Thursday, 12th of October 2023 (European Market)

Oct 12, 2023 9:36 am

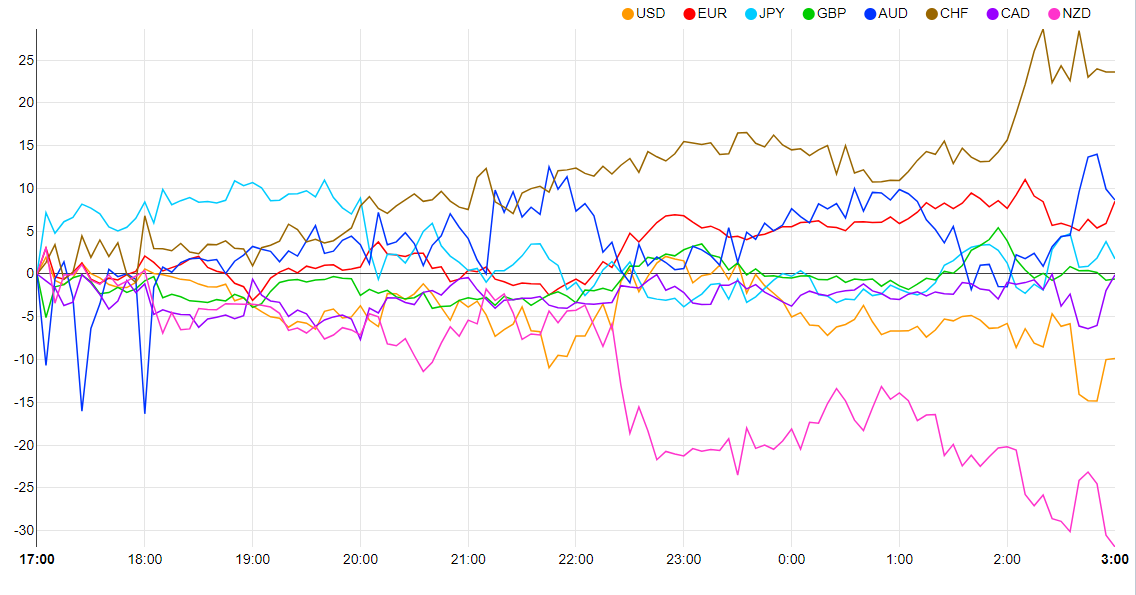

-Markets are still struggling to their footing this week although the pathway remains positivity as markets continues to overlook the geopolitical situation in Israel. EUR and GBP major beneficiaries of the calmer market tone especially against JPY – Two consecutive days.

-The US Dollar is in focus in the market today as we prepare to receive the US CPI data later this afternoon. USDIndex (tracks the strength of the Dollar) trades within its yesterday’s range, finding support around 105.30 but bearish bias persists on the index.

--UK’s GDP data was on the economic calendar this morning with prints coming in line with expectations at 0.2% - GBP unchanged as of now. US CPI data is next in line for the market today with the CPI m/m expected at 0.3% and CPI y/y expected at 3.6%.

-If reports come in better-than-expected then we can expect a strong dollar especially against the GBP and AUD while a lower-than-expected report should see the dollar weaken especially against the JPY.

-Risk mood (sentiment) is mostly tentative for now going into the risk event on the day. Equities and commodities are mostly mixed on the board- USOIL finds support around $83.00/bbl while GOLD is running into resistance around $1882 on the day.

Cumulative strength: NIL

Cumulative Weakness: NIL

-The US CPI is the major risk event in the market today and the next possible catalyst for moves in the market. If we get a better-than-expected print, we can look to sell GBPUSD and AUDUSD while a lower-than-expected print could provide us buying opportunities on USDJPY.

-Looking ahead, US Unemployment Claims is on the economic calendar along side the US CPI data later in the day.

Don't miss out on this opportunity to transform your financial future. Click the link> https://selar.co/m/click-to-cart to join now and embark on your journey towards financial success. It's time to make your money work for you!