HSAPAY's week 32 of 40 Baby Fund Plan

Aug 15, 2023 12:15 am

Welcome back ,

Here's HSAPAY's weekly update for August 14th, 2023 that'll help you and your growing family navigate the complexities of utilizing and investing in your HSA.

HSA Weekly Roundup

- 9 weeks & Counting

- These 10 medications are likely targets for Medicare price negotiations this fall

- 401(k) hardship withdrawals jumped 36% in the second quarter

3-6 Month HSA Investment Return Entries

- Dollar Rallies on Higher Bond Yields and a Weak Yuan

- Cracking the Currency Code: Analyzing Seasonal Patterns and the Future of the British Pound

- Wholesale prices rose 0.3% in July, higher than expected

- Interest rates should stay around 5% for longer — even as inflation falls, top economist Jim O'Neill says

- Alibaba reports solid earnings beat, revenue rises most since Sept. 2021

- Market Extra: Trading in risky ‘0DTE’ stock options hits record and could spark a stock-market selloff, strategists say

9 weeks & Counting

| ||

| ||

Did you know that your HSA can help alleviate the financial burden of medical expenses related to pregnancy, childbirth, and prenatal care?

💡 Here's how:

1️⃣ Make sure to save all receipts related to pregnancy, childbirth, and prenatal care these expenses are reimbursable.

2️⃣ Discuss your HSA eligibility and reimbursement options with your healthcare provider.

3️⃣ Submit your reimbursement claim once you've gathered all the required documents to your HSA provider.

#HSA #GrowingFamily #wellbeing | ||

These 10 medications are likely targets for Medicare price negotiations this fall

🎉 Exciting news! Medicare is finally taking action to negotiate drug prices with the pharmaceutical industry this fall. It's been almost six decades in the making, and we can't wait to see the results! The Centers for Medicare and Medicaid Services will reveal the list of 10 targeted drugs by Sept. 1.

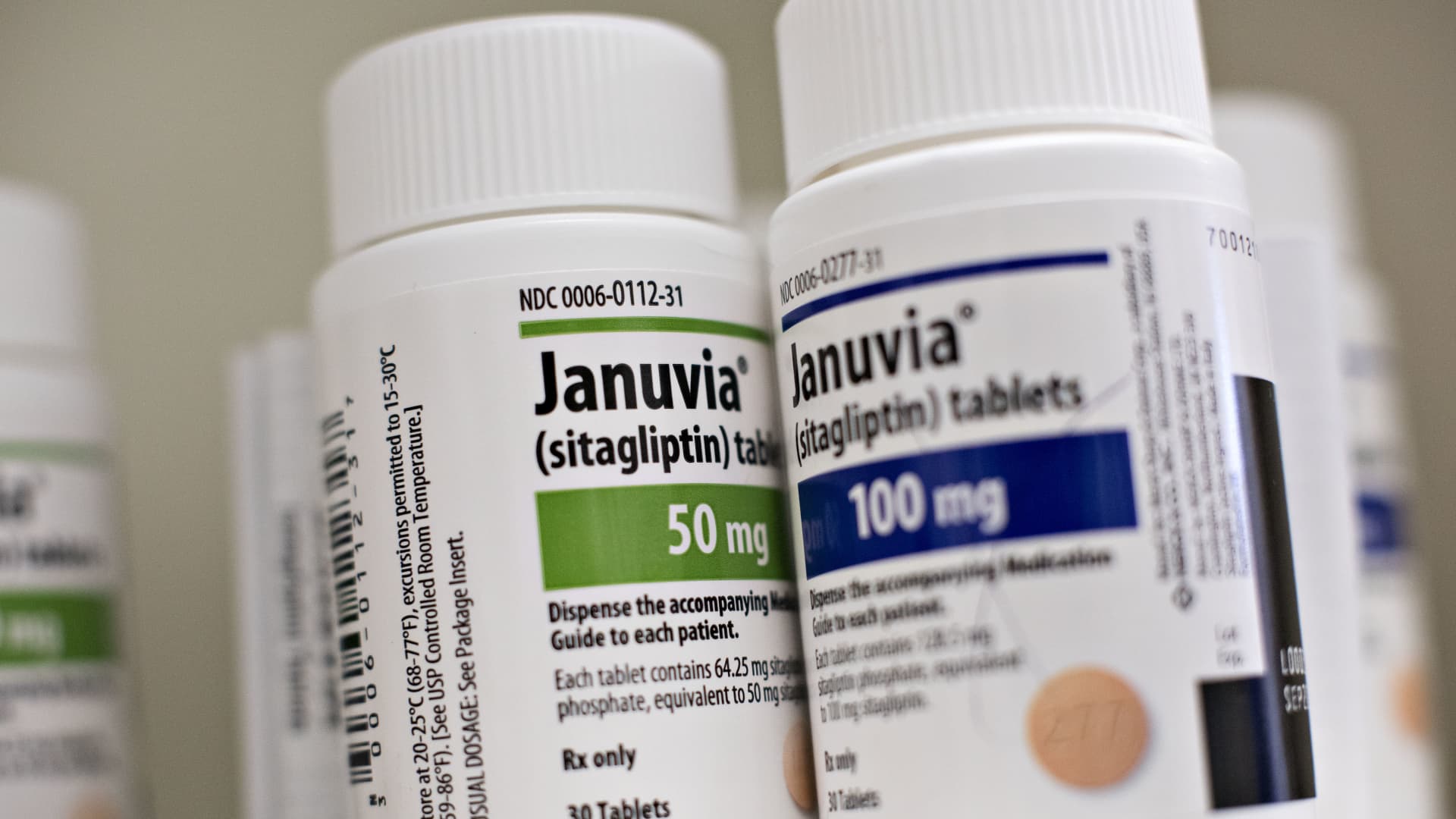

While we don't know which drugs will be selected, some pharmaceutical companies have already predicted that four of their top medications will be on the list. Merck's Januvia and Keytruda are among those expected to be targeted in the upcoming years. Additionally, an analysis by the Journal of Managed Care and Specialty Pharmacy suggests that six other drugs may be subject to negotiations this year. 🧐 Stay tuned for more updates on this exciting development!

These are the other six drugs that will likely be subject to negotiations this year, according to an analysis by the Journal of Managed Care and Specialty Pharmacy published in March:

- Jardiance, made by Boehringer Ingelheim, used to treat heart failure

- Enbrel, made by Amgen, used to treat rheumatoid arthritis

- Symbicort, made by AstraZeneca, used to treat asthma

- Ibrance, made by Pfizer, used to treat breast cancer

- Xtandi, made by Astellas Pharma, used to treat prostate cancer

- Breo Ellipta, made by GSK, used to manage pulmonary disease

401(k) hardship withdrawals jumped 36% in the second quarter

😔 According to a new report from Bank of America, more and more people are resorting to emergency withdrawals from their 401(k) plans, despite low unemployment rates and rising wages. 😱💸 Withdrawals in the second quarter of this year jumped a whopping 36% compared to the same period in 2018.

This trend is concerning for both the economy and retirement savings, especially given the current boom in the job market. 😕📉 While the number of those taking withdrawals is still relatively small, at just 0.52% of 401(k) participants, it's definitely worth keeping an eye on. Those of you with rising healthcare costs don't forget to lean on your HSA when you need it.

WGC Anticipates Unseasonal Gold Market in August This Year

🌟 Get ready for some gold market news, folks! According to the latest report from the World Gold Council (WGC), August has historically been a great month for gold returns. However, this year might be a bit different 🤔. The yellow metal had a solid gain of 3.1% in July 2023, bringing the year-to-date return to a nice 8.7%. But, there were some outflows of 32 tonnes from global gold ETF holdings, mainly from Europe and North America.

On the bright side, COMEX managed money net long futures positions rose by 93 tonnes. Unfortunately, the WGC report isn't too optimistic about August 😔. This is because of high local gold prices and a soft economic environment in India and China, which could lead to lower demand for physical gold purchases during the month. Stay tuned for more updates and how to maximize your HSA.

Dollar Rallies on Higher Bond Yields and a Weak Yuan

💰 The US dollar index rose by +0.36% on Friday, reaching a 5-week high 🚀. This was due to a stronger-than-expected U.S. Jul PPI report 💪 boosting bond yields and sparking speculation that the Fed may raise interest rates higher and for longer.

The dollar also received support from the Chinese yuan's slide to a 1-month low, following China's weaker-than-expected credit growth.

In other news, the University of Michigan U.S. Aug consumer sentiment fell -0.4 to 71.2, and the Aug 1-year inflation expectations unexpectedly eased to 3.3%, which is better than expectations of an increase to 3.5%. The Aug 5-10 year inflation expectation also saw a slight decrease. Overall, it was a positive day for the dollar 🤑, driven by the strong PPI report.

Cracking the Currency Code: Analyzing Seasonal Patterns and the Future of the British Pound

🌞 Understanding seasonal patterns is the key to unlocking more 💰💸 for currency traders! By keeping track of recurring trends, traders can make informed decisions in the foreign exchange market. These patterns are influenced by a variety of factors, including economic indicators, geopolitical events, and market sentiment.

For example, during the summer, many currencies experience a "summer slump" due to decreased trading volumes as market participants take vacations. This results in lower volatility and trading activity.

🎄 At the end of the year, investors often engage in profit-taking and portfolio rebalancing, triggering a sell-off in certain currencies. Currency traders closely monitor this trend to make the most of their investments. Keep an 👁️ out for seasonal patterns to maximize your profits in the foreign exchange market!

Wholesale prices rose 0.3% in July, higher than expected

📈 Wholesale prices went up more than expected in July! 😱 This is a bit of a surprise since we've been seeing inflation levels calm down lately. The Bureau of Labor Statistics reported that the producer price index (which measures how much producers get for their goods and services, not what consumers pay) went up 0.3% last month.

That's the biggest increase since January! 😮 Excluding food and energy, the core PPI also went up 0.3%, which is the biggest increase we've seen since November 2022 (after falling 0.1% in June). On a 12-month basis, core PPI rose 2.4%, which is tied for the lowest it's been since January 2021. Economists who were surveyed by Dow Jones were expecting a 0.2% increase for both readings, so this is a bit higher than what they predicted. Excluding food, energy, and trade services.

Interest rates should stay around 5% for longer — even as inflation falls, top economist Jim O'Neill says

💸 The US Federal Reserve might raise interest rates by 25 basis points in September, but the market thinks they'll start lowering them again in 2024 💸

😔 Veteran economist Jim O'Neill thinks rates should stay around 5% to keep inflation stable. But the Fed is expected to keep rates the same at their next meeting in September 🤔.

Economists predict the CPI will be up 0.2% monthly and 3.3% annually 👀💰

Alibaba reports solid earnings beat, revenue rises most since Sept. 2021

💻 Alibaba, the Chinese e-commerce powerhouse, just reported a whopping 14% increase in revenue for the June quarter! That's the biggest sales growth they've seen since September 2021! 😱

Their U.S. shares even rose by 4.5% in premarket trading! Taobao and Tmall Group, their main business, brought in 114.95 billion yuan ($15.8 billion) in revenue, up 12% from last year! 🎉 And the Taobao app for online shopping saw a 6.5% increase in daily active users in June, and even more in July! #Alibaba #growth #ecommerce #hsa #wealthmanagement #investing

Market Extra: Trading in risky ‘0DTE’ stock options hits record and could spark a stock-market selloff, strategists say

Trading stock options with super short lifespans is reaching new highs like a roller coaster🎢 ! But some experts are worried this could lead to a drop in the market... 😬 The data from SpotGamma shows that trading in "0DTEs" (options with no days until expiration) is at an all-time high, with 53% of all S&P 500-linked options being traded.

This includes options on ETFs like the SPDR S&P 500 ETF Trust (SPY). 🤑 How will the market react to big news like Thursday's U.S. consumer-price index report? 🤔 Stay tuned... and keep your HSA ready to trade your leap options in the short term.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Share the gift of the best & only HSA newsletter with friends, family, and colleagues. https://sendfox.com/hsagrow