Friday, 6th of October 2023 (European Market)

Oct 06, 2023 9:31 am

-It’s NFP day in the market and it’s as big as they come with stakes raised a little bit going into the event today. The market looks to the US Labour market for clues relating to the resilience of the US economy and the next direction for the US Dollar.

-The US Dollar dropped further on the week as yields continues to cool having tested highs around 4.88%. The USDIndex (tracks the strength of the Dollar) is on track to test 106.00 having peaked around 107.00 on Tuesday – NFP on track to determine proceedings.

-The market expects that 171,000 new jobs were added to the US economy last month and that unemployment rate must have dropped to 3.7%. if we get prints more than 171,000 and a decline in unemployment rate – we can expect downsides for GBPUSD and EURUSD.

-A significant drop in the number of jobs added to the US economy below 171,000 and a rise in unemployment rate would see the US Dollar end the trading week on the backfoot. Upsides on GBPUSD and EURUSD would also be attractive to buyers on the pairs.

-Markets are calm for now and awaiting the NFP report later during the day. Equities are uneventful on the day, Commodities are slightly higher on the board but margins are still small. USOIL still struggling around $82.00/bbl while GOLD finds support around $1820.

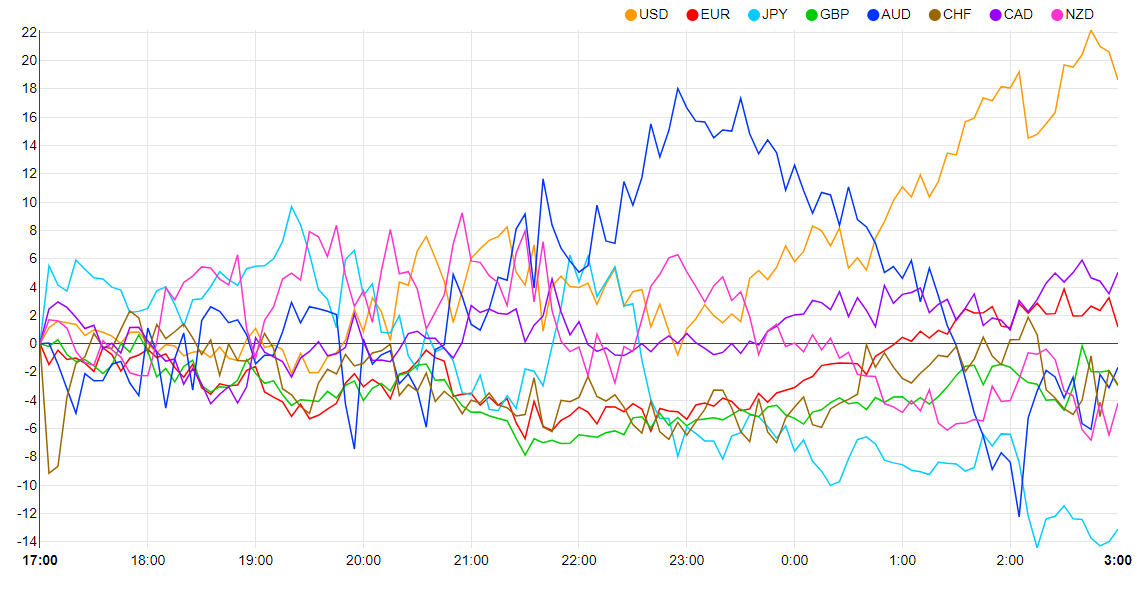

Cumulative Strength: USD

Cumulative Weakness: JPY

-FX is mostly mixed on the board ahead of the event later during the day. GBPUSD and EURUSD are attractive options for sell if we get a better-than-expected result for further downsides and we can also look at them for relief rallies (buy) if we get a lower-than-expected result.

-Looking ahead, Employment change and Unemployment rate for CAD is on the economic calendar alongside the Non-Farm Payrolls later during the day.

P.S: VIP ACCESS TO $1,000,000 FOREX ACCOUNT MANAGEMENT SERVICE 📔