HSAPAY's week 24 of 40 Baby Prep Plan

Jun 20, 2023 3:33 am

Welcome back ,

Here's HSAPAY's weekly update for June 19th, 2023 that'll help you and your growing family navigate the complexities of utilizing and investing in your HSA.

HSA Weekly Roundup

- Get control of your HSA Today

- Contributing with your HSA just got easier!

- Dental work with your HSA is super simple

Macro Minute & Precious Metals

- If Major Market Sectors are Bullish, Is it Actually a Recession?

- 3 Unusually Active Put Options to Generate Above-Average Income

- Vol is High by the Fourth of July

- Stocks Retreat as Hawkish Fed Comments Push Bond Yields Higher

3-6 Month HSA Investment Return Entries

- The Ratings Game: Nvidia is the only near-term ‘beat and raise’ chip maker when it comes to AI, analyst says

- Amazon Stock Keeps Rising, But It May Still Be a Good Time to Buy In

- 3 Stocks Making Moves After Analyst Notes

- Dollar Recovers as Bond Yields Climb on Hawkish Fed Comments

Get control of your HSA Today

| ||

With the maximum contribution limits for 2024 now announced, now is the perfect time to start planning for your retirement. Make your contributions count and secure your financial freedom. #InvestInYourFuture #RetirementPlanning #HSA #hsapa | ||

3:23 PM · June 18, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

Contributing with your HSA just got easier!

| ||

Consider contributing to your Health Savings Account (HSA)! Not only will it lower your taxable income, but it also helps you save for future healthcare expenses. Don't miss out on this opportunity to invest in your health and finances. #HSAs #taxsavings #healthcare #hsapay | ||

3:25 PM · June 19, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

Dental work with your HSA is super simple

| ||

Researching or asking for recommendations in a dental emergency may be too late. People must act now to deal with the crisis and keep things from worsening. If you have an HSA now is the time to sure up your dental coverage. #hsapay #teeth #dental #hsa | ||

7:03 PM · June 19, 2023 | ||

Sign up for HSAPAY's robo-advisor to find out how you can get in on the action.

If Major Market Sectors are Bullish, Is it Actually a Recession?

Hey there, lovely people! Let's chat about the US stock indexes, shall we? 📈I've chatted about this a few times, but I'm still seeing all three major indexes on a long-term uptrend. 🚀 Nasdaq seems to be leading the way, but hey, someone's gotta do it, right?! Speaking of interesting possibilities, what if all the market sectors were following each other like wagon trains? 🤔 That'd be wild!

Have you guys been keeping up with the orange juice market? It hit a record high this past May at $2.9550! 🤑 And let's not forget about boxed beef, which is always a key economic read for the US. Prices came in at $342.07 for choice and $309.58 for select, the highest they've been since late September!

3 Unusually Active Put Options to Generate Above-Average Income

It's Friday and the markets are a bit of a mixed bag. 🤔 Tesla (TSLA) seems to be leading the way with a whopping 19.5 million in price volume, leaving second-place Nvidia (NVDA) in the dust with only 7 million. 😮 As for me, I'm on the hunt for some interesting options activity, and today I'm feeling the put side of things. Currently, the natural gas producer EQT (EQT) is catching my eye with its September 15 $37 put option volume at 7,001 - that's a whopping 57.39 times higher than its open interest! 🤑

Vol is High by the Fourth of July

🌽Get ready for a wild ride in late June and early July, folks! That's when corn volatility spikes thanks to the highly anticipated USDA Acreage report which estimates how much corn farmers have planted 🌱.

This report is a big deal 💥 and can seriously rock the markets . Just look at what happened on June 30, 2022 when the USDA reported 89.921 million acres of corn planted in the 🇺🇸. December 2022 Corn futures fell a whopping 34 cents, dropping 5.20% from the day's open to the daily settlement price 😵.

The June 30, 2021, Acreage report was even more exciting when the reported acreage of 92.692 million acres fell short of the median polling estimate by 908,000

Stocks Retreat as Hawkish Fed Comments Push Bond Yields Higher

Stock indexes took a dive on Friday, giving up early gains and closing lower. The increase in bond yields caused pressure on technology stocks and led to long liquidation in the indexes. Bond yields rose due to hawkish comments from Richmond Fed President Barkin about inflation being "too high and stubbornly persistent."

🚀 Initially, the broader market rose due to carryover support from a rally in Asian markets. The S&P 500, Dow Jones Industrials, and Nasdaq 100 all hit new highs. However, the positive momentum didn't last, and the market ended up closing lower. 😍 On a positive note, the University of Michigan reported a decline in U.S. June 1-year inflation expectations to a 2-year low! ♥️

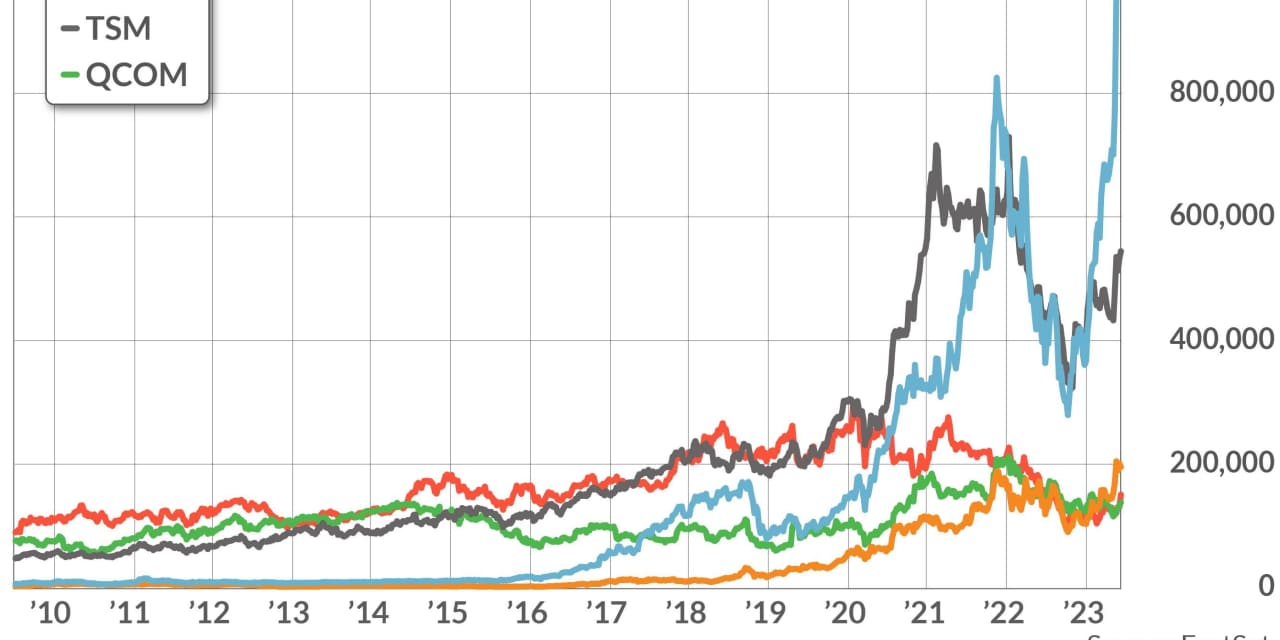

The Ratings Game: Nvidia is the only near-term ‘beat and raise’ chip maker when it comes to AI, analyst says

Nvidia will be the only chip maker positioned to exceed Wall Street expectations in the near term when it comes to AI, one analyst believes.

Amazon Stock Keeps Rising, But It May Still Be a Good Time to Buy In

🚀 Amazon (AMZN) stock has been soaring lately, with a 15.5% increase in the last month and a whopping 48% year-to-date! But don't worry, it's not too late to hop on the bandwagon. 😉 If the company generates positive free cash flow this quarter or next (which is looking likely), it could be a great opportunity to invest. One way to do this is by shorting out-of-the-money puts at strike prices below today's price.

🌟 According to Seeking Alpha, the average of 42 analysts' forecasts for 2024 is $2.59 per share, which is a whopping 66% higher.

3 Stocks Making Moves After Analyst Notes

📉 American Express Company (NYSE:AXP) took a hit of 0.7% at $173.21 as Citigroup warned of lower credit card spending. The firm cut its price target on AXP to $148 due to a significant drop in travel and entertainment spending.

😞 However, short-term traders may be happy with this news as they were already put-biased, according to American Express stock's Schaeffer's put/call open interest ratio (SOIR) of 1.01. Coinbase Global Inc is also facing a 1.7% drop in shares, currently at $52.97, as Bitcoin (BTC) struggles. Moreover, Mizuho reiterated its "underperform" rating, questioning the number of customers Coinbase is losing to Robinhood (HOOD).

🍕👍 On the bright side, Stifel upgraded Domino's Pizza (NYSE:DPZ)

Dollar Recovers as Bond Yields Climb on Hawkish Fed Comments

The U.S. economy is still 💥🔥, with strong 💪 in labor market and growth! However, some officials are concerned about inflation and are considering tightening monetary policy 🏦 to address it. On Friday, hawkish comments from Fed officials and positive consumer sentiment data helped the dollar index recover from a 5-week low and rise by +0.18%💰.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Share the gift of the best & only HSA newsletter with friends, family, and colleagues. https://sendfox.com/hsagrow

Enjoy,

frank

/Amazon%20Holiday%20delivery.jpg)