Update on Joint Venture Opportunity

May 28, 2021 11:12 pm

Hope you are having an amazing Friday!

Since Yesterday, the list has size has doubled!

Wanted to update you on Mike Botkin's Joint Venture Opportunity that I sent yesterday.

Thank you to everyone who reached out to Mike yesterday about the JV acquisition deal he is looking at.

He had some really great people reach out.

I have tried to send the JV Opportunity email to everyone who requested it, but I may have missed a few since the list size doubled since yesterday! If you didn't see it, please see the email below the signup button.

This thing is really taking off, and I am always looking for more great operators with great JV acquisition opportunities to feature.

Get in touch with me if you want to acquire businesses through Joint Ventures with amazing businesses and people.

***Also, please send this email to your friends who might be interested--they can just click the button below and sign up!

**NOTE**

- I AM NOT A PROFESSIONAL

- THE INFORMATION IN THIS EMAIL IS NOT INVESTMENT ADVICE. I AM NOT RECOMMENDING ANY INVESTMENT OR JOINT VENTURE

- I, SAM LESLIE, AM NOT A BROKER/DEALER OR A PROMOTER

- I, SAM LESLIE, AM NOT RECEIVING ANY PAYMENT TO INFORM YOU OF THIS JOINT VENTURE OPPORTUNITY

- I HAVE NOT EXECUTED ANY DUE DILIGENCE ON THIS DEAL AND AM NOT CURRENTLY PART OF IT IN ANY WAY.

- THERE IS SIGNIFICANT RISK IN JOINT VENTURING TO ACQUIRE ASSETS. SEEK PROFESSIONAL ADVICE BEFORE ENTERING INTO ANY AGREEMENT

-------------------------------------------------------------------

Hey Fellow Joint Venturers!

I have been talking with Mike Botkin about a deal he is interested in doing a Joint Venture on.

And I'm sending it out because I think it is interesting.

You are getting a chance to see it before it becomes public. If you aren't serious about doing a joint venture, please don't contact Mike. But, if you are, please do.

Currently, I am not part of this deal and have not executed Due Diligence on it, so please address any questions directly to Mike through his contact info at the bottom of this email.

Ok, now to the cool part.

Sam

__________________________________________

FROM MIKE:

Here is an overview of the deal I have an LOI on. I do want to preface with, I am still in due diligence. I did my initial site visit this past weekend, and feel strongly about this business.

About Me

I am 31, I currently own B&B Landscaping Group located in Orlando, Fl. We bought B&B Landscaping in December of 2020. Investor in B&B Landscaping is JD Ross (OpenDoor Co-Founder). Since taking over, we have implemented strategic and operational changes that have assisted in exceeding our projected marks to date. In back-to-back months (March/April) we achieved the highest gross sales numbers in company history.

Jan - April Growth Rate: 36%

YoY Growth Rate: 48%

Prior to B&B Landscaping, I was the Chief Operating Officer of Feltrim Group. At Feltrim, I oversaw operations of our entire portfolio, which consisted of various sectors....

Real Estate: Land Development, Property Mgt(1200 units), Buying/Flipping

Entertainment: Restaurant, Bar & Grill, Water Park, Sports Complex

Hospitality: 220 key full service resort, 400 short term rentals

Home Service: Lawncare, Pool cleaning, Home Maintenance, Cleaning

Prior to Feltrim, I was an early employee at Krossover Intelligence, a SaaS company. After Series B, we exited to BlueStar Sports.

Prior to Krossover, I was a high school teacher and basketball coach.

CURRENT DEAL

*I am still in due diligence, terms can change*

This deal was sourced off-market.

Company X is a residential lawn care company with ~900 customers. Located primarily in (3) neighborhoods. Keeping the density has resulted in really low fuel costs. The existing owners are both attorneys, the husband is an active attorney and passive in the business. The wife does not currently practice, and is involved in the business day/day from an office manager standpoint. The Org Chart is good and stable, featuring long tenured key roles such as General Manager, Irrigation Manager, Service Manager. Total of 45 employees.

The maintenance generates ~ $1.3m, while irrigation & enhancements/landscaping make up the balance. The company does offer a full range of services, marketing to clients as a true one-stop shop. Maintenance, irrigation, landscaping, spraying (3 employees on staff are licensed to spray).

Over 600 customers are located in a community called 'Celebration' (Disney built community). The HOA of Celebration requires homeowners to keep standard and maintain aesthetics of property - they are the strictest HOA I have ever seen/experienced with yard care (I lived in Celebration).

This gives Company X a huge lift in enhancements for mulching, plant care, tree work, etc.

Financials below

| Jan - Dec 2019 | Jan - Dec 2020 | Jan 1 - May 19, 2021 | Total | |

| Income | $ 2,539,882.25 | $ 2,500,067.70 | $ 1,034,297.05 | $ 6,074,247.00 |

| Cost of Goods Sold | $ 1,820,212.62 | $ 1,741,600.09 | $ 640,593.80 | $ 4,202,406.51 |

| Gross Profit | $ 719,669.63 | $ 758,467.61 | $ 393,703.25 | $ 1,871,840.49 |

| Total Expenses | $ 163,186.90 | $ 144,954.22 | $ 64,656.10 | $ 372,797.22 |

| NOI | $ 556,482.73 | $ 613,513.39 | $ 329,047.15 | $ 1,499,043.27 |

Plan would be to combine B&B Landscaping with Company X.

B&B Landscaping is 70% commercial

With the combination of B&B residential customers with Customer X. We'd become the biggest residential lawn service company in Orlando.

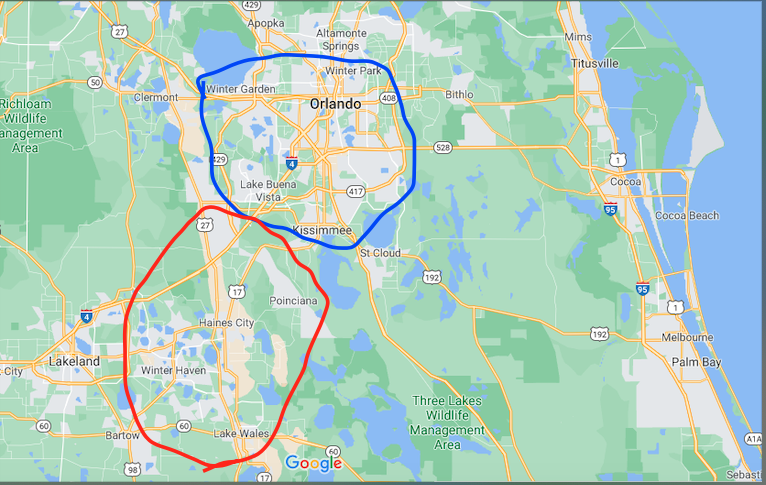

Here is a map to show existing service area

(Blue is Company X, Red is B&B Landscaping)

PROPOSED JOINT VENTURE TERMS

Company X asking Price: $1,950,000

*terms have not been worked through* (Our goal would be to get a down payment to sellers of 70%, with a seller note of 15% and an earnout/clawback of 15%)

Ideal combined capital for the Joint Venture would be $2.2m for acquisition + working cap

Joint Venture proposed terms:

Each quarter, we take 100% of FCF for distribution, less 30% to remain in business for capex/cash reserves

Equity = 35% for tranche

Hurdle 1

1.5x pref on invested capital

Hurdle 2 (once hurdle 1 is complete)

Equity split pro-rata

There is an SBA option for this deal, in which case I'd be open to syndicating the down payment for the SBA loan. Also, would be open to splitting equity + debt(non-SBA).

Let me know if this interests you to learn more.

Mike Botkin

Chief Executive Officer

O: 863-439-7575

M: 407-721-7921

W: www.bblandgroup.com

A: P.O. Box 1202 Haines City, FL 33845

_________________________________________

Alright folks, hope this was helpful.

If you have anything you would like to Joint Venture on, please send me an email.

Pressing On,

Sam Leslie