HSAPAY's week 2 of 30 HSA funding for baby prep plan

Jan 18, 2023 10:52 pm

Hi there,

Here's HSAPAY's Countdown for Baby weekly update for January 15th, 2023...

HSAPAY Weekly News provides the only curated content for healthcare planning and investment management for 32 Million HSA account holders. If you are excited to see how we can empower your HSA, climb on board.

The power of the HSA to drive down healthcare costs while providing retirement security for many is one of the most underrated tools for millions of Americans.

| ||

| ||

More than 1 in 5 Americans are covered by an HSA yet the average HSA account has less than $1200. With max contributions for 2023 up to $3850 for single and $7850 for families, there is a vast opportunity for employers to create more ways for employees to save! #hsapay #hsa | ||

Over the Counter (OTC) prenatal vitamins have offered expecting moms over multiple generations peace of mind and the necessary minerals to protect their babies throughout the duration of their pregnancies.

| ||

| ||

The path to an enjoyable and health pregnancy comes from lots of preparation and products. As the due date for delivery grows closer taking of yourself now is an essential part of daily planning. #hsapay #hsa | ||

🗒️ Dr. B Adds New Treatments to Platform, Expands Beyond Covid-19

Dr.

B began as a virtual service providing access to Covid-19 vaccines and later Covid-19 treatments.

It has now expanded to treatments for dermatology, sexual health, reproductive health and primary care.

The S&P might not be the great leading indicator that we have always been told, however a 3.4% return sure does out perform the best HSA savings accounts by nearly a 7x margin.

🗒️ Equal Weight RSP Leads S&P 500 in First Weeks of 2023

After outperforming in 2022, equal weight is off to a strong start this year.

The Invesco S&P 500 Equal Weight ETF (RSP) handily outperformed the S&P 500 last year, with that momentum continuing into the first weeks of 2023.RSP has climbed 4.9% year to date as of January 11, while the S&P 500 has increased 3.4% [...]

The post Equal Weight RSP Leads S&P 500 in First Weeks of 2023 appeared first on ETF Trends.

Adding Municipal bonds to your HSA can provide you with a great security blanket as key inflation indicators rise.

🗒️ Tap Into Municipal Bonds With VTEB and VTES (When You Can)

While inflation appears to be slowing, it’s still well above the level that the Federal Reserve would like it to be.

So, it’s likely that the U.S.central bank will continue to raise interest rates, which some believe will tip the U.S.economy into a recession.

For investors in higher tax brackets concerned about recession [...]

The post Tap Into Municipal Bonds With VTEB and VTES (When You Can) appeared first on ETF Trends.

With the stock market experiencing severe losses throughout 2022, what alternatives can HSA holders use to sure up their balances for 2023?

🗒️ Structure Matters: Losses of $18 Trillion in Stocks Favor Alternatives

As investors, we are trained to measure historic price as the mark on successful decision making.

No matter how you cut it, the loss of $18 trillion in global stock markets, as stated in a recent Fortune- Bloomberg article written by Jan-Patrick Barnert, is staggering and has left most investors “wondering about 2023”; especially growth investors.

This [...]

The post Structure Matters: Losses of $18 Trillion in Stocks Favor Alternatives appeared first on ETF Trends.

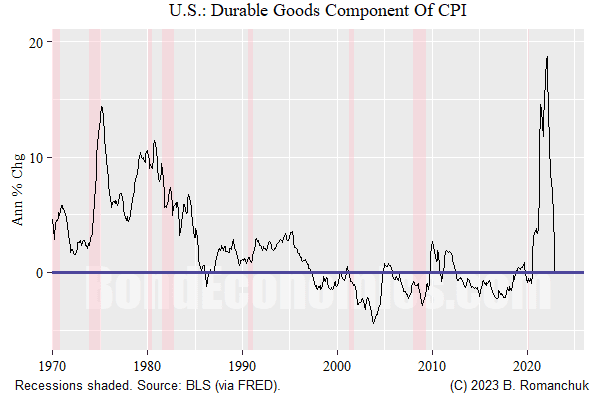

CPI conditions have shown a pull back YoY for December for the second consecutive month which implies the FED has proven to be effective in slowing down inflation. For bonds this could be a positive indicator within the next 2-3 Months.

The latest CPI report for the United States suggests that the inflation spike after 2020 was transitory in the rather weak sense that I understood the term “transitory.

” I am curling in a bonspiel over the next few days, so I do have a long time to spend on this article, so I just want to outline my thinking on the topic of “transitory.

”The figure above shows the annual inflation rate of the durable goods component of the CPI in the United States.

The spike in the inflation rate has reversed to a roughly flat annual inflation rate.

This component is somewhat cherry picked, but I think it is a somewhat “clean” sub-component of the CPI.

It avoids the construction lag of the housing component of the CPI, and dodges highly erratic energy prices (which we all know about).

For me, the “transitory” nature of inflation was that after the spike subsided, inflation rates would resume at a level similar to the pre-spike levels.

This is different than the 1970s....

Buying precious metals at the start of 2023 can give HSA holders looking for market hedging gains a strong slow growth strategy.

🗒️ VIDEO — Frank Holmes: Bullish on Gold, but Silver Will Shine Brightest in 2023

Frank Holmes: Bullish on Gold, but Silver Will Shine Brightest in 2023

youtu.be

Gold held up "exceptionally well" in 2022, according to Frank Holmes of US Global Investors (NASDAQ:GROW), and in 2023 he expects the yellow metal to thrive.

However, it's silver that he thinks will really shine.

"I remain extremely bullish on gold as an asset class....

🗒️ The Red-Hot Case for Copper as an Inflation Hedge (Updated 2023)

Move over, gold and silver — the humble copper has emerged as a potential hedge against inflation.Copper’s credentials come from its wide use in the global economy.

In 2021, 46 percent of the copper produced was used in the building and construction sector, 21 percent in electronics, 16 percent in transportation, 10 percent in consumer goods and 7 percent in industrial machinery.Every single major sector of the economy uses copper, and because of that its fate is tied closely to general economic growth.

In fact, many market participants use copper as a bellwether for investment purposes.

For example, if the price of copper is rising, that means demand is increasing and the economy is growing; if it’s beginning to fall, demand is sinking and the production of goods and services is being scaled back.Is copper a good hedge against inflation?

But that isn’t copper’s only superpower.

Because of how copper is tied to the world economy, it provides an excellent hedge against inflation....

Palladium can be the strong short term strategy for HSA members planning for raising funds for minor elective surgeries in 2023

🗒️ Palladium Price Forecast: Top Trends That Will Affect Palladium in 2023

With prices spiking to an all-time intraday high of US$3,339 an ounce and falling to a year-to-date-low of US$1,657, there's no question that the palladium market was punctuated by volatility in 2022.The precious metal started the year at the US$1,840 level, but rallied an impressive 81 percent between January and March as Russia’s invasion of Ukraine infused uncertainty into global markets.

Russia is the world's second largest palladium producer, and according to a report from Johnson Matthey (LSE:JMAT,OTC Pink:JMPLF), the country accounted for 28 percent of primary and secondary palladium supply in 2021. “Palladium peaked … as prices of a range of Russia-exposed commodities surged higher,” the document reads.The metal's price quickly pulled back to US$2,200 as material from leading Russian palladium producer Norilsk Nickel (MCX:GMKN) continued to reach the market.

But another supply speed bump soon emerged.

“The (April 2022) delisting of Russian refiners by the London Platinum and Palladium Market (LPPM) reignited availability fears and spurred the price back above US$2,500,” the market overview states.

“The LPPM decision means that ingot and sponge produced by Russian refineries after April 8th will no longer be accepted for ‘Good Delivery’ into the London and Zurich bullion market.

”However, as Wilma Swarts, director of platinum-group metals (PGMs) at Metals Focus, explained, supply troubles out of other regions had a major impact on palladium’s 2022 price story.

“The Russian war on Ukraine had a very material impact on the palladium price, but this was primarily due to market speculation rather than weakening regional supply,” Swarts wrote in an email to the Investing News Network (INN).

“Mine supply from Russia remained in line with production guidance.

”Instead, the PGMs expert pointed to the auto sector and output hiccups in Africa and North America.

“The lower supply stemmed more from the weak automotive recycling market and operational challenges in South African and North American mine supply,” she said.

“The delays in the Polokwane smelter rebuild and flood damage in Montana curtailed palladium mine supply.

”Unfortunately, tailwinds from supply disruptions were countered by weak auto demand.

This key end-use segment continues to endure supply chain issues and a semiconductor chip shortage, which are weighing on production and in turn dampening demand for palladium.Central bankers' commitment to quashing rampant inflation also repressed markets and helped to keep palladium values below US$2,250 from May through to October.Palladium market shifts back into deficitEven though annual production has declined since 2019, the palladium market briefly moved into excess in 2021.“After posting its first surplus in the past 10 years in 2021, palladium will shift back to a significant deficit,” Swarts said.

“Like platinum, the market balance results from weaker supply rather than more robust demand.

”In fact, palladium demand has yet to recover to its 2019 pre-pandemic level of 11.4 million ounces.

Persistently high prices haven't helped the situation, with substitution in the auto sector taking a toll on the precious metal.

“Palladium automotive demand, aside from the erosion of gasoline light-duty vehicle production, was also negatively impacted by the transition towards higher platinum loadings in autocatalysts at the expense of palladium,” Swarts said.

“The slowdown in consumer electronics also weighed on palladium demand.

”The Russia-Ukraine war forced automakers to downgrade their output guidance early in the year, and the market was further impacted in H2, when COVID-19 lockdowns in China heavily impacted auto production.

“According to the China Association of Automobile Manufacturers, total vehicle sales fell by 7.9 percent year-on-year (y/y) in November to 2.33m units, the first y/y decline since May,” a mid-December Metals Focus report reads.Palladium investment demand contracts furtherUnlike other precious metals, palladium has been unable to see upside from investment demand recently.

“Following continuous liquidation of palladium ETFs between 2015 and 2020, total holdings had fallen from a peak of nearly 3 million oz to less than 600,000 oz by the start of 2021,” the Johnson Matthey report notes.Although the metal rallied to fresh highs from 2020 through 2022, investors have chosen to avoid palladium exposure.

“This is due to a combination of factors, including elevated prices and wide spreads (which limit the upside for investors), along with widespread recognition of the risk posed by BEVs to future palladium demand,” the firm's overview states.Swarts also pointed to the growing shift toward electric vehicles as a deterrent for palladium investors.

“As an investment metal, palladium has for some time lost its luster as investors take stock of the shift towards electric vehicles and the success in substituting,” she explained to INN.

“(In 2022), retail investment is expected to contract by 11 percent and is expected to decline further in 2023.”Consumer demand will be key to 2023 growthBy December, the palladium price had reached US$1,657, its lowest point since February 2020....

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Enjoy,

frank