HSA has got you covered! 💪 Investing in your oral health is one of the most important... | ||

10:25 PM · June 21, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

Survey: 58% Of Americans Had at Least 1 Issue With Health Coverage In the Last Year

🆘OMG! According to a recent survey by KFF, over half (58%) of insured Americans have faced at least ONE issue with their health insurance in the past year 😩. This includes denied claims, provider network problems, and issues with prior authorization. The survey was conducted online and via phone, and included responses from adults with different types of insurance. Those in "fair" or "poor" health were more likely to have problems with their insurance . In fact, two-thirds (67%) of those in fair or poor health had issues compared to 56% of those in good health. Additionally, three in four insured adults who received mental health services in the last year, as well as those with more than 10 provider visits 😷, had problems with their insurance.

Are You Leaving Income Opportunities on the Table?

When asked about portfolio allocation for options strategies, half of advisors said they had none 😬 Additionally, half of respondents reported never using options for tax-efficient income Troy Cates, co-founder of NEOS, thinks education is the biggest obstacle to advisor investment in options. Advisors often ask about the types of options used and how to extract a tax-efficient income from option portfolios. With market volatility and risk, advisors and investors have been heavy on cash and alternatives. Now, options can help bring back those market allocations 💰

Treasury Yields Snapshot: June 16, 2023

Hey there! Want to know the latest on the 10-2 spread? So, usually it goes negative before a recession and then gets better. The time it takes for a recession to hit can vary a lot - from 16 to 62 weeks after the negative spread. Fun fact: in 1998 there was a little scare when the spread went negative briefly! For the 2009 recession, the spread went negative a few times before things got really bad 😟. But wait, there's more! If we start counting from the first negative spread date, it usually takes about 37 weeks (9 months) until a recession hits. If we wait until the spread goes positive again before a recession, it's usually around 17 weeks (4.25 months) - and sometimes just 14 weeks (3.5 months)! 😲

Crude Prices Extend Gains as Active U.S. Oil Rigs Fall

💰Friday was a good day for the oil industry! July WTI crude oil (CLN23) closed up +1.16 (+1.64%), while July RBOB gasoline (RBN23) closed up +3.88 (+1.47%). Both crude and gasoline prices were on the rise all day, with crude hitting a 1-week high and gasoline reaching a 2-week high. This was due in part to hopes that China will boost their stimulus measures to increase economic growth and energy demand. 🤑 Additionally, the weekly report from Baker Hughes showed that active U.S. oil rigs fell to a 13-1/2 month low, which further pushed up crude prices. On the consumer side, the University of Michigan's U.S. June consumer sentiment index rose +4.7 to a 4-month high of 63.9, exceeding expectations

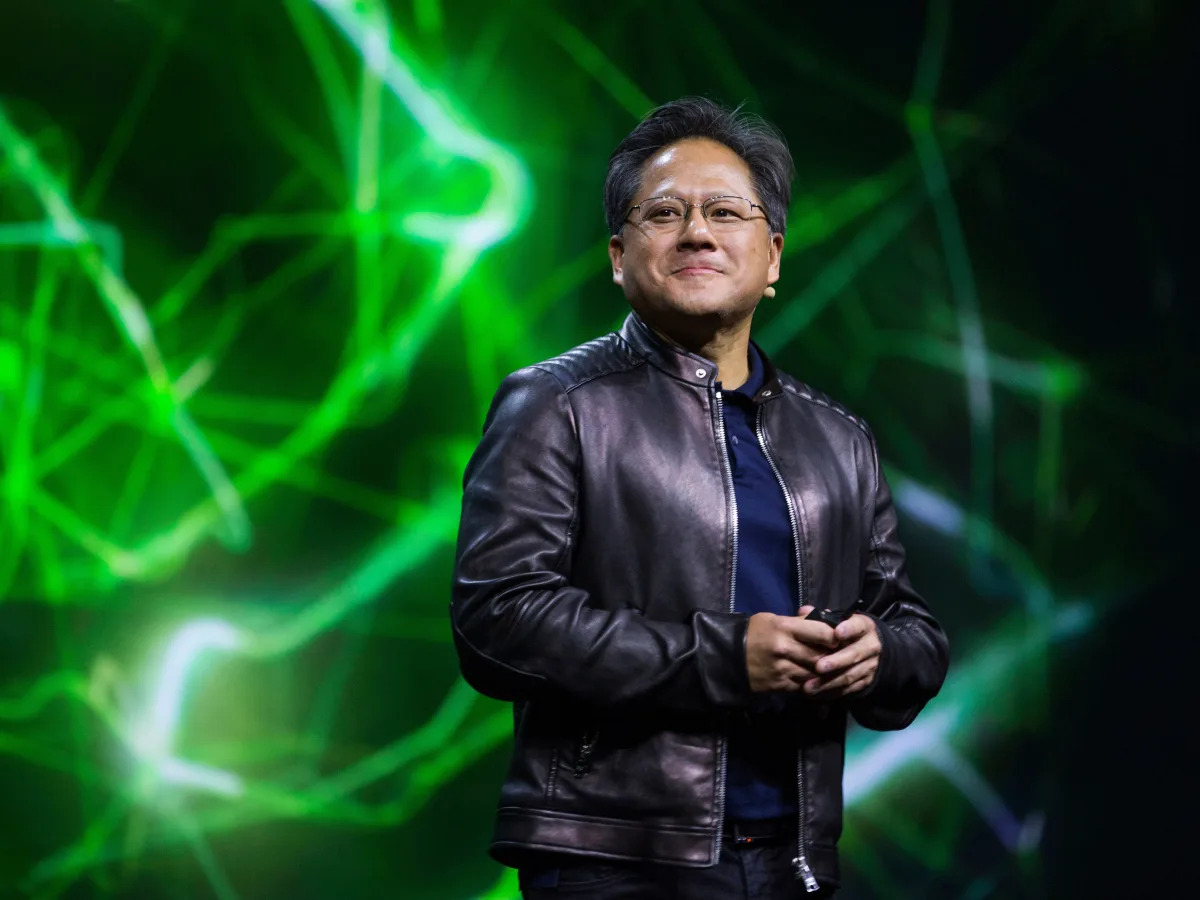

Nvidia is the top AI pick and the stock could jump 15%

🚀 Morgan Stanley just raised its price target on Nvidia to $500 and called it their "top pick." Analysts are saying that demand has been heating up since the chip maker's amazing earnings report last month. 😎 Nvidia is even getting orders from customers who weren't considered big buyers before! Morgan Stanley thinks there's still more room for the stock to climb, even though it's already up 200% this year. They predict 15% upside from current levels. 🙌🏽 Nvidia is now the new "top pick" for Morgan Stanley, taking the title from rival chip stock AMD. Analysts are confident that Nvidia will be the only company to beat estimates and keep on winning. 🏆

Nucor Anticipates Earnings Surge from Steel Mills Segment

💰 Big news from Nucor Corporation! They're predicting major earnings in Q2 of 2023, with a range of $5.45 to $5.55 per diluted share. That's an improvement from last quarter's $4.45 per diluted share. 🔥 Steel mills are expected to do particularly well, thanks to higher margins at the sheet mills. Meanwhile, the steel products segment is likely to remain steady. And good news for raw materials, too: the DRI facilities are showing improved profitability. Plus, Nucor has been buying back shares like crazy, with 3.1 million shares repurchased at $147.03 per share. So far this year, they've given back over $1.13 billion to their stockholders! 💸💸

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Share the gift of the best & only HSA newsletter with friends, family, and colleagues. https://sendfox.com/hsagrow

Enjoy,

frank